Comparing Medicare and Social Security Benefits and Taxes

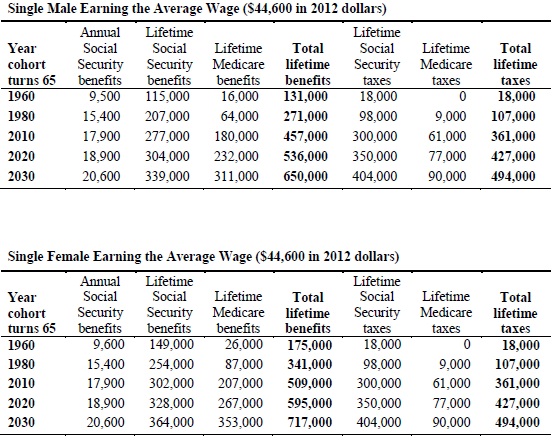

The Urban Institute's Eugene Steuerle and Caleb Quakenbush have updated their estimates calculating lifetime Social Security and Medicare benefits and taxes. In order to compare contributions to benefits received, they assume that the contributions have a rate of return (discount rate) of inflation plus two percent. We previously presented inflation-adjusted numbers based on the older estimates.

Their new estimates show the same story as the old: Social Security and Medicare benefits exceed taxes for past, present, and future age groups. In reality, though, this difference is more about Medicare benefits and taxes.

For Social Security, lifetime taxes largely compensate benefits on average--with the exception of middle-income one-earner couples--for recent retirees with that trend projected to continue into future years. For Medicare however, benefits exceed taxes by a factor between 2.5 and 4 for the recently retired. This discrepancy is due to the fact that only Part A of Medicare is financed with a dedicated tax. Parts B and D, on the other hand, finance only 25 percent of their program costs (net of cost-sharing) from premiums, while the other 75 percent comes from general revenue.

Source: Urban Institute

Steuerle's and Quakenbush's estimates should dispel the myth that benefits, particularly in Medicare, are paid for and that we can avoid entitlement reform. With health care costs projected to keep rising and population aging, policymakers are going to have to look to make changes to the Medicare program, as this problem is not going away.