Steuerle: Revenue Proposals Not Enough

Urban Institute scholar and CRFB board member Gene Steuerle writes in his blog The Government We Deserve that the current revenue proposals from both sides simply aren't enough to make a substantial dent in the deficit. Despite the continuing debate on tax rates, there is significant value in tax expenditures, especially beyond the itemized deduction limitations that have been proposed or talked about by both sides. Steuerle says:

Despite the ideological hype over revenue increases for the upper-income taxpayers and restricting itemized tax deductions, almost all the considered changes will tackle only a portion of the deficit.

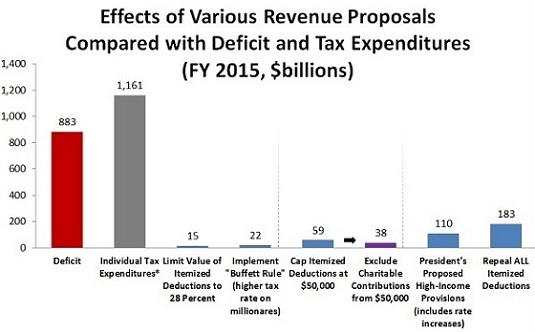

As the graph below indicates, the Congressional Budget Office projects a fiscal year 2015 deficit under current policy of $883 billion, not far from the $1 trillion–plus deficits in the Great Recession and its early aftermath. By comparison, the Tax Policy Center calculates that revenue gained from repealing ALL itemized deductions would be only $183 billion. Smaller limitations on itemized deductions have smaller effects: President Obama’s proposal to limit the value of itemized deductions to 28 percent would raise only $15 billion. Capping itemized deductions at $50,000 would raise $59 billion, or $38 billion if the charitable deduction was excluded.

The value of all individual tax expenditures is $1.161 trillion, even larger than the deficit. But most revenue proposals—particularly those confined to a tiny portion of taxpayers and only a subset of various tax programs—also only chip away at that amount.

He also uses a helpful graph that demonstrates the magnitude of the potential savings in tax expenditures. Although the savings from eliminating all tax expenditures would not be the same as the size of all tax expenditures, it conveys the magnitude of potential savings that are there. By this measure, both the White House and GOP proposals are clearly only going after a small portion of tax expenditures, and more generally, their policy proposals for revenue are relatively slim compared to the size of the deficit.

Sources: CBO Budget and Economic Outlook, U.S. Treasury Green Book, and Tax Policy Center

Of course, a comprehensive plan should not reduce the deficit entirely on the revenue side. We've shown in the past that an all-tax solution would be difficult to implement particularly if it were exclusively done on high earners. But bipartisan plans that relied on both significant revenue increases and spending cuts, like Simpson-Bowles or Domenici-Rivlin, raise quite a bit more revenue than current proposals through significant base-broadening that results in greater progressivity.

We hope that both the Democrats and Republican leaders are willing to be bold and put more spending cuts and revenue increases into a framework for a compromise this year. They don't have to lay out all of the specifics before the end of the year, but credible and adequate revenue and spending targets with at least some specific savings upfront would be a good way to go.