The Can Kicks Back: The Younger Generation is Being Swindled

Given the impact of Medicare and Social Security on our fiscal path, seniors are given a lot of attention whenever Congress debates deficit reduction. Another group often given rhetorical attention is the unborn, as politicians promise to address the debt before handing it off to the next generation. But a new report highlights one demographic group that's often ignored—young people between 18 and 30.

On Monday, The Can Kicks Back released a new report entitled "Swindled: How The Millenial Generation Will Pay the Price of Washington's Paralysis, " which analyzed the effect our nation's unaddressed fiscal challenges will have on the millenial generation. The report examines the fiscal gap: an estimate of the unfunded responsibilities that must be paid by future generations.

The report had five major takeaways:

- The true size of the nation’s debt problem is $200 trillion when you take into account all the future promises government has made but has not funded. That's the full tab millenials are going to inherit.

- The longer our country waits to address its long-term budget imbalance, the greater the burden will be on young people –– in part because of compounding interest payments.

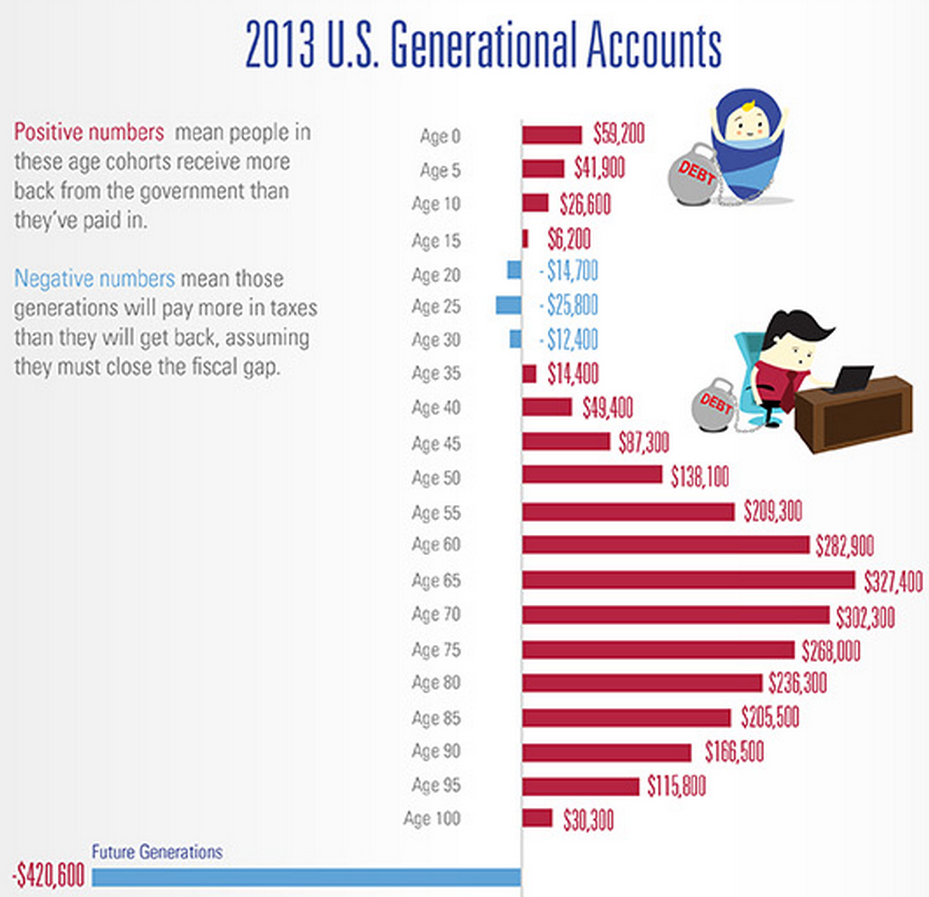

- Millennials and future Americans have a higher net tax burden than any other generation. Unlike older Americans who will collect more in benefits than they've paid in taxes over the course of their lifetime, millenials will be stuck with a giant bill.

- Changes in government spending have resulted in a shift from investment in the future to consumption in the present. Seniors' share of the pie is growing, while millenials' share is shrinking.

- Millennials cannot bear the burden being handed to them due to the economic challenges they are already facing, including unemployment, underemployment, falling wages, and massive student loans.

One of the report's most interesting graphs shows generational payments, which highlight the amount each age cohort is expected to pay in taxes, if the fiscal gap is going to be closed. While children under 18 and those over 35 are net recipients of money from the government—the burden of addressing the nation's debt will fall squarely on the Millenial generation, born between 1980 and 1995. These individuals will be forced to bear the burden of debt, either through tax increases or reduced government services from spending cuts.

Read the full report here.