A Good Way to Limit Tax Expenditures

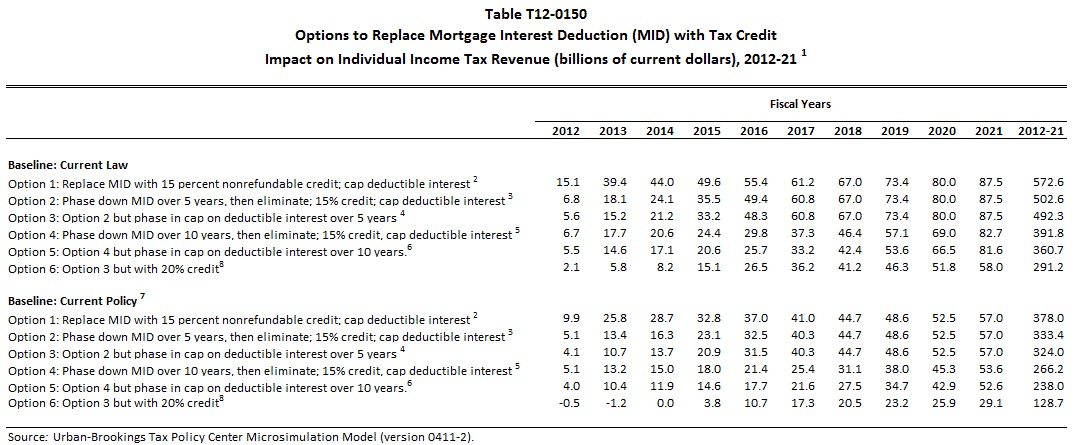

The Tax Policy Center has released a new table showing the revenue impact of options to reform the mortgage interest deduction. The options shown all involve some form of converting the deduction into a credit.

For example, converting the deduction into a 15 percent credit while limiting the size of the mortgage on which interest could be deducted to $500,000 (currently at $1.1 million) could raise $378 billion from 2012-2021, assuming current tax policies are extended (and the policy being in effect retroactive to the beginning of this year). Shifting the budget window to the current 2013-2022 period would most likely result in revenue of over $400 billion. A more gradual option would phase down the deduction over ten years while allowing taxpayers to choose between the deduction and the 15 percent credit while the deduction still existed. This option could raise $266 billion.

Converting itemized deductions into credits can be an effective way of limiting tax expenditures without necessarily eliminating them. Itemized deductions are poorly designed in that they only confer benefits to people who itemize their tax returns rather than take the standard deduction (generally higher-income earners), and they are more valuable to people in higher-income tax brackets. Even as subsidies, the deductions by their nature have low bang for the buck, often going to people who would engage in these activities anyway.

To see TPC's revenue table and the distributional tables related to it, click here.