CBO Quantifies the Fiscal Cliff and the Challenge Ahead

CBO has released two new reports that detail our short run problem of the fiscal cliff and the long term challenge of reducing the debt. Reading the reports together gives a good idea of the challenges lawmakers face as they work to replace the fiscal cliff with a "grand bargain."

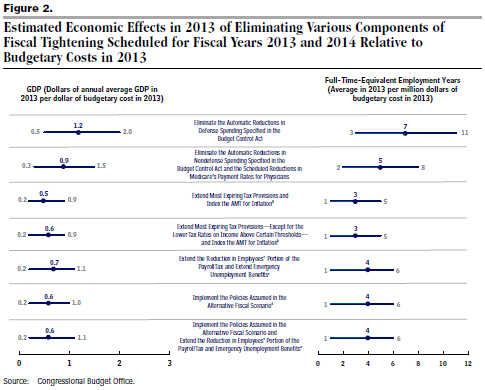

CBO's economic analysis of the fiscal cliff is revealing because it is the first time CBO has published its multipliers specifically for the fiscal cliff policies. All together, the sudden and untargeted fiscal contraction is projected to send the economy into another recession, but individual fiscal policies have different effects.

CBO projects the economy would shrink by 0.5 percent in 2013 if we go off the fiscal cliff and 3 percent in the first two quarters. Among the various fiscal cliff policies, the sequester is particularly damaging. It has the highest fiscal multiplier and thus a greater impact on the economy relative to the amount it reduces the deficit. Overall, CBO shows that averting the fiscal cliff as a whole does not have a high multiplier, but the sheer size of the cliff means it would have a large effect on the economy.

Of course, simply repealing the policies of the fiscal cliff would send a strong signal to the markets and the public that we are unwilling or unable to to deal with our unsustainable debt. As we have mentioned before, it is important that policymakers "go smart" with deficit reduction, and rely on larger spending cuts and tax increases further down the road when the the economy is recovering.

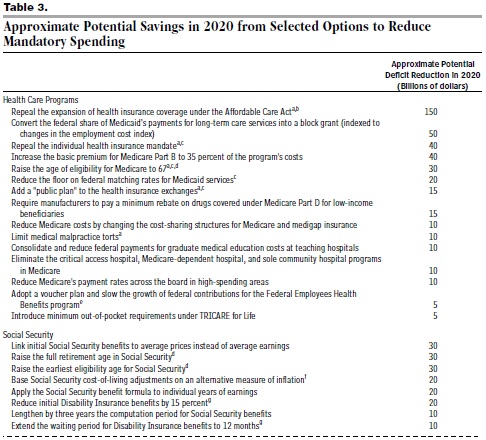

CBO's Options for Deficit Reduction report shows how some of its March 2011 Spending and Revenue Options could fit together in a budget package by showing their effects in 2020. CBO lays out three different goals that could be achieved: balancing the budget, stabilizing the debt, and a middle option that would put debt on a downward path like the approach we advocate (although not quite reaching balance in the medium term). In order to put debt on a downward path, policymakers would have to generate $750 billion in deficit reduction to current policy in 2020, which may be done using a combination of changes to mandatory spending, discretionary spending, and revenues. The table below shows the health care and Social Security options CBO presents.

CBO emphasizes that policymakers should look at both the short run and long run impact of a fiscal consolidation plan. The budget is projected to look very different in 2020 than it does today, with health care spending the greatest driver of future spending growth. Along with tax reform, which is one of the best ways to reduce the deficit without disrupting the economy, there is a strong case for a comprehensive plan to address the debt.

Together, both reports provide a good overview of the challenge we face in the months ahead. Going over the fiscal cliff would reduce the deficit, but at the cost of unnecessary pain that we can avoid. A comprehensive plan can resolve the long-term problem while minimizing the impact on a recovering economy. We hope the recent statements from lawmakers in Washington are signs that Congress and the President are willing to work together toward this kind of deal.