Ted Cruz's Tax Plan is a VAT

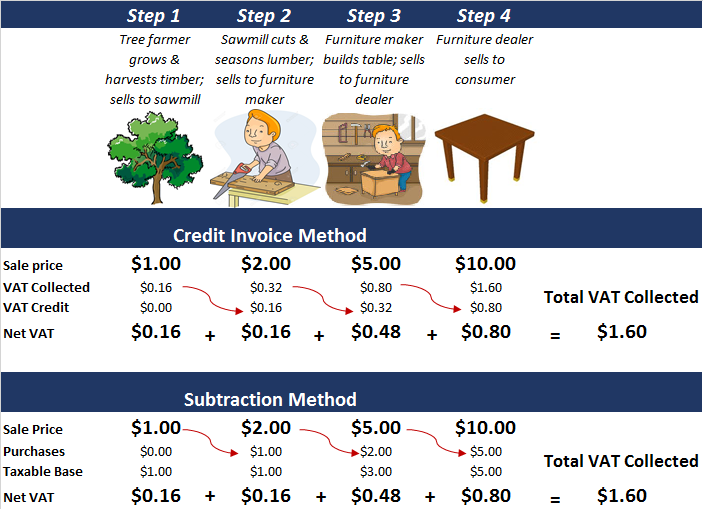

A VAT is a consumption tax that — unlike a sales tax — levies the value that each business adds along the chain of production. In most developed countries, the VAT is a major source of revenue; and generally these countries rely on a credit-invoice method VAT. This type of VAT taxes consumption by imposing a tax on every business transaction.

To avoid effectively double-taxing consumption, a credit-invoice method also provides an offset, or “credit,” for taxes paid by businesses earlier in the production line. So for example, a table sold for $10 might be subject to a $1.60 tax assuming a 16 percent VAT, but if the furniture dealer had spent $5 to make the table, he could subtract the 80 cents of VAT already paid at previous parts of the process and only pay 80 cents of additional taxes.

Table derived from Heritage Foundation

Senator Cruz’s plan does not function in this way, but instead looks a lot more like a corporate income tax with “full expensing” of equipment and no deductibility of wages. However, even though Senator Cruz’s plan might look like a tax on business, it is actually a consumption tax — and specifically it is a subtraction-method VAT.

A subtraction-method VAT assesses liability on the difference between sales and receipts for each business. Rather than give a credit for each penny of tax paid earlier in the chain of production, this method give a deduction for every dollar taxed. So in the case of the $10 table, rather than assessing a $1.60 tax on $10 and then providing an 80 cent credit, this method instead only asses a 80 cent tax on $5 in the first place. And so long as the tax is flat, the methods are equivalent.

Of course, there are advantages and disadvantages to each approach. The subtraction-method is probably simpler and easier to administer, particularly for the United States which currently has a corporate tax but no consumption-based tax system. On the other hand, the credit-invoice method may lead to less evasion since failure to pay taxes at one level simply increases taxes at the next level. The credit-invoice method also allows for different tax rates on different types of goods, though there are arguments this may be either better or worse than a flat tax on all products.

Yet fundamentally, the two types of VAT are equivalent; and Sen. Cruz’s Business Flat Tax has all the characteristics of a VAT. Perhaps not a “European-style VAT,” but a VAT nonetheless.

Ruling: Largely True