ARCHIVE: Analysis of Donald Trump's Health Care Plan

NOTE: This is an archive version of this analysis and contains out-of-date estimates. The most up-to-date analysis can be found here: https://crfb.org/blogs/analysis-donald-trumps-health-care-plan

Republican presidential candidate Donald Trump recently released a health care reform plan entitled “Healthcare Reform to Make America Great Again.” This plan has two major components. First, it would fully repeal the Affordable Care Act (“Obamacare”) and replace it with several new policies. Second, it would turn Medicaid into a “block grant” program.

By our estimates, Mr. Trump’s plan to repeal and replace Obamacare would cost roughly $270 billion over ten years including estimates of faster economic growth, and nearly $500 billion under conventional scoring.

The policies would cause almost 21 million people to lose their insurance coverage, as the replacement health care policies would only cover 5 percent of the 22 million individuals who would lose coverage upon the repeal of Obamacare. This would almost double the number of Americans without health insurance.

Block granting Medicaid, meanwhile, could have a wide range of savings depending on details which have yet to be provided. Past proposals have often saved several hundred billions of dollars.

The Cost of Repealing and Replacing Obamacare

In total, we estimate Mr. Trump’s “repeal and replace” plan for Obamacare would cost nearly $500 billion over ten years under conventional scoring and about $270 billion with dynamic scoring.

The largest component of this estimate comes from the “repeal.” The campaign website proposes to “completely repeal Obamacare,” which we assume to mean repealing the Affordable Care Act’s regulations, subsidies, Medicaid expansion, Medicare savings, and tax increases. Although repealing the coverage provisions would save about $1.1 trillion, based on Congressional Budget Office (CBO) estimates (adjusted for recent legislation and changes in the budget window), repealing the legislation’s tax increases and Medicare cuts would cost a combined $1.5 trillion. In total, this means repeal would cost $420 billion – or $200 billion including the economic benefits of repeal.

| 10-Year Estimates of “Healthcare Reform to Make America Great Again” | |

| Policy | Costs / Savings (-) |

| Repeal Obamacare Coverage Provisions | -$1,120 billion |

| Repeal Obamacare Tax Increases | $660 billion |

| Repeal Obamacare Medicare Savings | $880 billion |

| Dynamic Effects from Growth (excluded from conventional scores) | -$220 billion |

| Subtotal, Repeal Obamacare | $200 billion |

| Allow insurance to be purchased across state lines | -$10 billion |

| Create deduction for individual insurance premiums | $100 billion |

| Allow importation of prescription drugs | -$20 billion |

| Require price transparency and promote health savings accounts (HSAs) | * |

| Subtotal, Replace Obamacare | $70 billion |

| Total under Dynamic Scoring (including growth from repealing Obamacare) | $270 billion |

| Subtract Dynamic Effects from Growth (excluded from conventional scores) | -$220 billion |

| Total under Conventional Scoring | $490 billion |

* Less than $10 billion of net costs or savings.

Source: CRFB calculations based entirely on various CBO estimates for the independent pieces. All estimates are very rough and rounded to the nearest $10 billion. Interactions or interest costs not included.

Meanwhile, Mr. Trump’s plan to replace Obamacare would entail further costs. Most significantly, Mr. Trump would create a tax deduction for individuals buying their own health insurance. This would equalize the tax treatment between individually-purchased and employer-provided health insurance, but at a cost of roughly $100 billion over ten years.

The cost of these policies would partially be offset by savings from expanding prescription drug importation and re-importation and allowing people to purchase insurance across state lines. Policies to require price transparency and promote health savings accounts will likely have small effects in opposite directions, roughly canceling each other out.1 As a result, the replacement plan would cost $70 billion.

The total cost of Mr. Trump’s repeal and replace health care plan would be $270 billion over a decade under dynamic scoring and nearly $500 billion under conventional scoring. Those numbers would be smaller (and the direction could differ) if he retained some of the Medicare cuts and/or tax increases from Obamacare

Note that this analysis does not include Mr. Trump’s call to negotiate aggressively for Medicare drugs, a policy that is not listed on his website. He has previously claimed that $300 billion a year could be saved through negotiation, a claim we rated as false because Medicare will only spend an average of $111 billion each year on prescription drugs. Based on previous estimates by CBO, actual savings would likely be small or negligible.

The Coverage Impact of Repealing and Replacing Obamacare

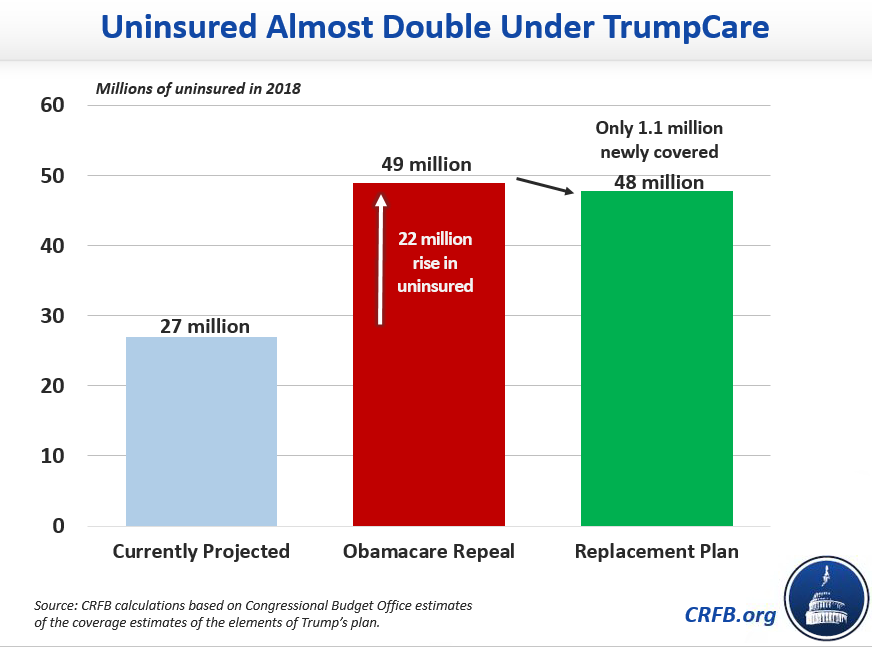

According to CBO, about 27 million Americans will lack health insurance coverage in 2018. Repealing Obamacare would increase that number by 22 million, whereas Mr. Trump’s replacement plan would only increase coverage by 1.1 million. In other words, the plan would increase the number of uninsured individuals by about 21 million and only cover about 5 percent of individuals that would lose coverage from Obamacare repeal.

The 1.1 million of gained coverage comes from the policies to allow insurance companies to sell across state lines, which would increase coverage by 400,000, and the deduction for individual health insurance, which would increase coverage by 700,000. (Estimates from CBO) Other elements of Mr. Trump’s replacement plan might reduce costs but would not significantly impact coverage.2

Note that these estimates do not account for Mr. Trump’s call to require insurance companies to cover individuals with pre-existing conditions – a policy not listed on his website. Doing so without penalties or subsidies to encourage individuals to purchase insurance, according to CBO, would actually further increase the number of uninsured individuals.

Block Granting Medicaid

In addition to repealing and replacing Obamacare, Mr. Trump proposes to transform Medicaid into a block grant to the states. Effectively, this means replacing the current system where the federal government pays for a portion of state Medicaid costs (based on a matching rate) with a system where the federal government gives each state a fixed allotment of dollars each year.

Not surprisingly, the amount of money this proposal would save (or cost) depends entirely on the size of that allotment, and how much it grows each year. For example, block grants could be designed to maintain current projected spending levels, or they could be designed to save hundreds of billions of dollars (last year’s House budget resolution assumed over $900 billion in Medicaid savings). However, the Trump campaign has not provided any information on the size of their proposed block grants, making it impossible to score any savings.

To offer some examples, we assumed block grants would be offered at current levels (excluding the Obamacare expansion) in 2017 but then indexed to grow more slowly than current law. Indexing block grants to per person Gross Domestic Product would only save $25 billion over the next decade; freezing block grants in nominal dollars would save nearly $850 billion. Practically any combination is possible.

| 10-Year Estimates of Different Block Grants for Medicaid | |

| Policy | Savings |

| Set block grants at current levels, growing at currently projected levels | $0 billion |

| Set block grants at current levels, growing with GDP | $160 billion |

| Set block grants at current levels, growing with inflation | $470 billion |

| Set block grants at current levels, freezing permanently | $845 billion |

| Set block grants at current levels, growing per-person spending with GDP | $25 billion |

| Set block grants at current levels, growing per-person spending with inflation | $350 billion |

| Set block grants at current levels, freezing per-person spending permanently | $745 billion |

| Medicaid and other health savings contained in the FY 2016 House Budget | $915 billion |

Sources: CRFB calculations based on CBO data, House Budget Committee. Per-person calculations based on aggregate national enrollment, not state-by-state enrollment

If Mr. Trump intends to generate aggressive savings from block granting Medicaid, it could more than pay for the cost of repealing and replacing Obamacare – though perhaps at the cost of a further reduction in coverage.

* * * * *

As our analysis above shows, Mr. Trump’s plan to repeal and replace Obamacare – based on the details available – would both add to the deficit and significantly reduce coverage. Meanwhile, his plan to block grant Medicaid could generate significant savings; however, insufficient details are available to estimate if there are any and how much.

These changes are for the most part in addition to Mr. Trump’s other policy proposals,3 which we’ve estimated would cost between $12 trillion to $15 trillion, driving debt to somewhere between 115 and 140 percent of the economy in ten years. As the campaign proceeds, we hope that Mr. Trump will present additional policies to pay for his proposals and put debt on a more sustainable path.

1 Mr. Trump also has proposed to promote price transparency to allow individuals to shop for the best price for each procedure and to promote health savings accounts (HSAs). With regards to price transparency, the Congressional Budget Office found that the effect on prices would be ambiguous, and in our view savings would likely be positive but small. In terms of HSAs, it is not clear how Mr. Trump’s policies would differ from current law. His website says that his plan would “allow individuals to use health savings accounts” and that contributions should be tax-free, allowed to accumulate, and available to family members without penalty. All of these items are already true under current law, and Mr. Trump’s additional proposal to allow HSAs to be passed to heirs will likely have a very small cost. If he intends to expand these accounts so that individuals without high-deductible plans could use them or to increase the limit on contributions, the proposal could have significant costs. However, we assume only a small cost based on the ideas specifically articulated in the press and scores of previous modest HSA proposals.

2 Mr. Trump also says that “We must review basic options for Medicaid and work with states to ensure that those who want healthcare coverage can have it.” However, without any specific proposals, it is not clear what changes, if any, are being proposed. Although we reached out to the Trump campaign, they did not provide us with any detail on this or other policies. Thus, we did not include this in our coverage estimates.

3 There is one policy, repealing the Affordable Care Act’s 3.8 percent surtax on investments, that is included both as a part of Mr. Trump’s health plan and as a part of Mr. Trump’s tax plan. When we update our tally of the total cost of Mr. Trump’s policies, we would remove this double counting and account for interest costs from this health plan.