How Alternative Policies Could Affect the Budget

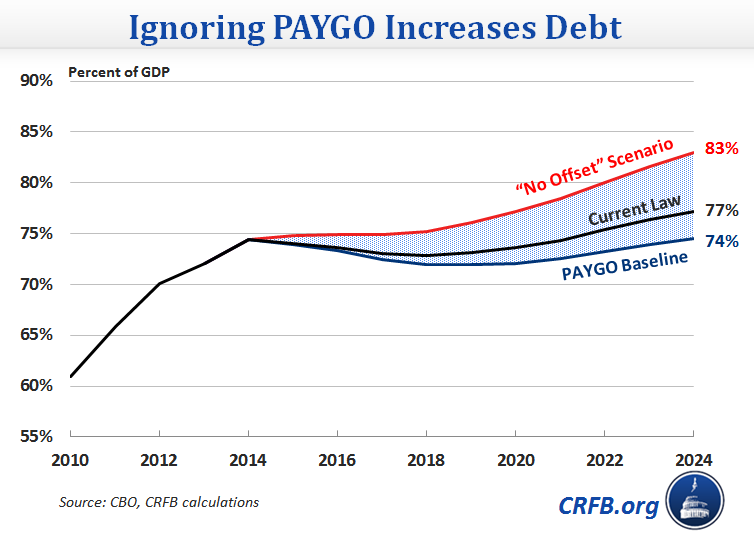

CBO's latest budget projections, while a slight improvement, are not good news for the country's fiscal future. Debt is higher than at any time in our country's history other than World War II, will rise to 77 percent of GDP by the end the decade and continue to climb thereafter. But even these projections may be too optimistic, since they assume policymakers do nothing to add to the debt by extending expiring provisions, repealing savings already in place, or enacting new unpaid-for legislation. While this may be a realistic assumption in some cases, policymakers in other cases have shown reckless disregard for budget discipline.

To show that the debt could be worse under different assumptions, CBO produces an "Alternative Fiscal Scenario" (AFS), which assumes that policymakers extend all expiring and expired tax provisions, permanently extend "doc fixes" to avoid a 24 percent Medicare physician payment cut next spring, and repeal the sequester. With these assumptions, debt would reach nearly 86 percent of GDP by the end of the decade.

To show the range of possibilities, we have estimated the debt under two different scenarios.

At the bottom of the range is a "PAYGO baseline" where lawmakers strictly follow PAYGO rules, offsetting any new costs with new savings so as not to add to the debt. This baseline also assumes that war spending is decreased as currently planned, rather than being increased indefinitely with inflation (an assumption that saves $725 billion over ten years). Debt under this baseline is slightly better than current law, with debt reaching about 74 percent of GDP in 2024.

On the flip side, the "No Offset Baseline" is similar to the AFS, but also includes the drawdown in war spending. Even with that drawdown, debt still reaches 83 percent of GDP in 2024, rising three times faster than under the current law baseline.

Policymakers may ultimately choose a mixed path of fiscal responsibility that ends up somewhere within this range. Alternatively, they could go outside it entirely by enacting new savings or costs. However, our debt problems are significant enough that, at the very least, policymakers should be paying for the costs of all new policies.

Read our full analysis of the updated CBO budget projections.