Coburn: Reasons to Raise the Medicare Age

Adding to the conversation around reforming federal health spending, Senator Tom Coburn (R-OK) has released a short report on why the Medicare age should be raised. We’ve talked about the reasons why raising the Medicare eligibility age is a good idea many times before on our blog (here, here, and here), and Senator Coburn’s report revisits many of these arguments:

- Medicare is the principle driver of federal deficits and debt.

- Medicare is rapidly approaching insolvency; the status quo is mathematically unsustainable.

- Across-the-board cuts to reimbursements are unsustainable and will harm access to care.

- Since the creation of the Medicare program, life expectancy has increased significantly.

- Today, more adults above age 65 are participating in the workforce than ever before.

- More older-age workers will help grow the economy and reduce the deficit.

- The “Normal Retirement Age” for Social Security is already 67.

- Changes to insurance make health plans cheaper for seniors, relative to younger adults.

- Adjusting the age of eligibility for Medicare is a relatively incremental approach.

- Increasing the age of eligibility is a proposal that has enjoyed bipartisan support.

The report highlights that since its inception, Medicare eligibility has remained unchanged while life expectancy has increased. Specifically, we would note that life expectancy at age 65 has risen. In 1970, people turning 65 could expect to live another 15 years on average, spending 24 percent of their adulthood on Medicare; whereas people turning 65 today can expect to live another 20 years, spending 30 percent of adulthood on Medicare.

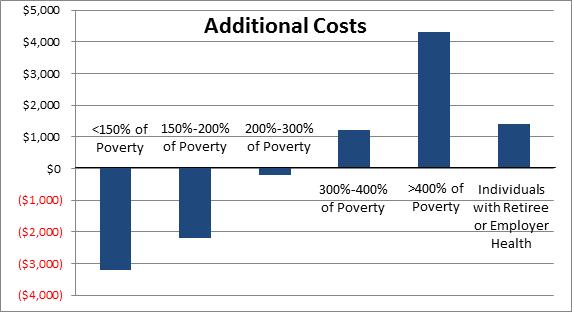

Another point made is that certain provisions under the Affordable Care Act (ACA) will make raising the Medicare age more affordable to seniors. Assuming the raising the Medicare age would also amend the ACA to include coverage under Medicaid and the health insurance exchanges for those 65 to 67, the lowest and middle income individuals would continue to have access to health insurance. In fact, this would actually help the most disadvantaged. Even according to a 2011 Kaiser Family Foundation study, which opposed raising the age, about 30 percent of all seniors age 65 to 67 (after full phase-in) and 60 percent of those without employer coverage would see their out of pocket costs reduced because Medicaid and the health insurance exchange plans are in some cases more generous than Medicare. Already, older Americans are among the least likely to be uninsured. In 2010, 22 percent of adults under age 65 were uninsured, but only 14.4 percent of those age 55 to 64 were. And those in their early 60s are less likely to be uninsured than those in their late 50s.

Source: Kaiser Family Foundation

Coburn's report also notes that raising the age would encourage longer working years, which would help the economy. By increasing labor supply and the amount of savings among near-retirees, economic growth would increase. They also cite CBO noting that disability has declined over time and so has the prevalence of physically demanding jobs, therefore concerns about near-retirees' ability to work are less than they were in the past.

As lawmakers gear up for another round of budget negotiations that will likely encompass reforms to health spending, Senator Coburn's brief serves as a good reminder why raising the Medicare age should remain on the table.