The Fiscal Cliff Resource Page

The United States faced a serious dilemma at the end of 2012 as a combination of steep tax increases and spending cuts were scheduled to occur all at once, known as the "fiscal cliff." A last-minute agreement was reached that diminished the impact of the fiscal cliff.

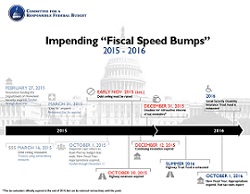

However, because policymakers have been unable to comprehensively deal with our fiscal challenges, a series of "Fiscal Speed Bumps" consistently arise and are often simply kicked down the road as Washington seeks to buy time instead of invest in solutions. A number of these deadlines converged into a "Gathering Storm" that threatened a new fiscal cliff at the end of 2015. A deal was reached in October 2015 that avoided some of these issues and a tax cut and spending package in December dealt with the remaining issues, while adding substantially to the national debt.

- The end of 2015 appropriations and return of sequester caps

- The expiration of the highway bill and insolvency of the Highway Trust Fund

- The exhaustion of extraordinary measures to avoid raising the Debt Ceiling

- The deadline to renew tax extenders retroactively

Fiscal Cliff Refresher

The original fiscal cliff referred to the major budget changes that were initially set to occur all at once at the end of 2012 and beginning of 2013. These changes included the expiration of the 2001/2003/2010 tax cuts, the triggering of across-the-board spending cuts through the "sequester," the expiration of the payroll tax holiday, the end of the "patch" protecting many middle-class families from the Alternative Minimum Tax, and the end of the "doc fix" preventing steep reductions in Medicare payments to physicians. As Ben Bernanke remarked at the end of February 2012:

Under current law, on January 1, 2013, there's going to be a massive fiscal cliff of large spending cuts and tax increases. I hope that Congress will look at that and figure out ways to achieve the same long-run fiscal improvement without having it all happen at one date.

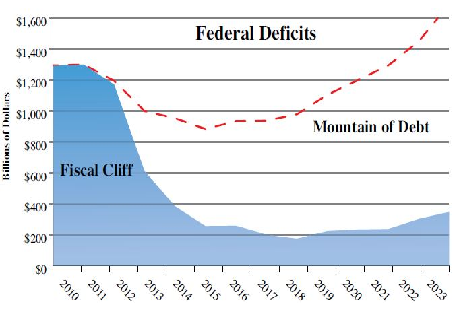

The fiscal cliff was minimized and the spending reductions under sequestration were eventually moderated for a couple of years because lawmakers found themselves between a rock and a hard place. While these changes would produce significant deficit reduction, they would do so in an abrupt and careless manner that would impair the fragile economic recovery. On the other hand, an even worse option would be to extend all of the policies with no corresponding offsets, leading to a mountain of debt and all of the associated economic risks.

The Gathering Storm

The inability to enact a comprehensive fiscal plan that puts the debt on a clear downward path as a share of the economy in a smart way has resulted in a series of mini cliffs that constantly re-emerge. Several of these Fiscal Speed Bumps converged at the end of 2015.

The Gathering Storm: Fiscal Clouds Amass this Fall

The Gathering Storm: Fiscal Clouds Amass this Fall- Health, Revenue and Other Mandatory Spending Options

- Fiscal Speed Bumps Infographic and Blog

- Fiscal Speed Bumps: Challenges, Risks and Opportunities

- Four Gimmicks to Watch Out for

- Avoiding Budget Gimmicks Chartbook 2015

- Additional Gathering Storm Resources

- Archived Fiscal Cliff Resources

The new fiscal year began on October 1 without a new spending plan, but a government shutdown has been avoided by a series of short-term stopgap measures. One complicating factor has been sequestration.

The sequester, or sequestration, refers to the annual spending caps that were a part of the fiscal cliff. Many want to replace it with a more sensible approach that deals with all parts of the budget and is less abrupt. The sequester for 2014 and 2015 was replaced by the Bipartisan Budget Act of 2013, also known as Ryan-Murray. Two more years of relief were provided by a deal that became the Bipartisan Budget Act of 2015.

Omnibus Bill Falls Back on the Usual Budget Gimmicks

Omnibus Bill Falls Back on the Usual Budget Gimmicks- Q&A: Everything You Should Know About Government Shutdowns

- The Tricks and Treats in the Budget Deal

- Budget Deal Truly Offsets Only Half Its Cost

- The Budget Deal: Too Many Gimmicks, Too Few Reforms

- Sequester Offset Solutions (SOS) Plan

- SOS Plan Summary

- Appropriations 101

- Appropriations Watch

- Appropriations Blogs

- Additional Appropriations/Sequestration Resources

Congress has had difficulty authorizing funding for surface transportation projects on a long-term basis. In addition, the Highway Trust Fund (HTF) has faced shortages because revenues through the gasoline tax have not been sufficient. Sustainably financing infrastructure is critical. Highway funding was renewed for five years in December, but the agreement will still leave a signifcant future shortfall in the HTF.

Highway Agreement is Gimmicky and Costly

Highway Agreement is Gimmicky and Costly- The Road to Sustainable Highway Spending

- The Road to Sustainable Highway Spending Summary

- Trust or Bust: Fixing the Highway Trust Fund

- Highway Funding Blogs

- Additional Highway Funding Resources

The statutory debt ceiling constantly has to be raised because of rising debt. Reforms to the debt limit should be considered that promote fiscal responsibility without generating much economic risk. The debt limit was suspended until 2017 by the Bipartisan Budget Act of 2015.

- Q&A: Everything You Should Know About the Debt Ceiling

- Improving the Debt Limit

- Understanding the Debt Limit

- Debt Ceiling Blogs

- Additional Debt Ceiling Resources

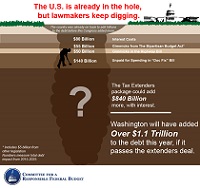

At the end of last year, over 50 temporary “tax extenders” expired. These include individual and business tax breaks for research and experimentation, wind energy, state and local sales tax, and many others. Most are renewed regularly and can be reinstated retroactively through the end of 2015. This could have been an opportunity for comprehensive, pro-growth tax reform that simplifies the tax code, reduces tax rates and deficits, broadens the tax base, promotes growth, and makes thoughtful choices about how to address each tax extender. Instead, lawmakers made a deal that expanded some and made a few permanent, while growing the debt considerably.

- Deficit-Financed Tax Bill Blows a Hole in the Budget

- The Fiscal Irresponsibility of the Tax Deal in 6 Charts

Negotiated Tax Deal Would Cost $680 Billion

Negotiated Tax Deal Would Cost $680 Billion- Tax Extenders Resource Page

- Are Tax Extenders Worth the Cost?

- Emerging Deal Could Add $2.3 Trillion in Debt by 2035

- The PREP Plan: Paying for Tax Extenders to Set Up Tax Reform

- The Tax Break-Down: Tax Extenders

- Tax Extenders Blogs

- Tax Reform Resource Page

- Additional Tax Extenders Resources

- The Gathering Storm: Fiscal Clouds Amass this Fall

- Health, Revenue and Other Mandatory Spending Options

- Fiscal Speed Bumps Infographic and Blog

- Fiscal Speed Bumps: Challenges, Risks and Opportunities

- Four Gimmicks to Watch Out for

- Avoiding Budget Gimmicks Chartbook 2015

Appropriations/Sequestration Resources

- Omnibus Bill Falls Back on the Usual Budget Gimmicks

- Q&A: Everything You Should Know About Government Shutdowns

- The Tricks and Treats in the Budget Deal

- Budget Deal Truly Offsets Only Half Its Cost

- The Budget Deal: Too Many Gimmicks, Too Few Reforms

- Sequester Offset Solutions (SOS) Plan

- Appropriations 101

- Appropriations Watch

- Appropriations Blogs

- SOS Plan Summary

- Summary of Rep. Scott Rigell Sequester Replacement Plan

Archive of Appropriations/Sequestration Resources

- Q&A: Everything You Need to Know About a Budget Conference - CRFB

- Understanding the Bipartisan Budget Act - CRFB

- Understanding the Sequester - CRFB

- Sequester FAQ - Fix the Debt Campaign

- Making the Grade on Sequestration Report Card - Fix the Debt Campaign

- The Sequester - What You Need to Know - Bipartisan Policy Center

- What Does Sequestration Mean? - Edsplainer Video - Washington Post

- Understanding the Sequester - In 4 Great Infographics - The Fix - Washington Post

- Sequestration: What in the World Is it? - Fiscal Times

- The Sequester: Absolutely Everything You Could Possibly Need to Know, In One FAQ - Wonkblog - Washington Post

- Sequestration Primer

- Sequester Pinterest Page

- Unintended Consequences of the Sequester

- Democrats, Republicans, Economists All Want to Replace the Sequester

- Simpson & Bowles Release $2.4 Trillion Deficit Reduction Framework

- Senate Democratic Proposal and Other Plans to Replace the Sequester

- Highway Agreement is Gimmicky and Costly

- The Road to Sustainable Highway Spending

- The Road to Sustainable Highway Spending Summary

- The Road to Sustainable Highway Funding Graphic

- Trust or Bust: Fixing the Highway Trust Fund

- Highway Funding Blogs

- Q&A: Everything You Should Know About the Debt Ceiling

- Improving the Debt Limit

- Understanding the Debt Limit

- Debt Ceiling Blogs

- Deficit-Financed Tax Bill Blows a Hole in the Budget

- The Fiscal Irresponsibility of the Tax Deal in 6 Charts

- Negotiated Tax Deal Would Cost $680 Billion

- Tax Extenders Resource Page

- Are Tax Extenders Worth the Cost?

- Who Gets What in the Tax Extenders Deal?

- Tax Deal Goes Beyond Simple Extensions

- Emerging Deal Could Add $2.3 Trillion in Debt by 2035

- The PREP Plan: Paying for Tax Extenders to Set Up Tax Reform

- The Tax Break-Down: Tax Extenders

- Tax Extenders Blogs

- Tax Reform Resource Page

Archive of CRFB Fiscal Cliff Policy Papers and Statements

- The Good, the Bad and the Ugly in the Fiscal Cliff Package

- Fiscal Cliff Blogs

- Washington's Gift for the New Year: Another Kicked Can

- What We Hope to See from the Fiscal Cliff Negotiations

- Raising Revenue from High Earners Through Base Broadening

- Between a Mountain of Debt and a Fiscal Cliff

- CRFB Reacts to OMB's Report on the Sequester

- With Conventions Out of the way, It's Time for Leaders to Lead

- Don't Keep Kicking the Can Down the Road

- CBO Makes The Case For Replacing The Fiscal Cliff With a Comprehensive Deficit Reduction Plan

- CBO Projections Show Need for Smart, "Go Big" Approach: Comparing Major Debt Reduction Plans

- CRFB Urges Tax Reform On Tax Day

Op-Eds and Articles on the Fiscal Cliff

- Hold Your Applause

- Statement from Erskine Bowles and Alan Simpson on Passage of the Fiscal Cliff Deal

- Maya MacGuineas: Make The Candidates Debate The Debt

- Ben Bernanke Testimony

- NY Times Editorial: Fiscal Cliff Notes

- World Bank Head: Use 'Fiscal Cliff' To Get US Finances on Track

- IMF on the Fiscal Cliff

- Open letter to our leaders in Washington

- Five Myths About the Fiscal Cliff

Fiscal Cliff Videos

- Fiscal Cliff Music Video - Merle Hazard

- The Fiscal Cliff for Beginners - Khan Academy

- What is the Fiscal Cliff? Everything You Need to Know - Wall Street Journal

- The Economist Explains the Fiscal Cliff - The Economist

- The Fiscal Cliff: How Much Would taxes Rise in 2013? - Tax Policy Center

- What is the Fiscal Cliff?: Edsplainer - Washington Post

- Fiscal Cliff Part 1 - National Priorities Project

- Fiscal Cliff Part 2 - National Priorities Project

Fiscal Cliff Infographics

- The Fiscal Cliff, in Graphs and GIFs - Washington Post

- Congressional Budget Office

- Concord Coalition

- Common Sense Coalition

- The Fiscal Cliff - ABC News

- Taxmageddon - ABC News

Fiscal Cliff Interactive and Social Media