Introducing "The Tax Break-Down"

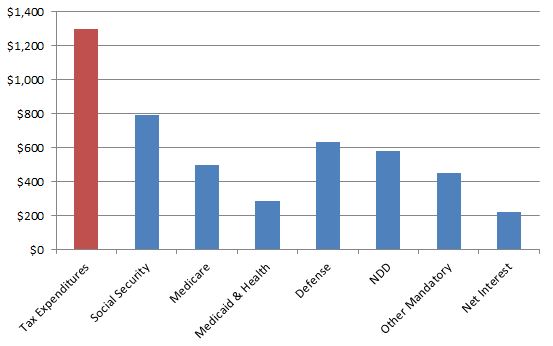

We've written many times before about the $1.3 trillion of tax breaks currently littering the code, urging policymakers to focus on paring back tax preferences in order to reform the tax code and reduce rates and deficits.

Encouragingly, the Blank Slate approach put forward by Senate Finance Committee Chairman Max Baucus and Ranking Member Orrin Hatch effectively puts all these tax expenditures on the table, requiring any that remain to be justified on economic, fairness, or policy grounds.

Our new blog series, The Tax Break-Down, will take a closer look at these tax breaks one at a time, showing their cost, describing who benefits from them, providing arguments for and against keeping them, and offering options to repeal or reform them. We’ve written in the past about more efficient ways to design the mortgage interest deduction, the charitable deduction, and the employer-provided health care exclusion and offered a list of options for reforming all three. This series will go beyond the most popular and well-known provisions to do a deeper dive on both the individual and corporate sides of the income tax.

Tax expenditures represent a large and often overlooked portion of government policy. Like programs in the regular budget, they provide support for housing, health care, philanthropy, infrastructure, research, education, retirement, domestic production, child care, work, aid to states, and a number of other functions. At $1.3 trillion in annual cost, they cost more than all discretionary spending and as much as Social Security and Medicare combined.

Many of these tax breaks serve important or desirable public policy purposes, though they do so with varying degrees of success. At the same time, many tax breaks complicate the code, reduce the progressivity of the code, and distort economic decision making. Every dollar spent on retaining a tax preference is a dollar which is unavailable for other purposes.

As Washington engages in the important debate on what tax reform should look like, we'll be offering information and analysis on the tax breaks under discussion. Tomorrow we will post our first Tax Break-Down, a discussion of the state and local tax deduction.

*****

Posts in the Tax Break-Down:

- The State & Local Tax Deduction

- Last-In, First-Out (LIFO) Accounting

- Preferential Rates on Capital Gains

- Child Tax Credit

- Section 199, the Domestic Production Activities Deduction

- Municipal Bonds

- Cafeteria Plans and Flexible Spending Accounts

- Accelerated Depreciation

- Individual Retirement Accounts

- American Opportunity Tax Credit

- Intangible Drilling Costs

- Foreign Earned Income Exclusion

- FICA Tip Credit

- Low-Income Housing Tax Credit

- Charitable Deduction

- Tax Extenders