The 2022 U.S. Economy in Ten Charts

In economic history, 2022 will be remembered for high and rising inflation and rising interest rates in response. While high inflation dominated the news cycle, the year was also one of low unemployment, wage growth, and falling deficits due to expiring COVID relief.

Below we highlight our top ten charts to explain the economy in 2022.

Inflation Hit a 40-Year High – With Most Inflation in the First Half of the Year

From the beginning of the year to June, the consumer price index (CPI) grew 5.4 percent and the personal consumption expenditure price index (PCE) grew 3.9 percent. On a year-over-year basis, the increase in June reached 9.0 percent for the CPI and 7.0 percent for the PCE.

Both CPI and PCE inflation in 2022 were at historically high levels. The CPI inflation rate of 7.1 percent is the highest since 1981.

Rising inflation in 2022 led to a rise in the Social Security cost-of-living adjustment (COLA). Starting in January 2023, benefits paid increased by 8.7 percent. This is the highest increase since 1981 and 2.8 percentage points higher than the 2022 COLA. A higher COLA could lead the Social Security trust funds to be insolvent even earlier than projected.

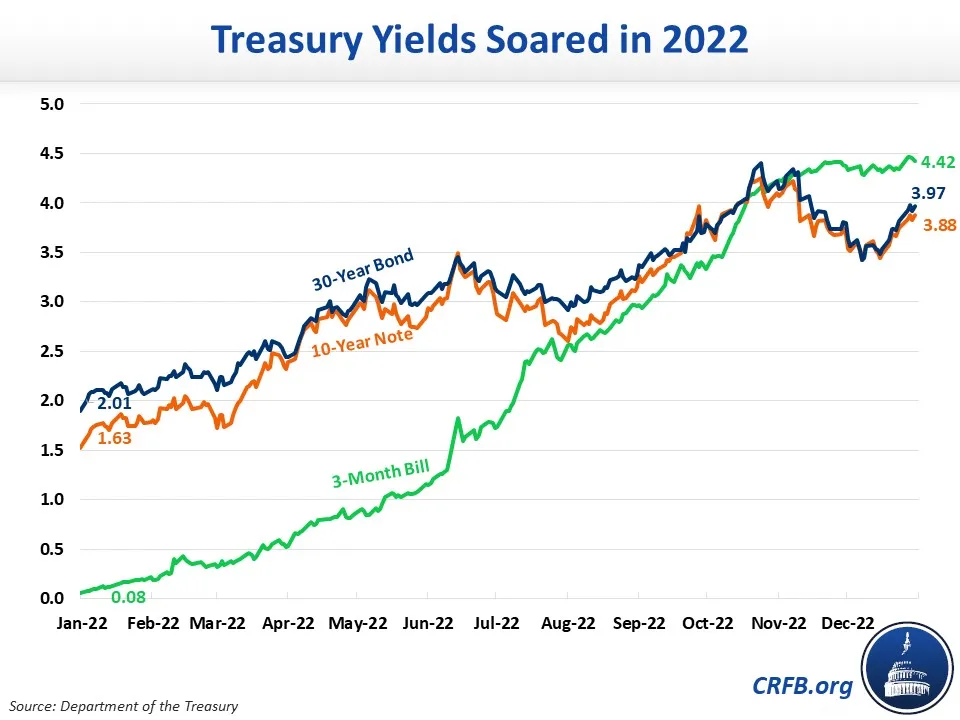

Interest Rates Rose Sharply

The Federal Reserve (Fed) raised interest rates seven times in 2022, from a target range of 0.0 percent to 0.25 percent before March to between 4.25 percent and 4.50 percent by the end of the year. This helped lead to a commensurate increase in Treasury bond rates. For example, the three-month bill yield grew from 0.1 percent at the beginning of 2022 to 4.4 percent by the end. The 30-year yield grew from 2.0 percent at the beginning of the year to 4.0 percent by the end.

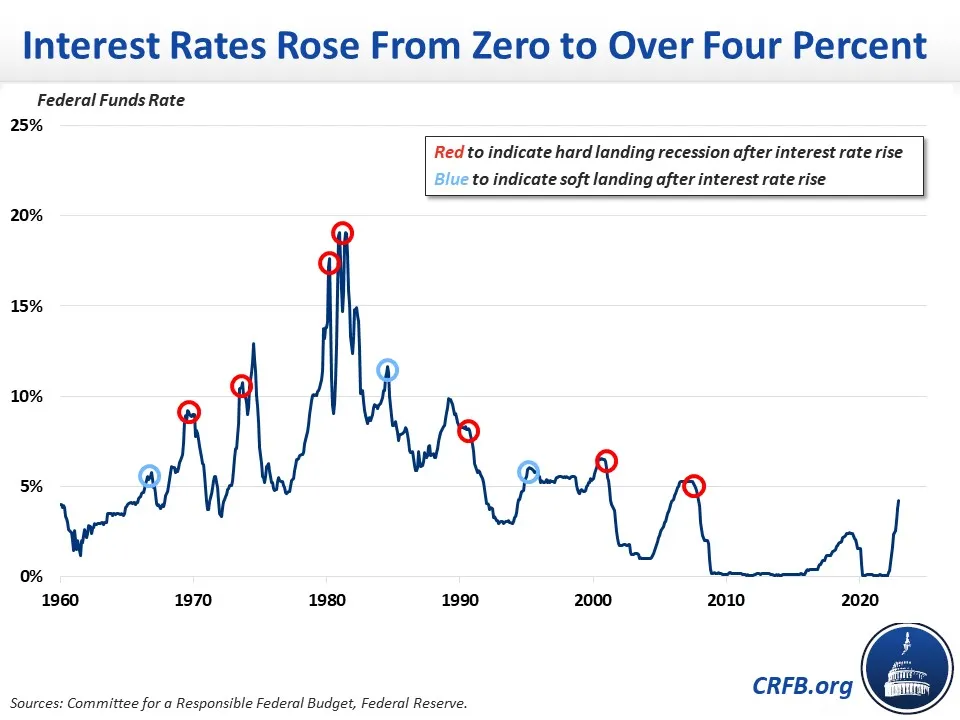

The Fed expects the median Federal Funds Rate to be 5.1 percent in 2023. It hopes to achieve a “soft landing,” where the inflation slows without an economic recession, although unemployment is projected to rise by more than one percentage point this year. Soft landings are possible but rare, occurring only three out of the last ten attempts.

Although the Fed is prime to respond to inflation and support price stability, we have shown that fiscal policy can be used to help the Fed fight inflation and reduce the likelihood of a deep recession.

Strong Employment and a Tight Labor Market in 2022

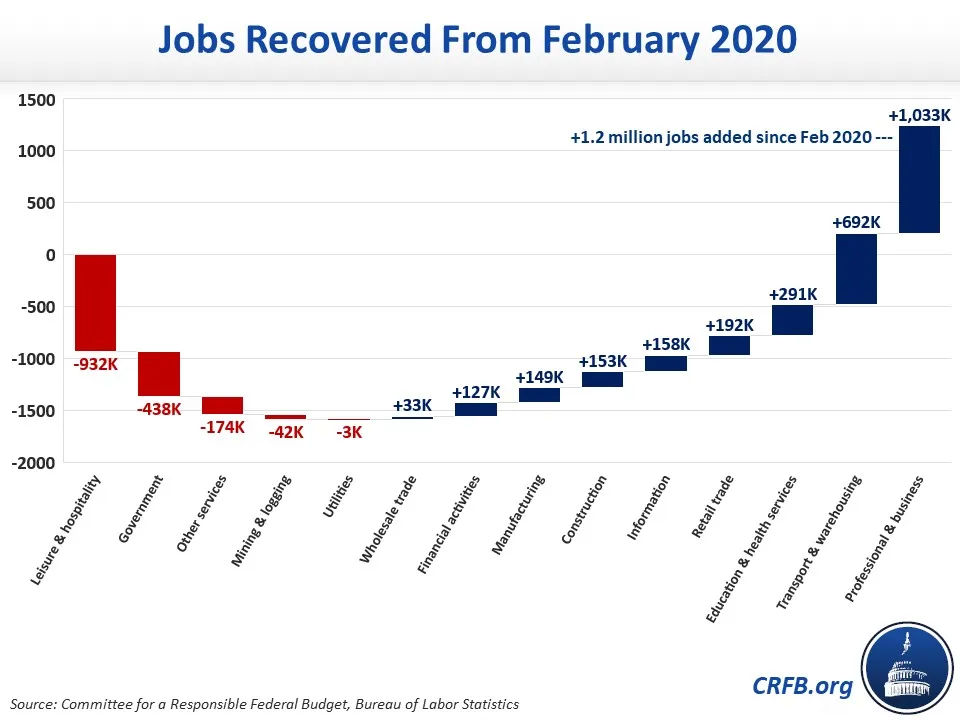

Throughout this year, the labor market has continued to recover from jobs lost since the start of the pandemic in February 2020. Specifically, the economy added 4.5 million jobs in 2022, according to the Bureau of Labor Statistics. Since before the pandemic, over 1.2 million jobs have been added. This is the net effect of around 930,000 job losses in leisure and hospitality, nearly 440,000 lost in government, and 220,000 losses in other industries, offset by 2.8 million gains in remaining sectors. Over 1 million of the jobs were gained in professional and business services and nearly 700,000 in transportation and warehousing since the pandemic began.

Job gains occurred as the labor market remained strong throughout the year and the unemployment rate fell from 4.0 percent in January to 3.5 percent in December, matching a 53-year low. The unemployment rate was 1.9 percent among college graduates at the end of 2022.

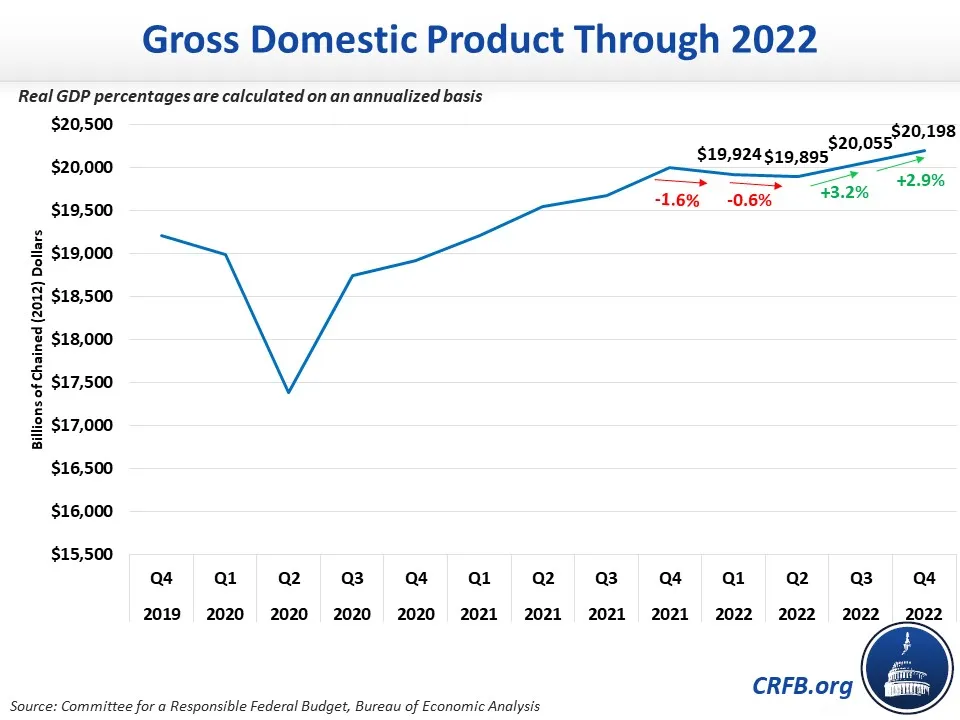

Uncertainty for Economic Growth

According to the most recent data from the Bureau of Economic Analysis, the advanced estimate for real gross domestic product (GDP) in the fourth quarter of 2022 is 2.9 percent on an annualized basis. Real GDP was negative in the first two quarters of the year, with the economy contracting 1.6 percent annualized in the first quarter and 0.6 percent annualized in the second quarter, followed by growth of 3.2 percent annualized in the third quarter.

Annual Deficits Fell in 2022, Set to Rise Again

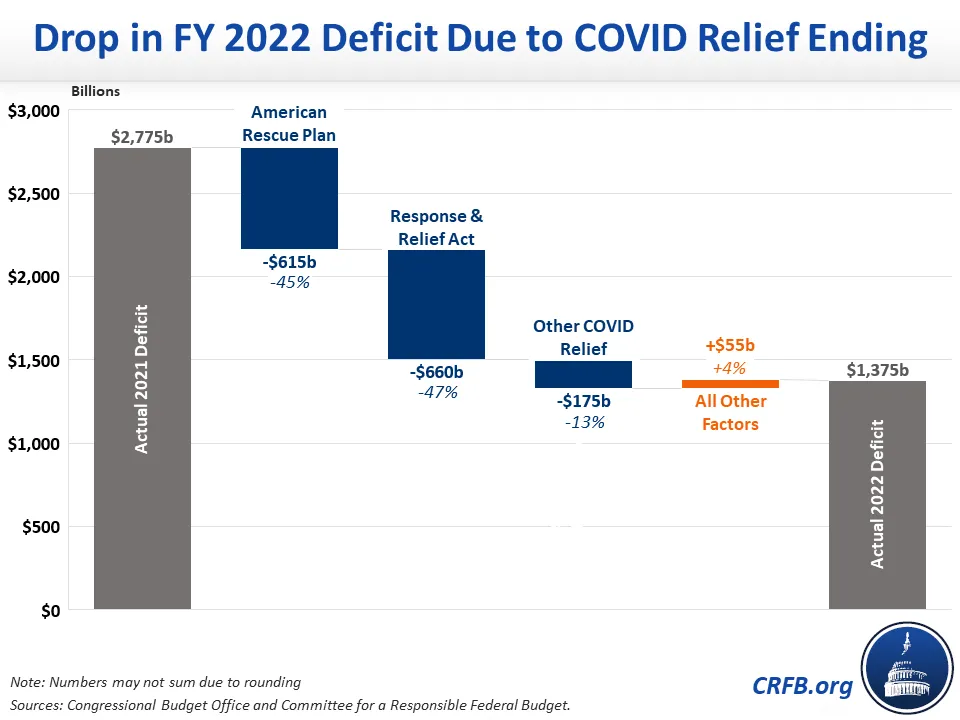

The budget deficit for Fiscal Year (FY) 2022 totaled $1.4 trillion. The deficit was larger than the Congressional Budget Office's (CBO) projected $1.0 trillion and $400 billion above pre-pandemic levels in FY 2019. The budget deficit fell $1.4 trillion from $2.8 trillion in FY 2021. Over 100 percent of this decline was the result of shrinking or expiring COVID relief, including $615 billion from the American Rescue Plan, $660 billion from the Response & Relief Act, and the rest from other COVID relief legislation.

For calendar year 2022, the budget deficit totaled $1.4 trillion. Structural deficits are rising, and the CBO's December monthly budget review shows deficits (adjusted for timing shifts) were about $100 billion higher in the final three months of 2022 compared to 2021, a 29 percent increase, despite a roughly $100 billion drop in COVID relief. Deficits are likely to rise further in light of the recent 9 percent increase in discretionary spending, 8.7 percent Social Security COLA, and continued rollover of our debt.