High Debt Drags Down the Economy

According to the Congressional Budget Office (CBO), rising debt levels could reduce projected annual income by between $2,000 and $6,000 per person by 2040, while a deficit reduction plan could instead increase income levels and reduce interest rates on government debt, an effect that would flow through to mortgages and other loans.

This is just one of many economic findings included in CBO's latest Long-Term Budget Outlook, which shows very clearly that rising debt could be detrimental to the American economy.

While CBO's standard long-term projections are based on "benchmark" economic projections which generally assume no major changes in fiscal policy, they also warn of the limits of such projections. As CBO explains, rising debt can have feedback effects by crowding out private investment in favor of public debt and ultimately slowing economic growth.

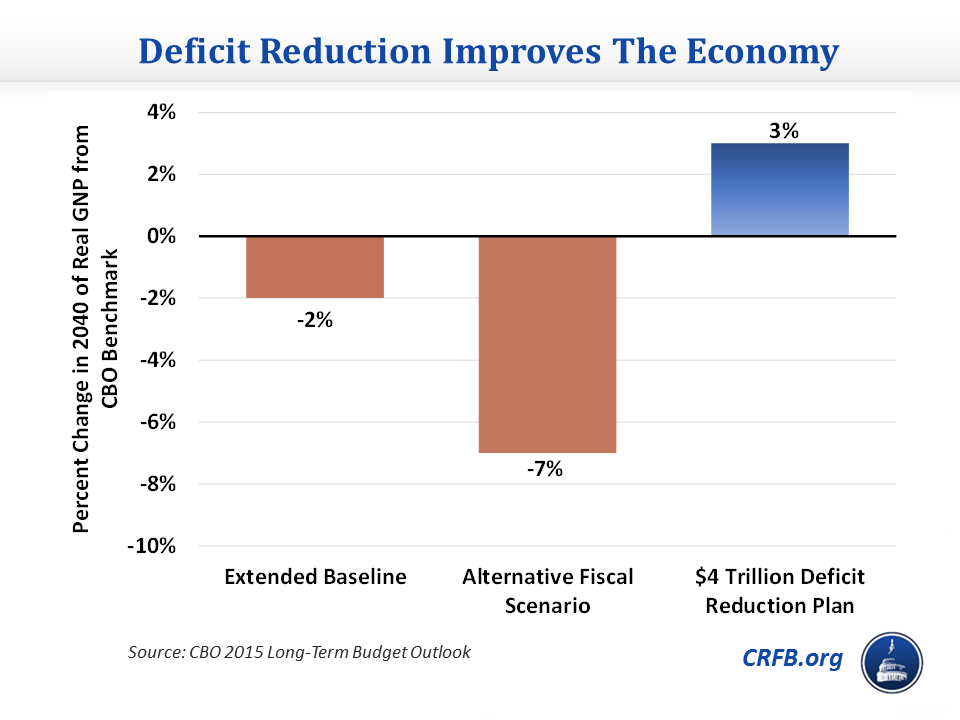

CBO's report quantifies these effects and their effect on debt. Under current law – where debt grows from about three-quarters of the size of the economy today to equal to the size of the economy by 2040 – CBO estimates GNP would be 2 percent smaller by 2040. If lawmakers continue to add to the debt in many of the ways that they have recently as in the Alternative Fiscal Scenario (AFS) – and debt reaches 156 percent of GDP by 2040 – CBO estimates the economy would shrink by an additional 5 percent, or roughly 7 percent in total. On the other hand, a $4 trillion deficit reduction would increase the size of the economy by 5 percent as compared to the Extended Baseline and 3 percent above the benchmark level.

The economic impact of debt would feed back into debt levels, primarily by lowering revenue, increasing interest spending, and lowering GDP levels (the denominator in the debt-to-GDP ratio). The Extended Baseline would show debt higher by a few percentage points of GDP, and the Alternative Fiscal Scenario would have debt levels in 2040 grow almost 20 percentage points higher.

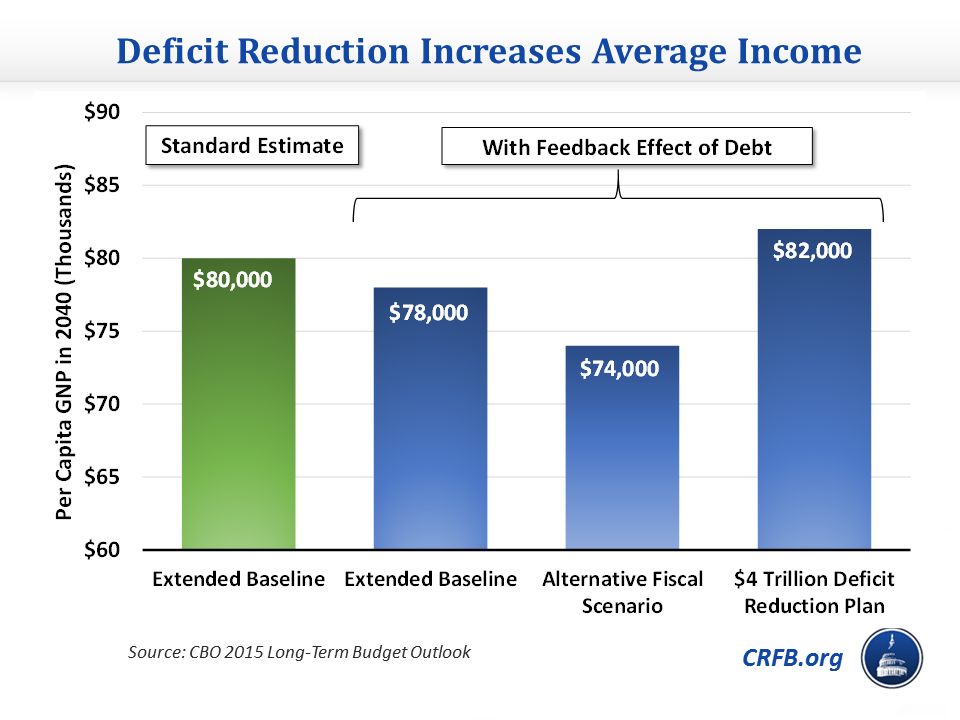

CBO's economic effects are also presented in real GNP per capita terms, which is a proxy for average income. By 2040, GNP would be $80,000 per person in 2015 dollars before accounting for the negative effects of growing debt levels. If the economic drag from higher debt is included, per capita GNP drops to $78,000 in the Extended Baseline and $74,000 in the Alternative Fiscal Scenario.

On the flip side, a deficit reduction package of $4 trillion will put debt on a downward path as a share of the economy and increase per capita GNP by $4,000 relative to current law ($2,000 relative to the benchmark case). Importantly, CBO's estimates of deficit reduction do not include any estimates of the types of tax and spending policies that are enacted. A smart deficit reduction plan that reforms the tax code and entitlements while increasing investments in areas such as education and R&D could increase economic growth even further.

In addition to the effects described above, CBO highlights three additional negative consequences of carrying a high level of debt:

- Higher interest spending crowds out the rest of the budget: As interest rates return to more typical levels from historically low levels and the debt grows, federal interest payments will increase rapidly, nearly tripling from 6 percent of the budget today to 17 percent by 2040. As interest takes up more of the budget, less will be available for other programs.

- Decreased budget flexibility: Borrowing can help respond to significant unexpected events such as recessions or wars. However, carrying greater amounts of outstanding debt in normal times mean there is less scope to respond to emergencies. CBO notes that the government may find it difficult at current or higher debt levels to support the economy in the same way as was done during the most recent recession.

- Greater chance of a fiscal crisis: If the debt continues to climb, at some point investors would lose confidence in the government's ability to pay back borrowed funds, causing an interest rate spike and the need for harsh deficit reduction measures in response. Though there is no way to know exactly when a fiscal crisis will occur, according to the CBO, "All else being equal...the larger a government's debt, the greater the risk of a fiscal crisis."

CBO shows that allowing debt to grow unabated would clearly be harmful for the budget and the economy.

This blog is part of a series examining aspects of CBO's 2015 Long-Term Budget Outlook. Click here to read our 6-page summary of CBO's paper, or here for other blogs in the series.