Expanding Principal Writedowns to Fannie and Freddie

Sometimes, the timing of things can really work out in Washington. Yesterday, President Obama nominated Rep. Mel Watt (D-NC) to be the head of the Federal Housing Finance Agency (FHFA), the agency in charge of Fannie Mae and Freddie Mac. If confirmed, he would replace current chief Ed DeMarco in a move that could signal a policy shift at the FHFA.

One issue that has received attention in recent years is "principal forgiveness" for mortgages backed by Fannie and Freddie, which would involve writing down the balance of mortgages where payments are delinquent or default is a possibility rather than reducing monthly interest payments or making other loan modifications. Although President Obama supports allowing principal forgiveness in Fannie and Freddie-backed mortgages, DeMarco has not, and thus the policy has not been implemented. If Watt is confirmed, that could change.

Coincidentally, the CBO released a report the same day as the Watt nomination, analyzing different possibilities for principal forgiveness for FHFA mortgages. The three different options they detailed for principal forgiveness would all reduce the deficit slightly by avoiding defaults on mortgages and, consequently, Fannie and Freddie-incurred losses that would be greater than the cost of the writedown.

First, the report goes into a little background on the housing situation. Within the Troubled Asset Relief Program (TARP) is the Home Affordable Modification Program (HAMP), a centerpiece in the government's effort to assist struggling homeowners. CBO's report describes how HAMP has evolved to include principal reductions:

In 2010, the Treasury Department expanded the program to include the possibility of principal forgiveness, a reduction in the amount the borrower owes. Before then, the program had been limited to other ways of reducing payments. (This report refers to HAMP without principal reduction as “standard HAMP.”) For the borrower, principal forgiveness provides not only a lower monthly payment, but also, unlike standard HAMP, an improved equity position as a result of the lower loan balance. Having equity (the difference between the value of the home and what the borrower owes) allows a borrower to more easily refinance or sell the home to avoid default and strengthens his or her incentive to continue to pay off the mortgage.

Principal reduction, though, has been limited to non-Fannie/Freddie mortgages. The FHFA has cited moral hazard -- that homeowners would be intentionally delinquent on mortgage payments to qualify for assistance -- and implementation concerns, as well as potential adverse effects on future borrowers.

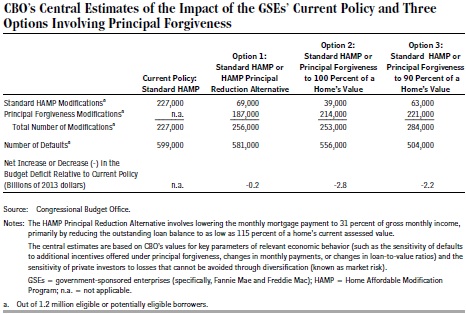

CBO analyzed three options for introducing principal writedowns for FHFA mortgages, allowing the FHFA in all options to choose between two programs for each borrower based on which they expect would cost the federal government the least. These options are:

- Option 1: The FHFA chooses between the current HAMP and HAMP with principal reductions, the latter involving a reduction of monthly payments to 31 percent of the borrowers' gross income and a reduction of the loan balance to as low as 115 percent of the home's value.

- Option 2: The FHFA chooses between the current HAMP and HAMP with principal reductions, which would reduce the loan balance to equal the home's value.

- Option 3: The FHFA chooses between the current HAMP and HAMP with principal reductions, which would reduce the loan balance to equal 90 percent of the home's value.

Overall, Option 1 is the most modest option, Option 3 has the largest effect for homeowners, and Option 2 has the largest amount of deficit reduction. There would be 18,000 fewer defaults with Option 1, 43,000 fewer defaults with Option 2, and 95,000 defaults with Option 3. Savings would be $0.2 billion, $2.8 billion, and $2.2 billion under Options 1, 2, and 3, respectively. These deficit reduction figures are generated using fair-value accounting. CBO also expects a small but positive boost to the economy. CBO notes that their estimates are subject to variability in the financial situation of those who participate and, of course, the actual design of a principal writedown program (eligibility criteria, etc.).

It will be interesting to see how Rep. Watt's confirmation process will play out. If confirmed, we may have an idea of where the FHFA will head in terms of policy and its effects on homeowners and the budget.