Rattner Discusses Economic Problems Facing Millennials

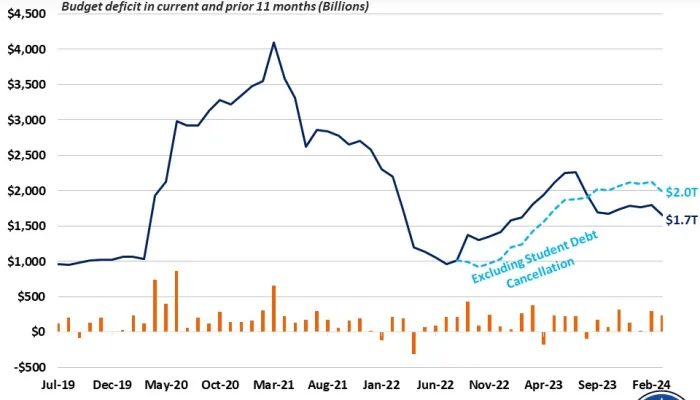

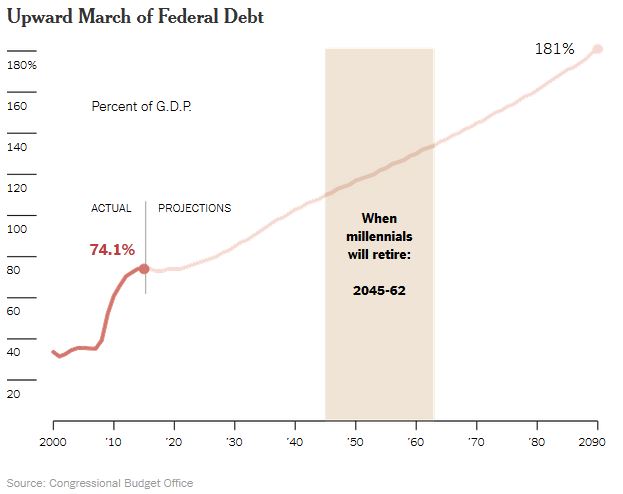

Steven Rattner wrote an article in yesterday's The New York Times discussing the financial problems facing millennials. Rattner writes that millennials, those currently aged between 18 and 34 years old, are expected to earn less than previous generations and face greater college debts. Looking further out, the rising national debt means this generation is likely to face a combination of higher taxes and lower benefits than generations before them.

In line with Rattner's argument, we’ve written previously about how waiting to reduce the debt increases the costs of doing so and shifts the burden onto fewer people.

Rattner acknowledges that the bleak outlook for millennials is partly the result of bad timing, noting that “those who graduate in weaker economic times typically earn less than those who enter the work force during more robust periods. Starting behind often means never catching up.” He also cites large increases in student debt as weighing on their future prospects.

While some factors are out of the control of policymakers, Rattner states that reducing the national debt burden faced by these younger workers is something that can achieved with a little sacrifice. He says that “we need to reform the entitlement programs, for example, by reducing Social Security benefits for the highest income Americans.” He also advocates for increased investment in “education, infrastructure and research and development” to speed up growth, noting that this “would require higher taxes on my generation [baby boomers], which is getting a lot more from government than we are paying into it.”

While people may disagree about how to solve this problem, it is clear that current projections of the national debt are problematic for our nation, and for younger generations in particular. The sooner we act, the easier it will be to put the country’s finances on a sustainable path without making drastic changes to taxes or benefits.