What Happened to Interest Rates?

One of the biggest stories in CBO's August budget update was the huge downward revision to expected spending on interest to service the debt, down by $615 billion in total through 2024.

Primarily, this revision stems from lower projected interest rates, resulting in $465 billion less spending over ten years. Another $90 billion came from technical changes (mostly from estimates of payments on inflation-protected debt securities), and $60 billion came from a lower debt burden as a result of all the revisions in the new baseline (a change known as debt service). The interest rate story is the most interesting, though, since it has the largest implications for the federal government's interest burden in the future.

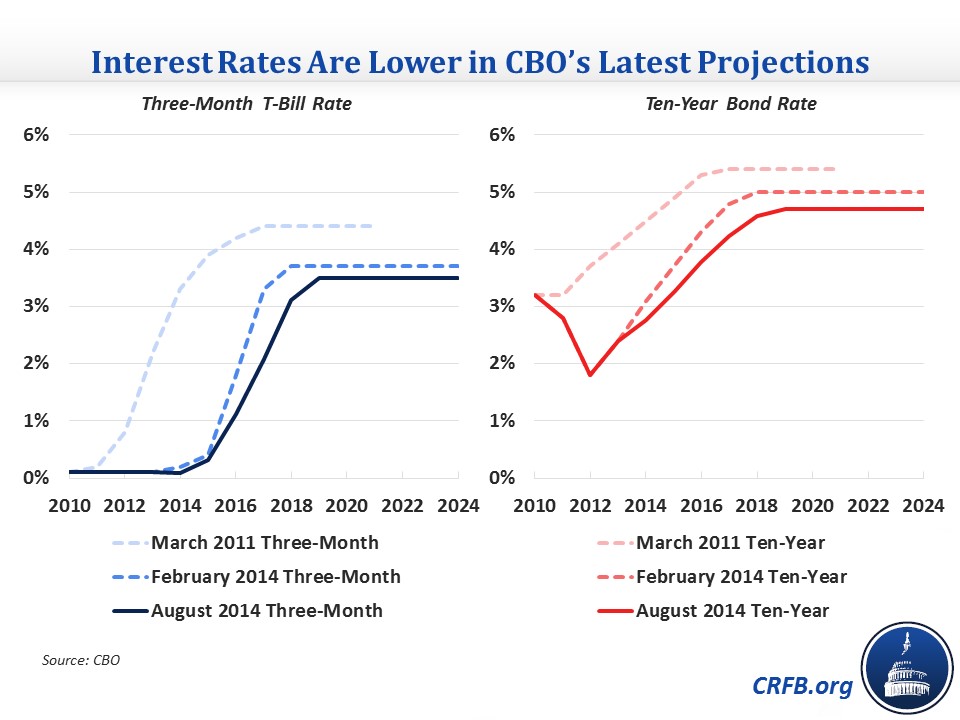

Our analysis of the report noted that interest rates had been revised down both in the short term and the longer term. In 2014, the rate on ten-year Treasury notes is now expected to average 2.8 percent rather than 3.1 percent, and to stabilize by 2019 at 4.7 percent instead of 5.0 percent. CBO made a similar revision to projected three-month T-bill rates. As a result of these changes, interest spending was revised down by more than $30 billion through 2016 and by $50-65 billion annually in the 2017-2024 period.

This downward revision by CBO continues a recent trend of declining projections as interest rates have stayed depressed for longer and the economy has been slower to recover than CBO originally anticipated.

For example, interest spending in 2021 is now projected to be $627 billion, more than a 20 percent drop from the $807 billion CBO expected in March 2011. As you can see below, interest rates are lower every year in the latest outlook than they were in February and much lower than they were three years ago; in fact, the three-month T-bill rate for this year predicted in March 2011 is closer to the current ten-year rate than the three-month rate. The stark difference in the short term stems in part from the fact that CBO anticipated at that time that the Federal Reserve would raise the federal funds rate in late 2011 and begin shrinking its balance sheet a year later. Instead, the federal funds rate has yet to be raised in light of the slow recovery, and the Fed has significantly expanded its balance sheet and continues to do so.

The reasoning behind the most recent revision is less explicit, but CBO Assistant Director for Macroeconomic Analysis Wendy Edelberg explained factors that influenced their change in a follow-up blog post:

That reassessment involved both reconsidering the relative importance of factors that had been included in the agency’s previous analyses, such as the growth of the labor force, and adding factors not incorporated before, such as the effect of income inequality on the saving rate, the risk premium, the share of output going to owners of capital, and the effect of an aging population on the saving rate.

The latest revision will lead to slower growth in interest spending over the next decade, but that growth is still substantial. That category will increase more than three-fold from $231 billion in 2014 to $800 billion in 2024, though that is down from $875 billion projected in the April outlook (a drop of 8.6 percent). Of course, if interest rates continue to be extraordinarily low in the next few years rather than rise gradually as CBO expects, there may be further change. Notably, though, because much of the interest spending revisions stem from a slower economic recovery, lower revenue expectations generally ensue as well.

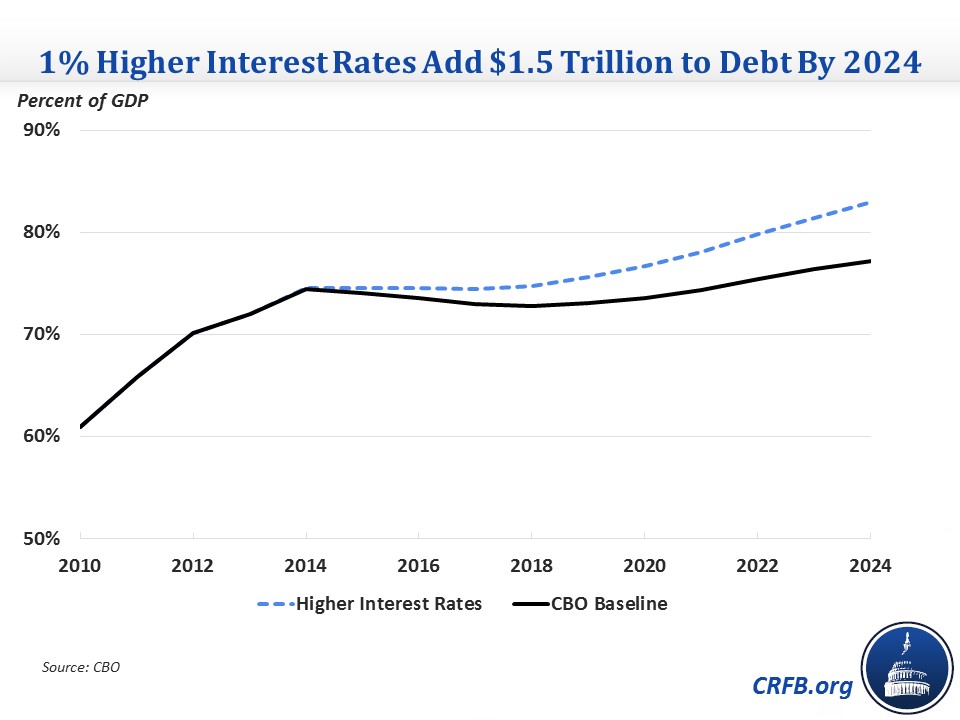

The inherent uncertainty in ten-year economic projections and the extra uncertainty surrounding interest rates means that CBO's baseline could change substantially over time. According to data in their February baseline, a 1 percentage point annual increase in interest rates across all types of Treasury securities would increase debt by $1.5 trillion through 2024 -- $1.1 trillion from higher interest spending, $100 billion of lower remittances from the Federal Reserve in the short term, and $300 billion in extra interest spending on the higher debt from the first two effects. This $1.5 trillion would increase the debt-to-GDP ratio by nearly 6 percentage points. Having lower interest rates by the same 1 percentage point would save a similar amount, but slightly less for reasons we explained in a previous paper.

It should be noted that one of the reasons that changes in interest rates can have such a large effect on debt going forward is that debt is at a high level by historical standards. Relying more on debt to finance operations means that the government is more at the whim of financial markets and the Federal Reserve's monetary policy. Further, if policymakers add to debt with policies like the tax extenders, they risk not only increasing debt and debt service but also interest rates as the stock of debt gets larger. As CBO pointed out in its long-term outlook, reducing debt would lower the uncertainty with respect to interest rates (and other assumptions) by shrinking the presence of interest spending and lessening upward pressure on rates.