Richmond Fed Releases Bailout Barometer

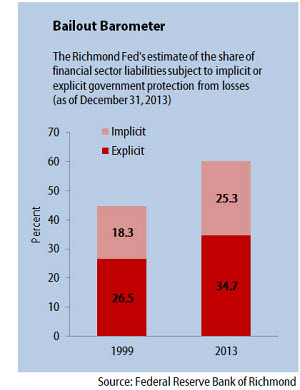

The Federal Reserve Bank of Richmond has updated their “Bailout Barometer,” which measures the total financial sector liabilities that have a government guarantee. The total amount guaranteed by the federal government in 2013 was nearly $26 trillion, 60 percent of the total liabilities in the financial sector, a notable increase from the barometer's first estimate of 45 percent guaranteed in 1999.

These guarantees are categorized as either explicit, though guarantee programs like the Federal Deposit Insurance Corporation (FDIC) insurance, or implicit, through the assumption that the government will protect the liabilities in any "too-big-to-fail" bank.

About 35 percent, or $15 trillion, of the financial sector's liabilities are explicitly guaranteed by the government. That figure includes FDIC-insured deposits, similar insurance at credit unions, the total liabilities of the two major Government Sponsored Enterprises (GSEs) Fannie Mae and Freddie Mac, and the pension liabilities covered by the Pension Benefit Guaranty Corporation (PBGC). The cost of providing most of these guarantees is already covered by various fees. We've written previously about proposals to remove the GSEs from the government's books here and the financial problems facing the PBGC here.

Another 25 percent, or $11 trillion, of financial sector liabilities are implicitly guaranteed, including too-big-to-fail banks dubbed systemically important, uninsured deposits at large banks and credit unions, GSEs that are not Fannie and Freddie, money market mutual funds, and other small short-term liabilities of nonbank financial companies.

The cost of providing these implicit guarantees generally isn't covered by any existing fees, though there have been several proposals to place a tax on large financial institutions, such as one in the President's budget or in the Tax Reform Act of 2014.

The Richmond Fed explains the problems that can arise from having too many informal and implied guarantees:

When creditors expect to be protected from losses, they will overfund risky activities, making financial crises and bailouts like those that occurred in 2007-08 more likely. An extensive safety net also creates a need for robust supervision of firms benefitting from perceived protection. Over time, shrinking the financial safety net is essential to restore market discipline and achieve financial stability. Doing so requires credible limits on ad hoc bailouts

This $26 trillion in liabilities from the bailout barometer is on top of the $13 trillion the government currently owes in the form of debt held by the public. And while it should not be considered a tangible liability comparable to debt, it is representative of just how large our fiscal exposure is to the financial sector. The fact the remains that at a time with our debt at historic levels not seen since World War II, the risk of a further financial crisis or serious recession would have significant fiscal consequences. This is why we need to actively look to put our debt as a share of the economy on a credible downward path, so we have the fiscal space to spend if needed.