Everything You Need to Know About the President's Budget, In 9 Charts

On Tuesday, the President released his annual budget proposal, which details his priorities for FY 2015 as well as the coming decade. We published a paper analyzing the budget, and will continue to delve into specific parts of the budget in the upcoming week.

In addition, we released a chartbook which walks through different portions of the budget and highlights several of the budget's long-term projections.

A PDF version of this chartbook is available here. The individual charts, with descriptions, are also posted below.

Chart 1: The President's Budget and our Long-Term Debt

Under OMB's projections of the President's FY 2015 budget, debt would rise to 75 percent of GDP by 2015 and then fall to 69 percent by 2024. While these debt levels are too high -- the highest seen since World War II -- putting debt on a downward path would be an important accomplishment to help put the country on a sustainable fiscal path.

Chart 2: Ten-Year Projections of the President's Budget

The President's FY 2015 budget would decrease debt and deficits over time. Adjusted for timing shifts, deficits under this budget will fall from 4.1 percent of GDP in 2013 to 2.2 percent by 2017, and will remain around 2 percent through 2024. However, the budget increases both revenues and spending as a percentage of GDP relative to the PAYGO baseline (a current law baseline which removes the effects of the war drawdown).

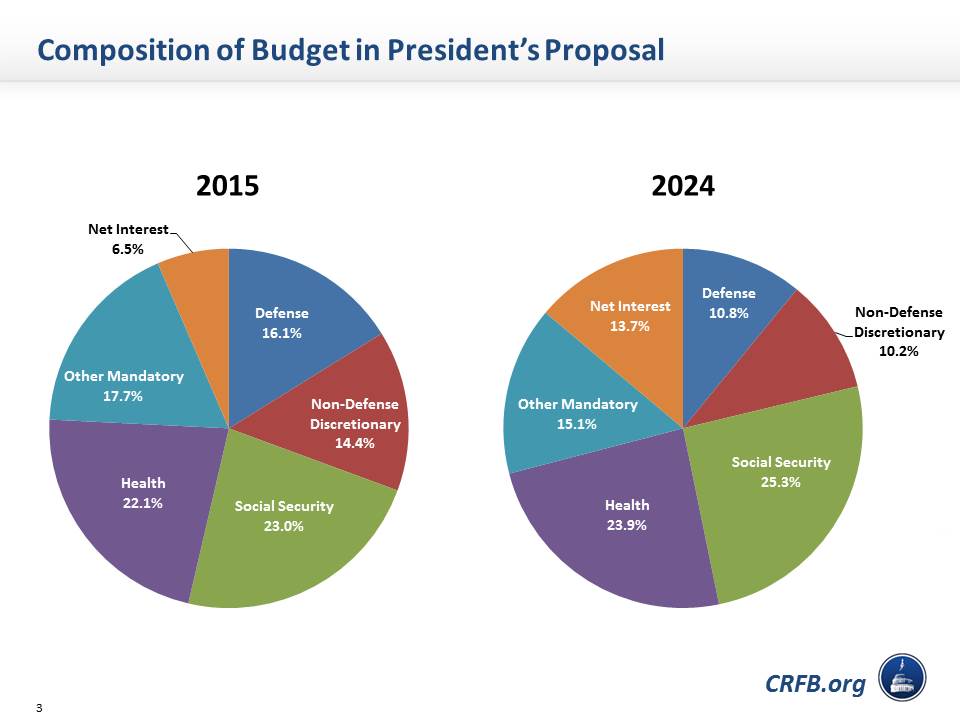

Chart 3: The Composition of the Budget Changes over Time

Over the next decade, the composition of spending in the President's budget proposal changes dramatically. Social Security and health care spending both increase modestly as a percentage of outlays, and both mandatory and discretionary spending decrease. Net interest spending on debt service more than doubles as a percentage of outlays over this time period, reflecting both higher interest rates and a larger national debt.

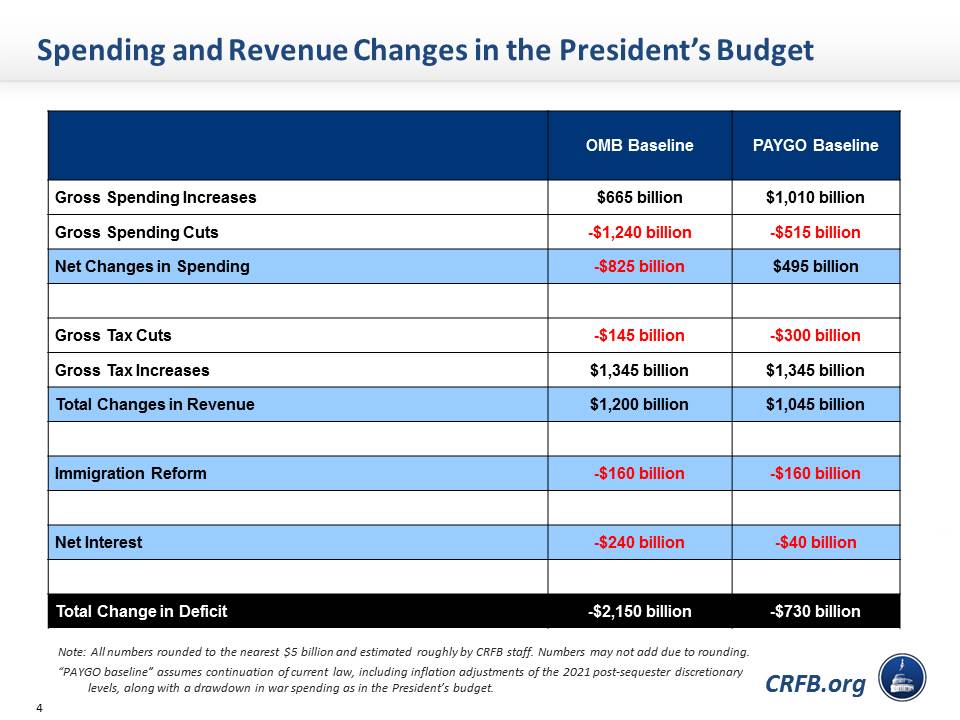

Chart 4: Deficit Reduction in the President's Budget

Relative to OMB's "adjusted baseline," the President's FY 2015 budget would reduce the deficit by nearly $2.2 trillion over ten years. However, compared to the PAYGO baseline, the budget would only reduce the deficit by about $730 billion over ten years.

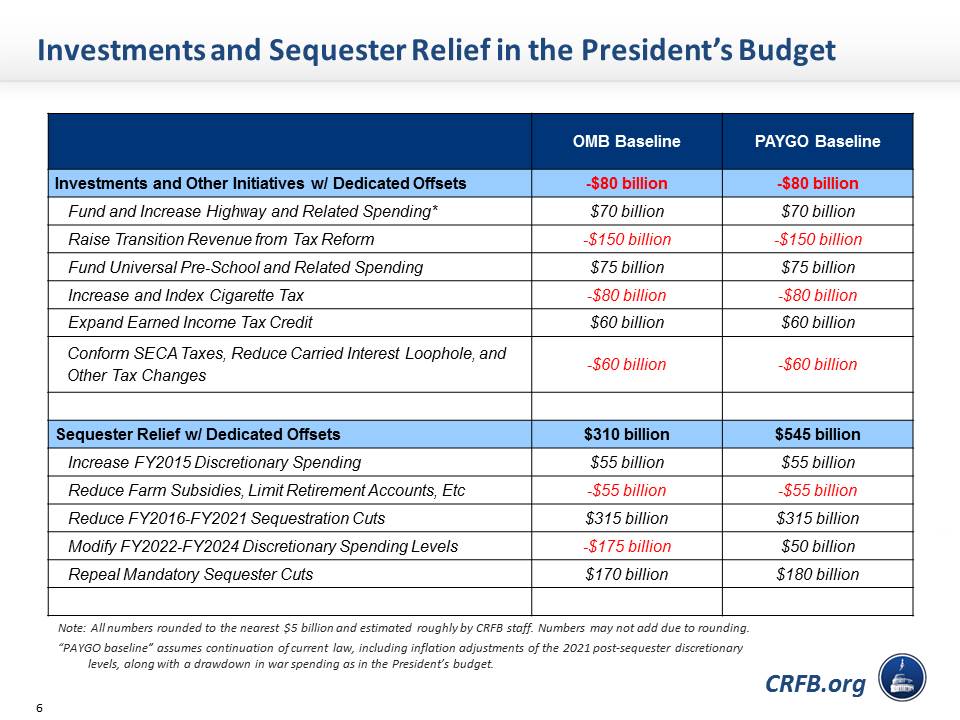

Chart 5: The President Proposes New Initiatives But Pays for Them

It is encouraging that the President abides by PAYGO in his FY 2015 budget and offsets the cost of new policies or costly changes to policies with legitimate offsets. For example, the President's proposal to fund universal pre-school is offset by his proposed increase in the cigarette tax. He also proposes paying for increased discretionary spending by combining a number of smaller policies, including reducing farm subsidies and limiting retirement accounts.

Chart 6: Discretionary Spending in the President's Budget

The President's budget would increase discretionary spending by $55 billion in FY2015 -- lifting non-defense discretionary $28 billion to pre-sequester levels and lifting defense discretionary by that same $28 billion. Beyond 2015, the budget would continue to grow discretionary spending, but more slowly than inflation. The result would be spending levels roughly half way between the pre- and post-sequester caps agreed to under the Budget Control Act of 2011 -- closer to the post-sequester levels in the later years.

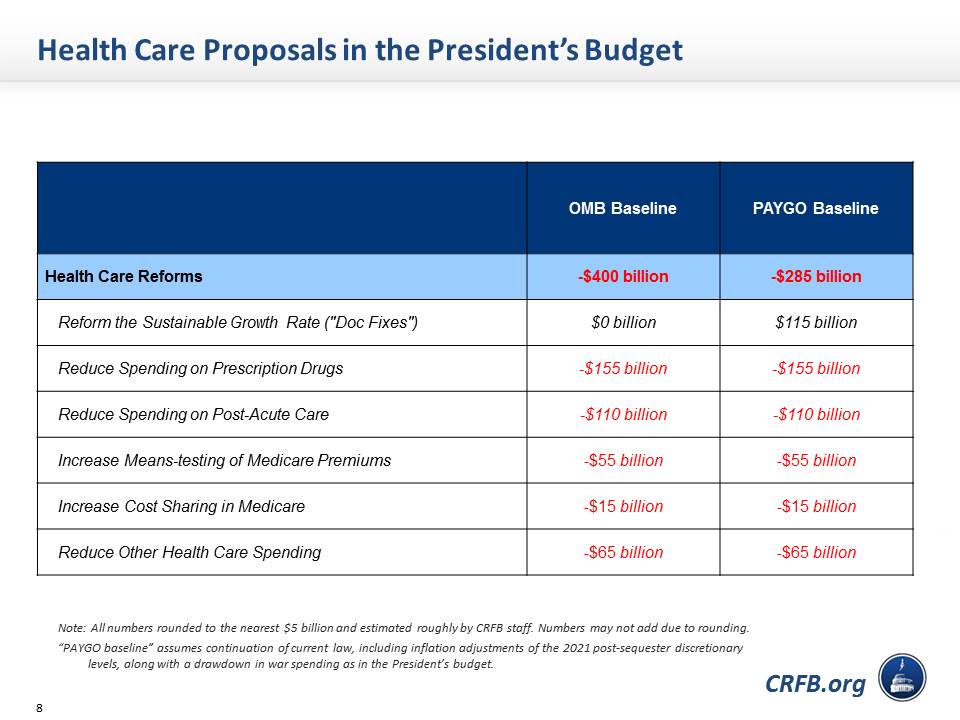

Chart 7: Health Care Reform Proposals are Maintained

In this year's budget, nearly all of the health care reform proposals from his last budget are maintained, which is commendable. Three policies, in particular, achieve over 65 percent of the budget's health care savings: requiring drug companies in Medicare Part D to offer higher rebates to Part D plans; slowing payment updates for post-acute care providers, such as nursing homes and home health facilities; and further reducing subsidies to high-income Medicare beneficiaries.

Importantly, he also responsibly fixes the Sustainable Growth Rate by paying for it with savings elsewhere in the budget (the budget includes $400 billion of gross health care savings). The President suggests that the SGR be fixed in a manner along the lines of what the three relevant Congressional committees are proposing.

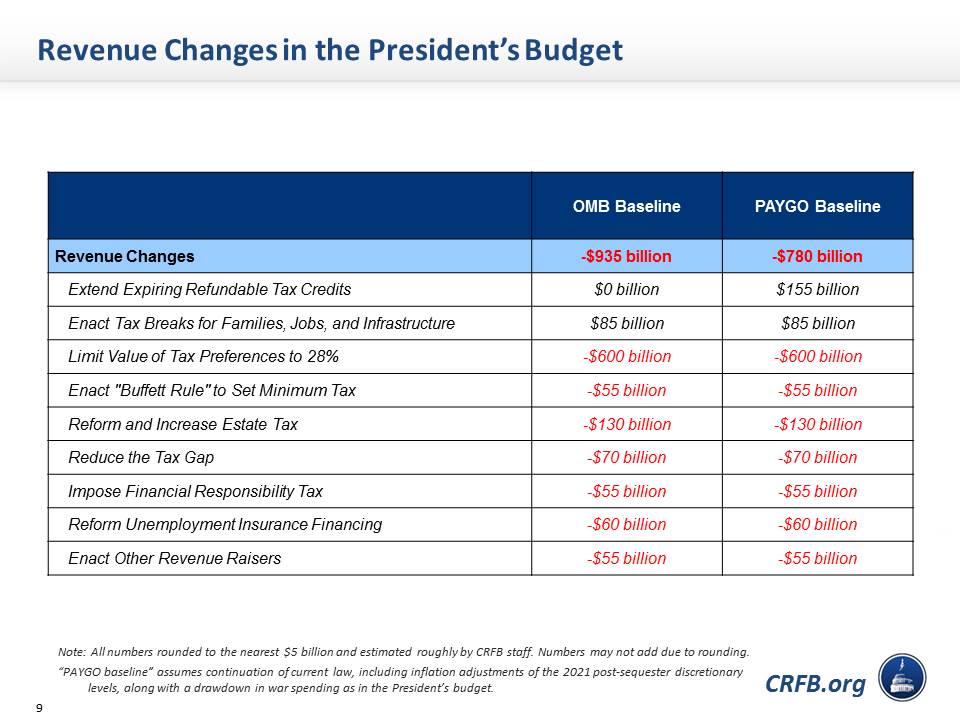

Chart 8: The President Raises Significant Revenue

The President's budget includes a number of proposals to increase total revenue. The largest of them would limit the value of most deductions and tax exclusions to 28 percent, effectively capping the value for those making above $250,000 a year. The budget would also institute a "Buffett Rule" to set a minimum 30% tax for those making over $2 million, impose a new tax on large financial institutions, raise estate taxes to their 2009 levels, and make numerous other changes. On the corporate side, President Obama calls for comprehensive rate-lowering, base-broadening reform which is revenue neutral over the long-term but raises about $150 billion in the short-term to fund transportation infrastructure.

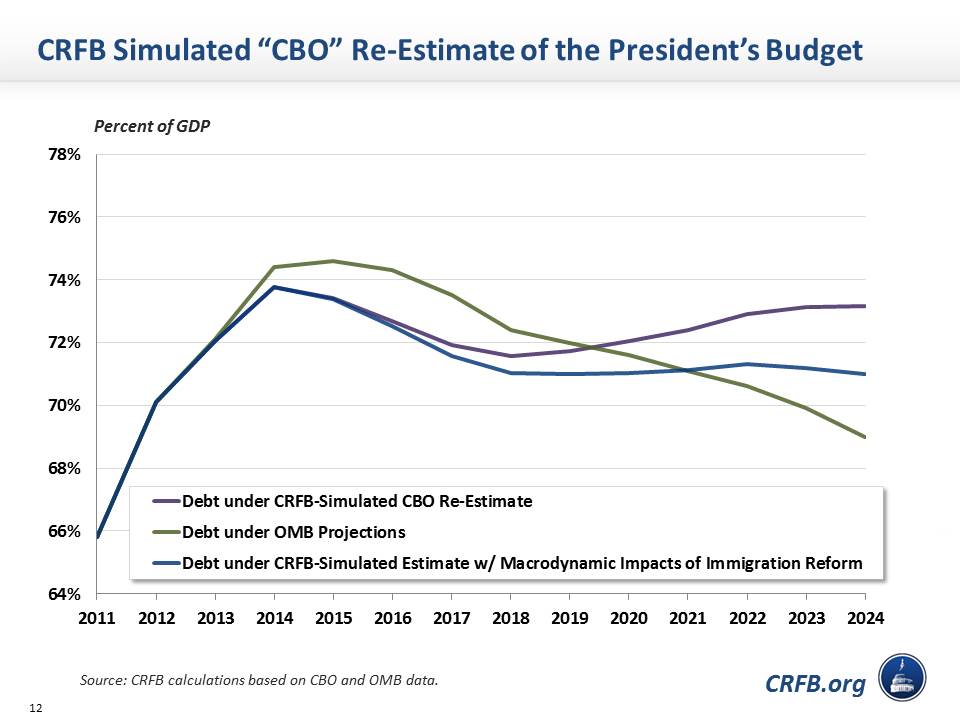

Chart 9: Does the President's Budget Really put Debt on a Downward Path?

Although OMB projects the budget would put debt on a downward path, this is in part due to the specific economic and technical assumptions OMB has adopted. When the Congressional Budget Office re-estimates the President's budget, it may produce more pessimistic findings. In our rough attempt to simulate a CBO re-estimate, we predict that they will find debt levels to be modestly growing, rather than shrinking, by the end of the decade; and reach 73 percent of GDP rather than 69 percent. After accounting for immigration reform, we project debt levels would be stable at 71 percent of GDP.

Our main takeaways from the President's FY 2015 budget are mixed: he abides by many responsible budgetary practices, but it may not be enough to address our structural fiscal issues. We appreciate that the President's budget:

- Abides by PAYGO with specific offsets;

- Includes responsible tax and health reforms;

- Sets sustainable and affordable discretionary levels; and

- Puts debt on a downward path.

At the same time, we are concerned that the budget:

- Moves in the wrong direction on entitlements, removing rather than adding needed reforms;

- Leaves debt levels too high;

- Claims phony "war savings" that may also be unrealistically high; and

- May rely on overly optimistic projections to put debt on a downward path.

For more analysis of the President's Fy 2015 budget, be sure to read our full paper.