CRFB Publishes Analysis of CBO's 2015 Budget and Economic Outlook

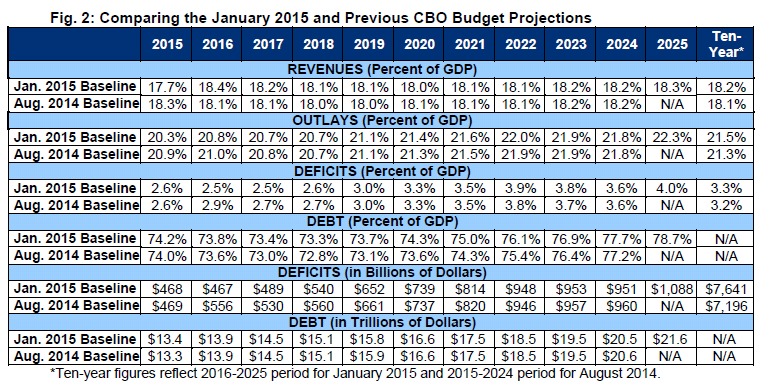

Yesterday, CRFB published an analysis of CBO’s latest Budget and Economic Outlook. The six-page document summarizes the forecasts and emphasizes the return of trillion-dollar deficits over the next ten years. Although CBO projects slightly decreasing deficits over the next two years, there will be a jump from a 2016 low of $467 billion to a $1.09 trillion by 2025.

The paper includes an overview of when and how deficits will change from decreasing to increasing over the next decade despite repeated reductions in discretionary spending. Additionally, we highlight CBO's prediction that debt will reach 79 percent of GDP by 2025, up from 74 percent currently. These projections may actually be optimistic, as we explain in our paper:

Even these projections assume that lawmakers do not enact new deficit-increasing policies. If they act irresponsibly and extend temporary policies and repeal scheduled cuts, debt would be much worse and could reach 88 percent of GDP by 2025.

The report also analyzes the changes in CBO’s estimates since their last baseline. It details the difference between CBO's August 2014 and January 2015 projections by looking at the legislative, economic, and technical changes that produce slightly lower deficits than previously predicted. We describe the ways in which CBO data may be underestimating short-term economic growth, based on new data:

CBO’s near-term growth projections are somewhat lower than their August projections; however, they were developed from data available in early December 2014. More recent data suggests third quarter economic growth was stronger than CBO’s latest estimate, and falling oil prices have likely provided a further boost.

Ultimately, CBO’s outlook represents an unsustainable fiscal situation, showing the return of trillion-dollar deficits and an upward path of debt after 2020. Serious tax and entitlement reforms are vital for making debt manageable.

Click here to read the full report.