Taking a Broader Look at Federal Support for Education

On Friday, we discussed the President's recent speeches on his policy proposals for higher education. With most K-12 schools and university funding coming from state and local governments, it's easy to forget the role the federal government has in supporting education. In addition to many federal programs that supplement or support primary and secondary education, the federal government plays a central role in providing aid and financing for higher education. In this post, we will take a broad look at the federal budgetary commitment to education, some of the major policy changes that have affected the education budget, and a preview of what lies ahead.

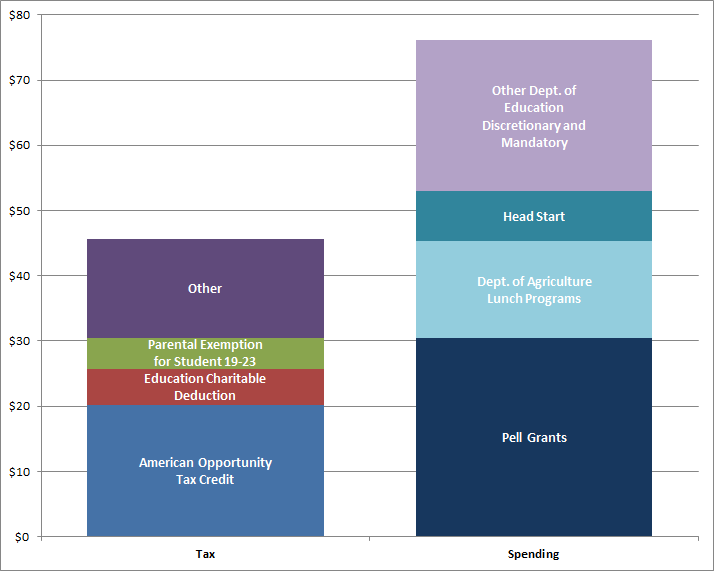

A Breakdown of the Education Budget

The Department of Education received appropriations of $68.0 billion for FY 2013, but mandatory programs and student loans complicate matters somewhat. The Pell Grant program is the largest at a total of $30 billion, funded through an annual $22 billion discretionary appropriation and also a mandatory fund. The majority of the remaining $42.9 billion of discretionary funding goes to K-12 education programs, special education programs, and education programs for the disadvantaged. The Department of Education has six grant programs for higher education, 14 programs to support K-12 teachers, five student loan programs, and dozens of other programs to support disadvantaged populations and special education (more information can be found here).

Note that included in the remaining discretionary and mandatory total in the chart below are student loans, which in 2013 will count as a over $40 billion net gain for the government under the Federal Credit Reform Act (FCRA) accounting method. But this gain from student loans is a result of extraordinarily low interest-rates and will not last when the economy returns to full capacity. Using fair-value estimates, student loans would be a $10 billion cost to the federal government at normal interest rates.

But looking at only the Education Department would far understate the federal government's budgetary support of education. Some programs related to education are managed by other departments; the early childhood education program Head Start is managed by the Department of Health and Human Services and the National School Lunch and School Breakfast programs are part of the Department of Agriculture.

We've also said before that tax expenditures can be better thought of as spending through the tax code. When thought of this way, provisions related to education will cost $46 billion in 2013. In fact, the 17 tax expenditures related to higher education rival the Pell Grant program in size. We've said before that many of these tax provisions are poorly targeted, often delivering a windfall to wealthier families. The largest tax provision, the American Opportunity Tax Credit (AOTC) will direct a quarter of its total benefits to families making over $100,000.

Federal Support for Education

Source: Joint Committee on Taxation and Department Congressional Justifications

Note: Department of Education Funding Includes Student Loans

Recent Policy Changes in the Education Budget

Since President Obama took office, a number of significant policy changes have been made that affect education spending. The stimulus bill included the creation of the AOTC, which expanded the existing Hope Credit and made it fully refundable. The AOTC was due to expire at the end of 2012 but was extended for five years as part of the American Taxpayer Relief Act. In addition, Pell Grants awards were increased and temporary funding for some provisions and state relief were also included as a part of the 2009 stimulus. While some of the smaller provisions have since expired, the Pell Grant and AOTC expansions appear to be permanent but will add to the deficit unless offsets are found.

There have also been changes made to the income-based repayment (IBR) formula for student loans. In 2010, Congress passed the Health Care and Education Reconciliation Act of 2010, which reduced the rate of repayment for student loans from 15 percent of AGI to 10 percent and allowed forgiveness of the loan after 20 years in repayment (previously 25). In 2011, the President applied the new formula to student loans that had been issued since 2008. Some critics of the program have argued that its aid is poorly targeted and suggested the funds be reallocated to better targeted programs like Pell Grants.

Since the President took office, some provisions which save money in student loans have also been enacted. The largest change to education in the Budget Control Act, of course, was the creation of overall discretionary caps. But the BCA also eliminated the in-school subsidy for graduate students and applied the savings toward the Pell Grant program. The most recent change was the passage of the student loan bill, which linked rates to ten-year Treasury rates. The bill will only save $715 million over ten-years, but could potentially save more in the long-run as interest rates return to their historical averages.

What Lies Ahead for the Education Budget

The student loan bill resolved the most urgent temporary policy in the education budget, but many other issues will need to be addressed in the next few years. For next year, lawmakers still need to decide what to do with sequestration, which is creating a substantial gap between the House and Senate on funding levels for the Education Department. The House Appropriations bill would provide $121.8 billion for Labor-HHS-Education, while the Senate would provide $164.3 billion. Post-sequester funding for Labor-HHS-Education was $149.6 billion. With the FY 2013 continuing resolution due to expire at the end of September, lawmakers will need to make a decision in the next month.

Also unaddressed is a near $50 billion Pell Grant shortfall between projected award grants and funding levels. The Bipartisan Path Forward used a variety of policies to achieve savings, including eliminating the in-school interest subsidy to shore up the Pell Grant shortfall. The President's Budget and the New America Foundation's Education Policy Program have also proposed reforms that would address the shortfall, with the latter going further to redirect education resources from poorly targeted tax provisions to the more effective Pell Grant program.

As mentioned previously, lawmakers will need to decide whether to allow the AOTC to expire or to find a permanent expansion when the refundable credit expansion ends in 2018. If lawmakers decide that the AOTC expansion should be continued, they will need to find savings to offset those costs.

*****

While the majority of funding for education is handled by state and local governments, the federal government support for education is still a significant matter, particularly for higher education. Whether the Congress decides to move forward with the President's policies or not, some decisions will need to be made over the next few years.