Sources of Spending Growth in CBO's Baseline

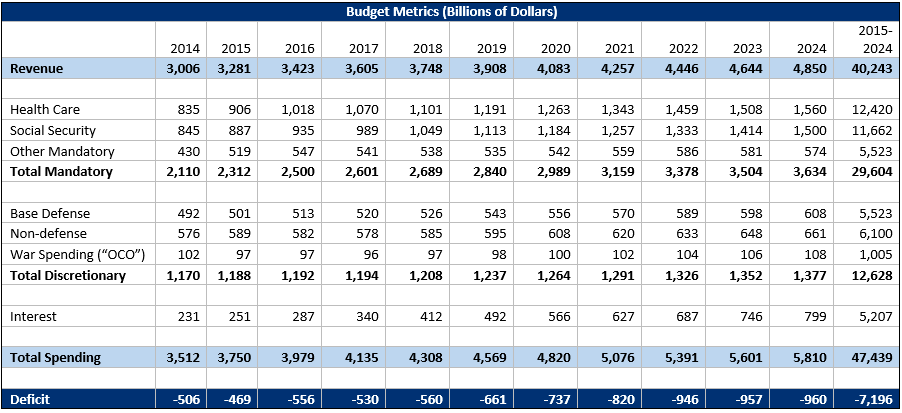

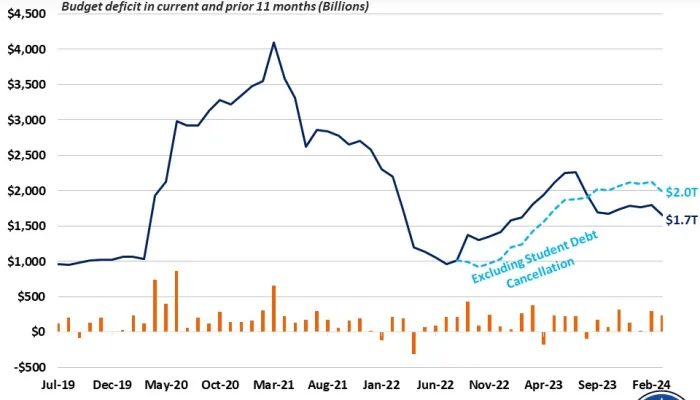

CBO's recent budget projections reaffirm that our debt problems are significant. Entitlements are projected to grow, as a result of a retiring population and increased health care costs. Revenues are not projected to keep pace, leaving the budget with ever-growing deficits and increasing interest payments. By 2024, annual deficits will reach almost $1 trillion.

Deficits will remain roughly stable over the next few years as the economy recovers and revenue collections pick up faster than the growth in spending. If nothing is done by 2018, however, deficits will begin to grow again. Interest payments are the fastest growing portion of the budget, more than tripling between 2014 and 2024.

Importantly, all these projections are based on CBO's estimates of current law, which may not be entirely realistic. For instance, CBO is required to assume that war spending will increase indefinitely with inflation, rather than being decreased as currently planned. On the flip side, policymakers may pass additional unpaid-for spending or tax cuts that will increase the debt beyond current law. Based on these possible outcomes, we've calculated two alternative budget paths.

Viewing the numbers as a percentage of the economy better illustrates the growth of mandatory spending. Health care programs grow from 4.9 percent of GDP this year to 5.9 percent of GDP by 2024. Social Security will grow from 4.9 percent of GDP to 5.6 percent. As a whole, the mandatory portion of the budget grows from 60 percent of total spending to 62 percent. The defense budget, non-defense discretionary spending, and other mandatory spending all shrink as a percentage of the economy.

Although our short-term deficits are manageable, our long-term debt problems are far from solved. Policymakers should address the drivers of the debt through some combination of entitlement reform to slow the growth of mandatory spending and tax reform that raises enough revenue to meet our spending commitments.