CBO Looks at a Carbon Tax

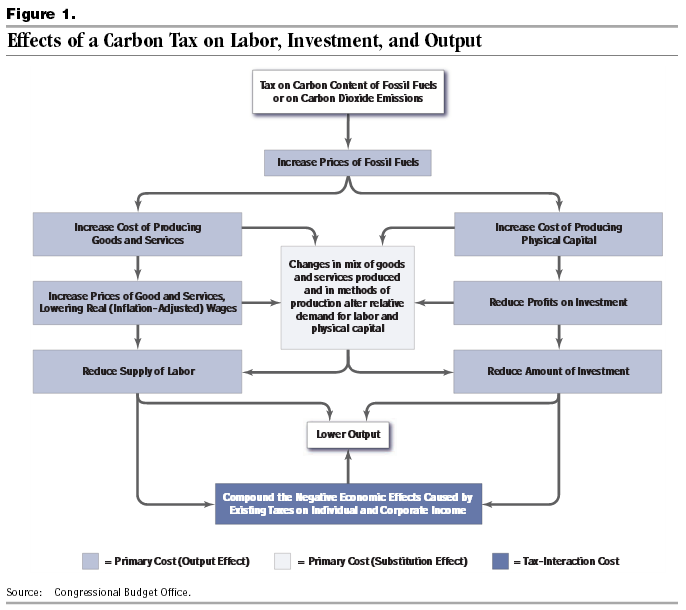

The revenue debate in DC is one that is often focused on the individual income tax system. But one option to raise revenue is to use new taxes that tax "economic bads," reducing the social costs while raising revenue. CBO explores one of these taxes, a carbon tax, in a recently released report.

CBO assumes that a carbon tax priced at $20 per metric ton of carbon dioxide would raise a similar level as a corresponding cap and trade auction, or $1.2 trillion over ten years according to a 2011 estimate. This would be equivalent to the revenue raised by all other federal excise taxes. Like many other consumption taxes, a carbon tax would be relatively regressive. CBO has estimated the distributional effects of a $28 per metric ton tax on carbon dioxide would reduce after-tax income by 2.5 percent for the bottom quintile and by less than 1 percent for the top quintile.

Source: CBO

There would be a question on how to use the revenue. One option would use the revenues to reduce the long-term budget deficit. While a carbon tax could hurt growth somewhat on its own, a rising debt path is also expected to constrict growth. While CBO has not estimated a tradeoff between the tax and a reduced deficit, they do point to an earlier study which estimated that repealing the 2001/2003 tax cuts would increase growth, with the lower debt burden outweighing the effects of higher marginal rates.

Another option would be to lower economically distorting taxes. Tax swaps -- using a carbon tax to lower other tax rates -- have been investigated, but evidence on the growth effect is mixed. The regressivity of the tax could also be addressed by lowering taxes or increasing spending to low income groups. Of course, lawmakers could decide to use some combination of deficit reduction and "give-backs" if a carbon tax was enacted.

As for the environmental effects, CBO estimates that a $20 carbon tax would reduce emissions by 8 percent by 2021. One problem CBO identifies is the difficulty of estimating the social cost of carbon (SCC) to which the tax should be set. While $20 per metric ton is the tax CBO has explored, the SCC could be higher or lower, and experts differ on the appropriate tax rate.

Given the sentiment in Congress on a carbon tax right now, a carbon tax is unlikely to be enacted. But the CBO report does show that the tax code can be used to change market behavior. However, it is important that our code is reviewed and reformed and all that options be explored for making sure it raises the necessary revenue and accomplishes the appropriate policy goals.

Click here to read the full report.