Auerbach-Gale Projections Also Show Unsustainable Debt Picture

Alan Auerbach and William Gale at the Tax Policy Center recently released their frequently-updated budget projections. Their new outlook is familiar to those following the official CBO numbers: a somewhat stable near-term outlook but continuously rising debt over the long term. Beyond the overall debt numbers, their report contains a number of interesting tidbits about the composition of the budget and considerations for policymakers in addressing deficits and debt.

Auerbach and Gale's projection shows debt remaining at around 75 percent of GDP over the next three years before rising steadily to 81 percent by 2025. This is somewhat higher than CBO's 2025 debt level of 77 percent of GDP largely due to different policy assumptions the authors make. Specifically, they assume that temporary tax provisions -- including the tax extenders that expired at the end of last year -- are permanently extended and that lawmakers will grow appropriated spending with inflation rather than having it limited by the sequester-level caps. On the other hand, it assumes that war spending is drawn down rather than increased with inflation.

The authors make a number of observations about this ten-year outlook. Maybe most notable is the fact that unlike previous large debt run-ups, like those during wars, the current outlook does not show debt returning to a more normal level after the increase following the Great Recession; debt will continue increase from its already high level.

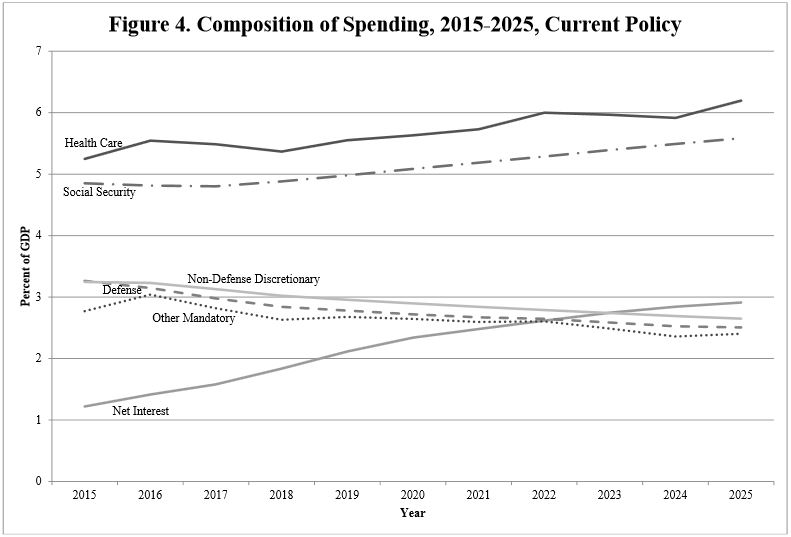

They also note how the composition of the budget will change over time. Non-interest spending will remain largely stable at just above 19 percent of GDP because health care and Social Security spending will be rising while other spending falls by a similar amount. Interest spending is expected to rise rapidly in the coming decade as debt increases and interest rates rise. Revenue, which is expected to be largely stable at 18 percent of GDP, will increasingly be reliant on growing revenue from the individual income tax.

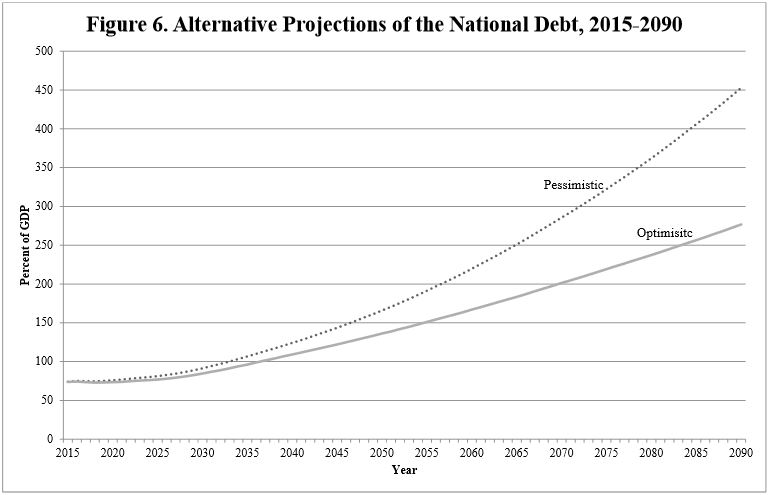

Many of the trends described above continue over the long term. Debt continues to rise at an increasing pace, exceeding its previous high of 106 percent of GDP in the mid- to late-2030s (depending on the health care growth assumptions used) and exceeding 200 percent sometime between the late 2050s and 2070.

The authors find that it would take between 1.6 and 1.8 percent of GDP ($285 to $310 billion in 2015) of annual deficit reduction just to stabilize debt at its current level in 25 years, and it would take changes of 3 percent ($535 billion) to get debt down to 36 percent (the 1957-2007 average). If these changes are delayed by five years, they grow one-quarter larger, requiring 2 percent of GDP changes to stabilize debt and 3.8 percent of GDP deficit reduction to bring it to 36 percent. This squares with what we have shown about the drawbacks of delaying changes.

Auerbach and Gale confirm what CBO has shown: debt will rise to an unsustainable level over the long term. To prevent this, lawmakers will need to restrain health care and retirement spending and ensure revenue is adequate to pay for the government we have.