Are Social Security Benefits Modest?

With Social Security’s recent 80th birthday behind us, a debate has arisen over whether or not Social Security benefits are "modest" for a typical retiree. Although this is not one of the 8 Social Security myths we addressed last week, it is a claim worth considering.

On one side of the debate is Bryann DaSilva of the Center on Budget and Policy Priorities (CBPP), who recently made the case that Social Security benefits are modest both in absolute terms and by international standards. On the other side is former Social Security Deputy Commissioner Andrew Biggs, who responded that Social Security's actual replacement rates – the amount of one's pre-retirement income it provides – are much higher than the numbers provided by SSA's chief actuary.

While much has been written on the right way to measure replacement rates,* there has been relatively little discussion about how Social Security compares internationally.

DaSilva's claim that benefits in the U.S. are “modest by international standards” stems from a 2013 piece by CBPP’s Kathy Ruffing that compares replacement rates provided by Social Security to those provided by similar programs in other Organisation for Economic Co-operation and Development (OECD) countries. Ruffing includes an excellent graph that shows the U.S. ranks “31st place among the 34 OECD member countries.”

Setting aside disagreements over the right way to measure replacement rates, Ruffing's point is more or less true – the U.S. system has a lower replacement rate than other countries. Yet it isn’t clear that any sort of replacement rates represent the right way to view the relative modesty of benefits. Based on OECD data, it is certainly not true that American seniors “get lower benefits than their counterparts in most other rich countries,” as Ruffing concludes.

The magnitude of benefits, after all, is a measure of how much seniors receive and how much they can buy with that money. Replacement rates may be a useful way to assess how good Social Security is as an income replacement program, but it tells very little about how much it provides seniors in terms of retirement security. Indeed, it is possible that part of the reason replacement rates in the United States are lower than many OECD countries is that income in the United States is higher than many others.

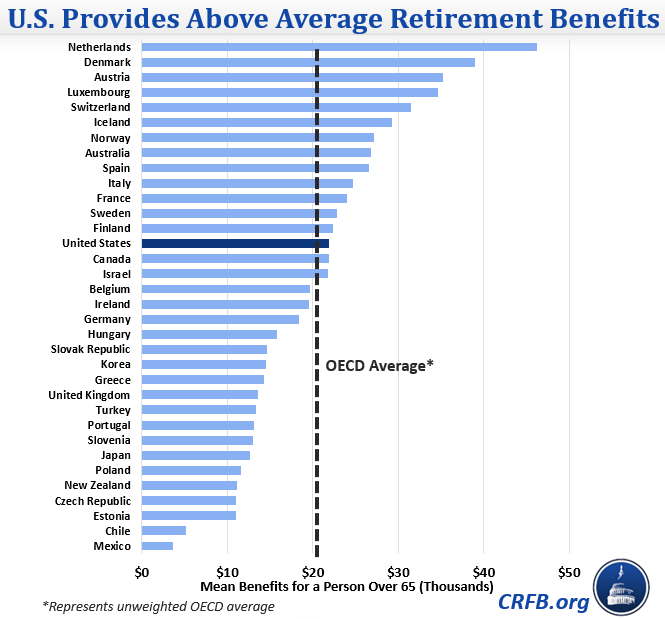

Rather than looking at replacement rates, we use OECD data to show the average value of benefits in each country, measured using “purchasing power parity” (PPP) so that all numbers represent how much they allow seniors to purchase in each country. By this measure, Social Security in the U.S. provides a much more typical level of benefits compared to other OECD countries. And indeed, average Social Security benefits in the United States are about $1,500 per year larger than the unweighted OECD average, and that excludes the effect of spousal benefits.

Source: CRFB calculations based on OECD data on average wages and replacement rates. Numbers based on mean rather than median due to data limitations, however our very rough estimates of median benefits suggest similar results.

In other words, while Social Security might provide Americans with a smaller share of their working income than other countries’ retirement programs, it does not provide them with lower benefits.

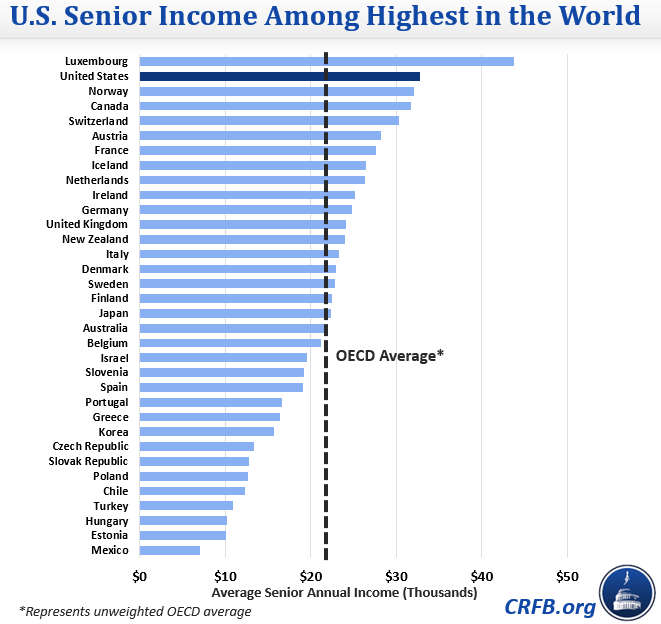

Moreover, when looking beyond Social Security, it is even more difficult to conclude that the average American senior is worse off than seniors in other countries. According to OECD data, in the late 2000s, the average income earned by Americans 65 and older was the second highest in the OECD, exceeded only by those in Luxembourg. And even measured as a percentage of population incomes (a measure close to the replacement rate measure cited by CBPP), Americans are in the top two quintiles.

Source: OECD

Importantly, these statistics show only the average American senior, and they do not speak to how lower- (or higher-) income seniors fare in the United States relative to other countries. But looking at the averages, it is hard to conclude that Social Security is less generous or that senior income is lower than in other developed nations.

Update: These graphs have been corrected since publication to clarify when a median and a mean was used.

*The debate over replacements rates essentially comes down to what one measures Social Security benefits against. The replacement rate figures published by Social Security and cited by CBPP compare against previous waged-indexed earnings, while Biggs argues it is more appropriate to use price-indexed earnings. CBO estimates a mean replacement rate of 47 to 50 percent measured against wage-indexed earnings and 58 to 64 percent against price-indexed earnings. Biggs also mentions that the CBPP-cited figures "exclude things like spousal benefits, which in the U.S. are still substantial but which many other countries don’t pay."