Paying For the Tax Extenders

The Senate Finance Committee met yesterday to consider the fate of the 50-plus tax breaks that expired last year known as "tax extenders." Unfortunately, they chose to extend almost all of them for two years by adding the costs of the tax cuts to the national debt.

However, lawmakers had many options to pay for these tax breaks, if they were so inclined. Below we've compiled a list below of some of the commonly discussed revenue ideas, including those endorsed by both House Ways and Means Committee Chairman Dave Camp (R-MI) and President Obama.

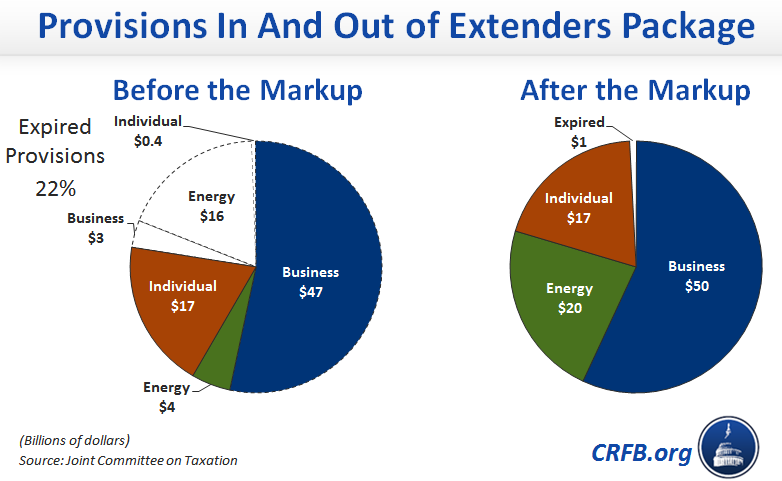

Earlier this week, we gave some credit to Chairman Ron Wyden (D-OR) and Ranking Member Orrin Hatch (R-UT) for releasing draft legislation that would have allowed a quarter of the provisions to expire. We also criticized lawmakers for not paying for any of the remaining tax breaks. However, it was clear that many of the popular provisions missing from the initial draft were likely to be restored. The largest was the renewable energy production tax credit, an incentive that Wyden has praised many times. The second-largest, dealing with payments between overseas corporate subsidiaries, would have changed the way multinational corporations do business and was unlikely to be considered outside of international tax reform.

Between the modifications made by Chairman Wyden and the amendments passed by the Finance Committee, nearly every provision that had been allowed to expire was restored. In addition to the two mentioned above, the committee added back incentives for energy-efficient buildings, special breaks for film production and NASCAR racetracks, and others. The total cost of the bill increased by almost $20 billion, to $86 billion, while amendments only added $1 billion worth of savings to pay for the added extensions.

Numbers do not add to the $86 billion total due to rounding.

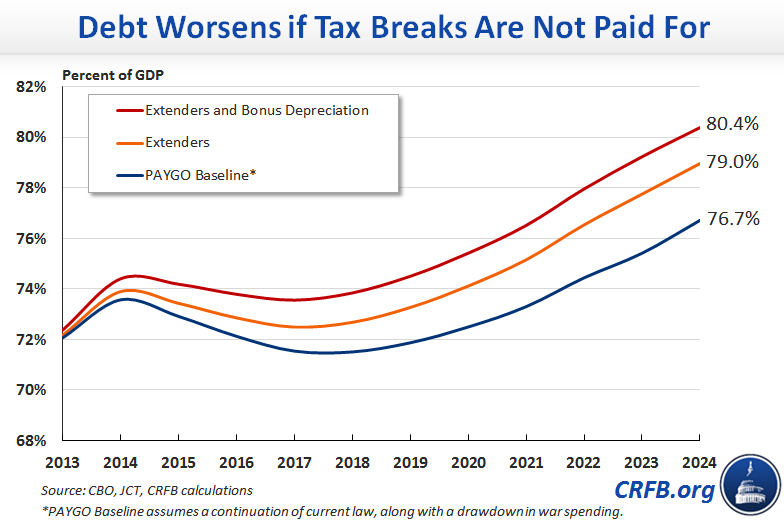

Congress has not usually paid for the extenders, choosing to pass these tax cuts every year by adding to the deficit. Given our unsustainable debt situation, it is important that lawmakers abide by PAYGO and ensure that any extension is paid for with savings elsewhere, following the example set by both Chairman Camp and President Obama. As it was, Senators submitted over 90 amendments, ranging from tax breaks for bike-sharing programs to beer production. This type of logrolling – loading up legislation with special interest provisions – results when legislation is not subject to the discipline of PAYGO. Many of these provisions would not be considered a high enough priority to include if their advocates had to propose offsets.

If lawmakers were interested in taking a fiscally responsible approach and either reducing the size of the extenders or offsetting the costs, they had a number of options. The Finance Committee extended them for two years, but lawmakers could also get creative by modifying some, making them permanent, or choosing to keep some expired. For instance, the package of education reforms in Camp's discussion draft let one education break expire and repealed several other permanent ones to pay for a permanent extension of the American Opportunity Tax Credit, which is scheduled to expire in 2017. As another example, Camp's discussion draft shrank the expiring renewable energy production tax credit back to its original pre-inflation level, which pays for the credit to be extended and phased out over the next ten years.

Importantly, the $85 billion two-year cost to extend all of these provisions is deceptive. In reality, if lawmakers continue the current trend of extending all the provisions year after year, the cumulative cost would sum to approximately $750 billion (or almost $930 billion with interest) over the next ten years. One provision alone, bonus depreciation, accounts for two-fifths of the cost of the entire package.

If lawmakers want to consider paying for the provisions, there are many options, including more than $60 billion worth of options that have been suggested both by President Obama (in his most recent budget) and Chairman Camp (in his tax reform draft).

Possible Revenue Offsets for the Tax Extenders Bill

| Policy | Ten-Year Savings |

| Offsets Proposed By Both President Obama and Chairman Camp | |

| Close the carried interest loophole | $15 billion |

| Tax derivative contracts on a “mark-to-market” basis | $15 billion |

| End the "John Edwards/Newt Gingrich" loophole | $15 - $35 billion |

| Repeal select tax preferences for oil and gas companies | $10 billion |

| Require inherited pensions to be distributed over 5 years | $5 billion |

| Close the corporate jet loophole | $3 billion |

| Close estate tax loophole about reporting the value of property | $2 billion |

| Offsets Proposed by President Obama | |

| Limit tax benefit for large retirement accounts | $30 billion |

| Close other estate tax loopholes | $10 billion |

| Impose surcharge for air traffic services | $8 billion |

| Enact spectrum license user fees | $5 billion |

| Offsets Proposed by Chairman Camp | |

| Enact a package of education reforms | $20 billion |

| Extend, reduce, and phaseout the wind Production Tax Credit over 10 years | $10 billion |

| Repeal tax exemption for advance refunding bonds | $8 billion |

| Eliminate "divorce subsidy" - equalize treatment of payments between married and divorced individuals | $6 billion |

| Equalize payroll taxes for employees and the self-employed | $5 billion |

| Repeal credit for plug-in electric vehicles | $5 billion |

| Prevent nonprofits from avoiding tax on their business income by using losses from one business to offset gains in another | $3 billion |

| Other Revenue Offsets | |

| Eliminate mortgage interest deduction for yachts and second homes | $15 billion |

| Extend GSE fees | $12 billion |

| Treat companies managed and controlled in the U.S. as U.S. companies | $7 billion |

| Extend customs fees that expire in 2023 | $4 billion |

| Extend mandatory receipts from TSA fees that expire in 2023 | $2 billion |

| Allow taxpayers to voluntarily pay more taxes to pay down the national debt | $0.2 billion |

Source: CBO, JCT, OMB