Fed and Treasury 'rowing in opposite directions'

The Federal Reserve's efforts to help the economy recover through quantitative easing (QE), twisting, and tapering have made front page news without fail. Although it has gotten less attention, the Treasury Department has also been changing the way it finances the national debt to take advantage of lower interest rates, inadvertently counteracting some of the intended effect of the Fed's policies on the economy. That's exactly what a new Brookings working paper by Robin Greenwood, Samuel Hanson, Joshua Rudolph, and Lawrence Summers argues: during the past 5 years, the Fed and the Treasury have been "rowing in opposite directions."

In 2008, the Fed reduced interest rates to near zero in an attempt to help the economy grow. But nominal interest rates cannot go below zero, so conventional monetary tools stopped working. To further stimulate the economy, the Fed took extraordinary measures and began purchasing long-term government bonds and government guaranteed debt (like Mortgage Backed Securities, or MBS). These measures reduced the amount of long-term debt available for public investors and lowered long-term rates.

But while the Fed was engaging in these unconventional transactions, the Treasury was selling more long-term debt to lengthen the average maturity of the national debt, thereby locking in today's low rates and mitigating the risks of higher interest rates in the future, essentially providing a partial counterbalance to the Fed’s policies.

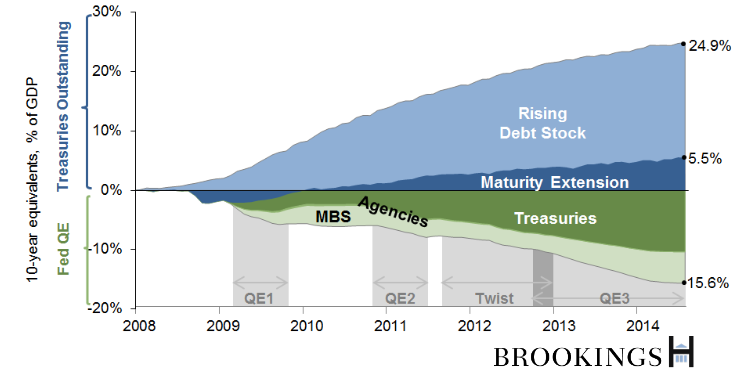

The authors estimate that up to a third of the Fed’s actions were offset by the those of the Treasury (although the authors admitted that this likely offset less than one-third of the impact on lowering long-term interest rates). The Fed purchased 15.6 percent of GDP in 10 year equivalent debt instruments, taking them off the market. At the same time, the Treasury sold 5.5 percent of GDP in similar instruments, adding to the debt stock that the market could hold. All in all, the the number of long-term bonds available to investors decreased by 10.1 percent of GDP. Finally, the total amount of long-term debt on the markets increased despite the Fed's intervention, since the overall national debt was increasing.

Effect of the Fed’s QE vs. the Treasury’s Maturity Extension Program

Why were the Fed and the Treasury at odds?

The Treasury Department has a mandate to issue debt at the lowest possible cost and limit fiscal risk (the risk that the federal government will not be able to roll-over maturing debt at low rates). By buying long-term debt, Treasury locks in record-low interest rates and limits interest rate risk, the concern that interest rates will go up.

However, the report's authors claim that, in unconventional times, traditional debt management should also consider the effects of policy on the overall economy, rather than focusing solely on lowering borrowing costs and fiscal risk. Most economists agree that, in normal times, the Fed should limit its actions to influencing interest rates, rather than intervening in the long-term debt or troubled asset markets. This uncoordinated action therefore only becomes an issue in extraordinary times, when interest rates are at the zero lower bound.

The report concludes that, to avoid these agencies working at odds, they should increase cooperation by meeting annually and issuing a joint statement on how they plan to manage the nation’s debt.

Is more Fed-Treasury coordination a good idea?

At a Brookings event to discuss the report, a panel of experts from the public and private sectors cried foul, seeing increased cooperation as an infringement in the Central Bank’s independence, which was designed to prevent politicians from using monetary policy in the short term for political or electoral reasons. Indeed, before the Fed-Treasury 1951 Accord restored the Fed's independence, event participants argued that the interests of the Treasury – and the administration in charge – superseded the Fed's goals. Since the 1970s, there has been little collaboration between the agencies. As the panelists pointed out, going back on this hard-earned independence by entangling debt management and monetary policy again could set a bad precedent and could reduce market confidence.

The authors reaffirmed their strong support the Fed’s independence, but Larry Summers, former Treasury Secretary, argued that communication, and even cooperation between the agencies to implement certain policies, already occurs on a regular basis. While the report authors acknowledged that the specific channels for more coordination are open to debate, the authors and most panelists agreed that any eventual arrangement should be formalized to avoid ad-hoc systems that may send a signal that the Fed is no longer independent.

The panelists also commented on Treasury's motivation and the actual effect of its policies. First, they argued that the Treasury did not react to Fed policies; instead, the maturity lengthening strategy pre-dated the financial crisis and was consistent with Treasury policy in similar economic circumstances. Second, although mechanically the Treasury offset approximately 35 percent of the Fed asset purchases, the actual reduction in the intended effect on long-term rates could be much smaller. This is precisely because Fed actions get a lot more attention from the markets than Treasury announcements about debt management, thus impacting the markets by more than the relative size of the Fed's asset purchases to the Treasury's debt sales. As evidence of this fact, long-term rates have been at historically low levels as intended by the Fed, meaning that more cooperation would not have necessarily been materially more effective.

Whatever the shape this increased communication may take, it is clear that both the Fed and Treasury have immense power to influence the size and type of our nation’s debt – even if only the former takes the spotlight.