CBO Releases Analysis of the President's Budget

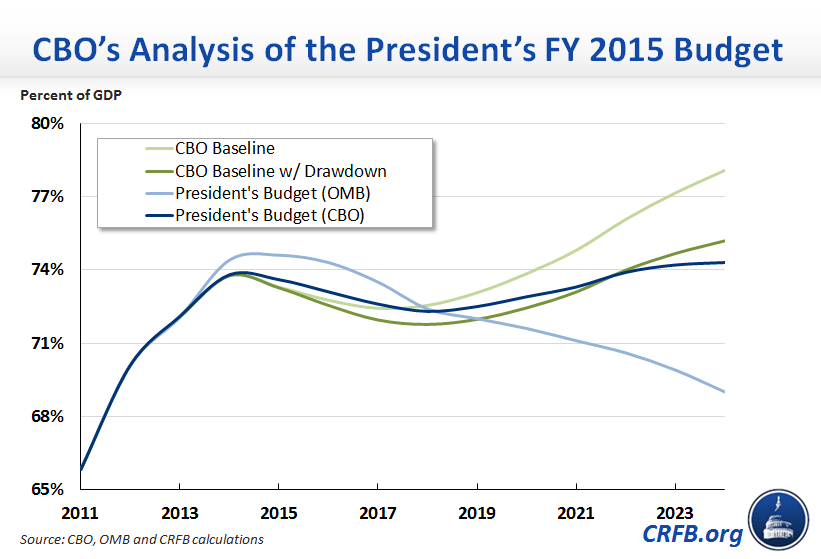

The Congressional Budget Office (CBO) has released its analysis of the President's FY 2015 budget, applying its own budget baseline and methodology to the President's policies. The agency finds that the budget would reduce debt relative to CBO's baseline by significantly less than the Administration anticipates, with debt on a modest upward path in the latter part of the ten-year budget window, increasing to 74.3 percent of GDP in 2024, rather than falling to 69 percent of GDP as OMB previously estimated. This development is not surprising, and we anticipated it when the budget was first released.

Thus, the budget only marginally improves the fiscal outlook relative to CBO's baseline, reducing 2015-2024 deficits on net by only $275 billion and debt in 2024 by only one percentage point of GDP, and it clearly does not do enough to put debt on a sustainable downward path.

The budget gets deficits close to stable at about 3 percent of GDP over the next ten years, a slight improvement over CBO's baseline, where deficits rise substantially in the second half of the ten-year window. Still, the $275 billion of net deficit reduction in the budget (excluding the war drawdown) does not put debt as a share of GDP on a downward path; debt as a percent of GDP would be 74.3 percent in 2024, about the same level it will be at the end of 2014, and it would be on an upward path after 2018. Compared to CBO's baseline, excluding the President's war drawdown, this represents an improvement of only one percentage point of GDP.

The budget gets most of its deficit reduction through tax increases and revenue resulting from immigration reform. As a result, revenue rises steadily from 17.6 percent of GDP in 2014 to 19.2 percent by 2024; by comparison, CBO's baseline has revenue staying steady around 18 percent of GDP. Outlays in the budget remain steady at around 21 percent of GDP through 2019 before rising gradually to 22 percent. This path is similar to what CBO projects in its baseline.

Budget Metrics as a Percent of GDP

A key difference between CBO's and the Administration's estimates of the budget is in their economic assumptions. CBO's projections are much more pessimistic, assuming GDP in 2024 will be $700 billion lower than the Administration projects. These differences in assumptions not only result in CBO projecting $1.3 trillion higher deficits over ten years, they also raise the debt-to-GDP ratio by lowering the denominator. Also, CBO does not give the President credit for $150 billion of claimed transition revenue from corporate tax reform (which the budget would dedicate to the Highway Trust Fund), instead assuming that the specified $225 billion in corporate tax revenue raised would all go to rate reduction.

CBO's projections make clear that while the President's budget is a small step in the right direction, it does not do nearly enough to put debt as a share of GDP on a clear downward path. In particular, the budget falls short on entitlement reforms, an area that would have been helped had the chained CPI reform not been removed from his budget.