TRUSTGO: To Fix the Debt, Start By Making Trust Funds Solvent

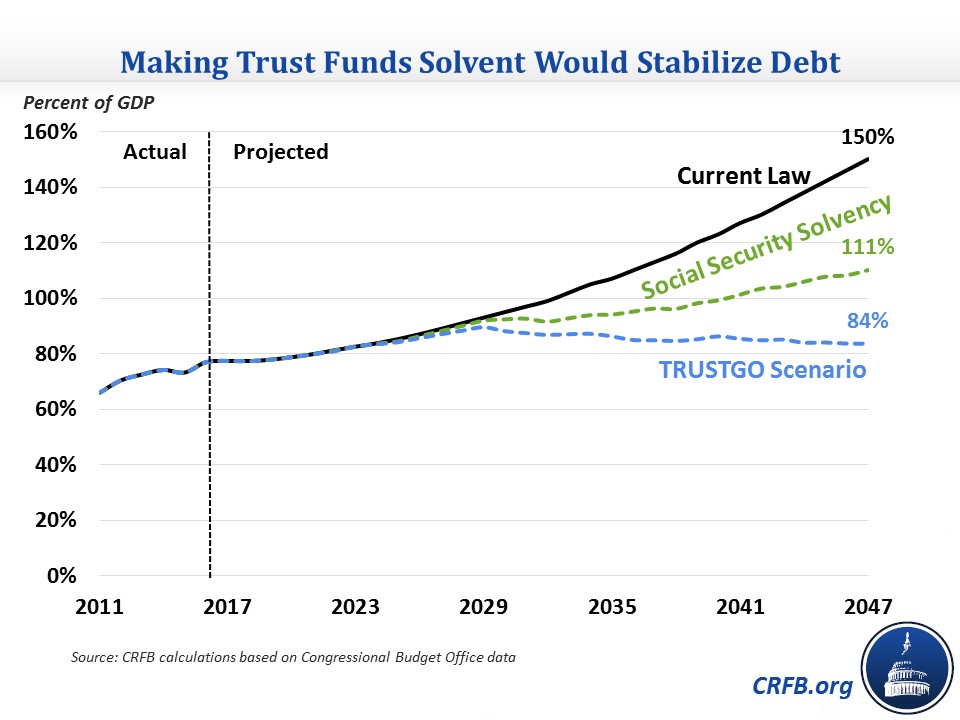

Last week, we showed that today's post-war era record-high debt is slated to double as a share of the economy over the next three decades, while four major government trust funds are projected to be insolvent in half that time. The Congressional Budget Office's (CBO) projections assume spending continues at scheduled levels even when trust funds deplete their reserves; our projections show that making the trust fund funds solvent could slow the growth of the debt this decade and stabilize the debt thereafter.

Under CBO's current law baseline, debt held by the public is projected to rise from 77 percent of Gross Domestic Product (GDP) this year – already higher than any time since the aftermath of World War II – to 89 percent of GDP after a decade and 150 percent of GDP after three decades. Under that same baseline, the Highway Trust Fund (HTF) will be exhausted by 2021, the Social Security Disability Insurance (SSDI) trust fund by 2023, the Medicare Hospital Insurance (HI) trust fund by 2025, and the Social Security Old-Age & Survivors Insurance (OASI) trust fund by 2031.

Status of Major Trust Funds

| Exhaustion Date | Annual Deficit In Exhaustion Year | Percent Cut At Insolvency | |

|---|---|---|---|

| Highway Trust Fund (combined) | 2021 | $18 billion (0.1% of GDP) | 32% |

| Medicare Hospital Insurance Trust Fund | 2025 | $63 billion (0.2% of GDP) | 13% |

| Social Security Disability Insurance Trust Fund | 2023 | $31 billion (0.1% of GDP) | 17% |

| Social Security Old-Age & Survivors Insurance Trust Fund | 2031 | $530 billion (1.6% of GDP) | 29% |

| Addendum: Theoretical Combined Social Security Trust Funds | 2030 | $540 billion (1.7% of GDP) | 27% |

Source: Congressional Budget Office, CRFB calculations.

While the law calls for deep immediate cuts to these programs upon trust fund depletion, CBO's baseline measures what would happen if spending and benefits continued to be funded out of general revenue.

CBO also shows what would happen if Social Security were made solvent* upon trust fund depletion. By CBO's estimate, making Social Security solvent would substantially slow debt growth, leading it to rise to 111 percent of GDP after three decades rather than 150 percent. Most of this reduction is due to less debt issuance from eliminating Social Security deficits; some comes from an increase in the size of the economy because of that lower debt.

What if the HTF and HI trust funds were also made solvent, in addition to the SSDI and OASI trust funds? We call this our "TRUSTGO scenario," and under this scenario we estimate debt would ultimately stabilize. Specifically, we project debt would reach 87 percent of GDP (rather than 89 percent under current law) by the end of the decade, peak at 90 percent of GDP in 2029 (rather than 93 percent), and decline slightly to 84 percent (rather than 150 percent) by 2047. This reduction is mostly driven by reduced deficits from all major trust funds but also by an additional increase in GDP by 2047.

Importantly, these estimates are rough. CBO does not provide specific data on long-term HI trust fund spending or HTF spending or revenue. For our estimate, we assume that HI spending after 2027 grows with total Medicare spending, HTF spending grows with GDP, and HTF revenue continues to decline slightly over time as it does in CBO's ten-year projections.

We also make a simplifying assumption that each trust fund's spending and revenue are brought in line on an annual basis in each year after insolvency. It is likely (and preferable) that actual plans to ensure solvency would act at least a little bit in advance of the insolvency date, so it is possible the path of debt would be flatter. It is also possible that policymakers would leave the trust funds with surplus funds, which would involve more total deficit reduction than we assume here. On the other hand, it is possible that policymakers will fund trust funds in part with budgetary gimmicks or even explicit general revenue transfers, which would worsen the above scenario. It is also likely that trust funds will be made solvent in part through higher payroll and gas taxes, which would likely lead to somewhat lower income tax collection and therefore also worsen the above scenario.

Still, our projections make clear that policymakers can make significant progress in fixing the debt by making Social Security, Medicare, and the Highway Trust Fund solvent. Of course, the longer they wait to act, the more painful any solvency plan will be and the harder enacting it will become.

*CBO specifically estimates a scenario where Social Security spending is limited to revenue in the year the trust funds become insolvent. The results would be similar if a tax increase of the same size were used.