Quantifying the Effects of Uncertainty

We have seen many lawmakers and business leaders claim that the fiscal cliff is holding back the recovery and leading to higher unemployment, and in today's The Wall Street Journal, a Bank of America survey shows that in the mind of investors it is the top risk for the U.S. economy. In the survey, 35 percent found the fiscal cliff to be the greatest risk to the economy according to investors, while the European debt crisis was second with 33 percent naming it the largest threat.

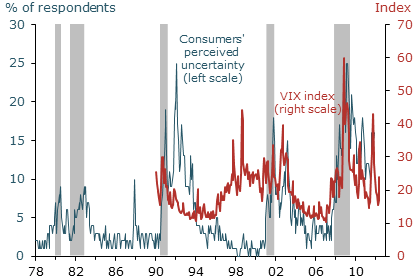

This uncertainty should hold back growth, in theory, as businesses and consumers hold off on spending in case of another downturn. And now this theory may have some statistical evidence. According to a recent Economic Letter, Sylvain Leduc and Zheng Liu from the San Francisco Federal Reserve find that increased uncertainty may have substantially contributed to unemployment.

In this Economic Letter, we examine the economic effects of uncertainty using a statistical approach. We provide evidence that uncertainty harms economic activity, with effects similar to a decline in aggregate demand. The private sector responds to rising uncertainty by cutting back spending, leading to a rise in unemployment and reductions in both output and inflation. We also show that monetary policymakers typically try to mitigate uncertainty’s adverse effects the same way they respond to a fall in aggregate demand, by lowering nominal short-term interest rates.

Our statistical model suggests that uncertainty has pushed the unemployment rate up at least one percentage point in the past three years. By contrast, uncertainty was not an important factor in the unemployment surge during the deep downturn of 1981–82. One possible reason why uncertainty has weighed more heavily on the economy in the recent recession and recovery is that monetary policy has been limited by the zero lower bound on nominal interest rates. Because nominal rates cannot go significantly lower than their current near-zero level, policy is less able to counteract uncertainty’s negative economic effects.

Of course, the 2008 financial crisis and the ensuing recession and slow recovery has been responsible for much of this uncertainty but a lot of uncertainty in the past few years has been over the future course of fiscal policy. Unasnwered questions like "What tax and spending changes will lawmakers make to control debt?" and even "Will lawmakers act in advance before a crisis to control our debt?" create much uncertainty. Uncertainty spiked during the debt ceiling negotiations and although it is not reflected in the graph below, it is likely spiking again because of the fiscal cliff.

Uncertainty caused by fiscal policy is a reminder that a deficit reduction plan can benefit the economic recovery now while also increasing the size of the economy over the long-term. The main premise of the Announcement Effect Club is that by passing a credible plan now but gradually phasing in the savings, economic confidence would be much higher knowing that there is a plan to put the debt on a sustainable path. This confidence would benefit the economy upfront. It certainly would not happen if we had another can-kicking exercise or policymakers permanently extended and deficit financed everything.

Lawmakers just need to agree on a deficit reduction plan to reduce uncertainty in the short-term and control our debt in the longer-term.

The full Economic Letter can be found here.