8 Myths on Social Security's 80th Birthday

Today marks Social Security's 80th birthday, celebrating the anniversary of the establishment of the old-age portion of the program in the Social Security Act of 1935. To kick off the celebration, CRFB released a new report yesterday, "Debunking 8 Social Security Myths on Its 80th Birthday," that seeks to clear up the conversation about the program.

The 8 myths are:

- Myth #1: Social Security does not face a large funding shortfall

- Myth #2: Today’s workers will not receive Social Security benefits

- Myth #3: Social Security would be fine if we hadn’t “raided the trust fund”

- Myth #4: Social Security cannot run a deficit

- Myth #5: Social Security has nothing to do with the rest of the budget

- Myth #6: We don’t need to worry about Social Security for 20 years

- Myth #7: Social Security reform is code for slashing benefits, especially for the poor

- Myth #8: Social Security is too hard to fix

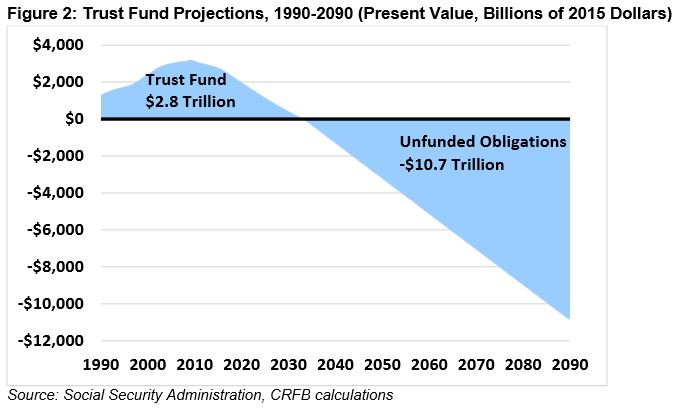

The report clears up misconceptions about Social Security's finances, its role in the scope of the overall federal budget, the consequences of inaction, and what reform entails. For example, the report clears up talk about the Social Security trust fund being "raided," noting that while there is a legitimate argument that the surpluses the program accumulated during the 1990s and 2000s were used to mask deficits (or make surpluses look larger) in the rest of the budget, no money was actually taken out of the trust fund. It still has the $2.8 trillion that it holds in special Treasury bonds and will draw down that money as needed to cover program deficits. The trust fund will go insolvent not because it was raided but because of those deficits.

The report goes in depth on several other misconceptions about the program. Lawmakers and citizens will need to have an informed debate about the trade-offs needed to keep Social Security solvent for another 80 years and beyond. Clearing up these myths should help with that purpose.

Click here to read the full report.