CRFB's Plan to Offset Upcoming Policies

Congress and the President need to prep for some important upcoming fiscal moments, and CRFB has a plan to help them do just that. The Paying for Reform and Extension Policies Plan, or the PREP Plan shows a path to restoring the expired tax extenders and avoiding the Medicare Sustainable Growth Rate cuts without adding $1 trillion to the deficit.

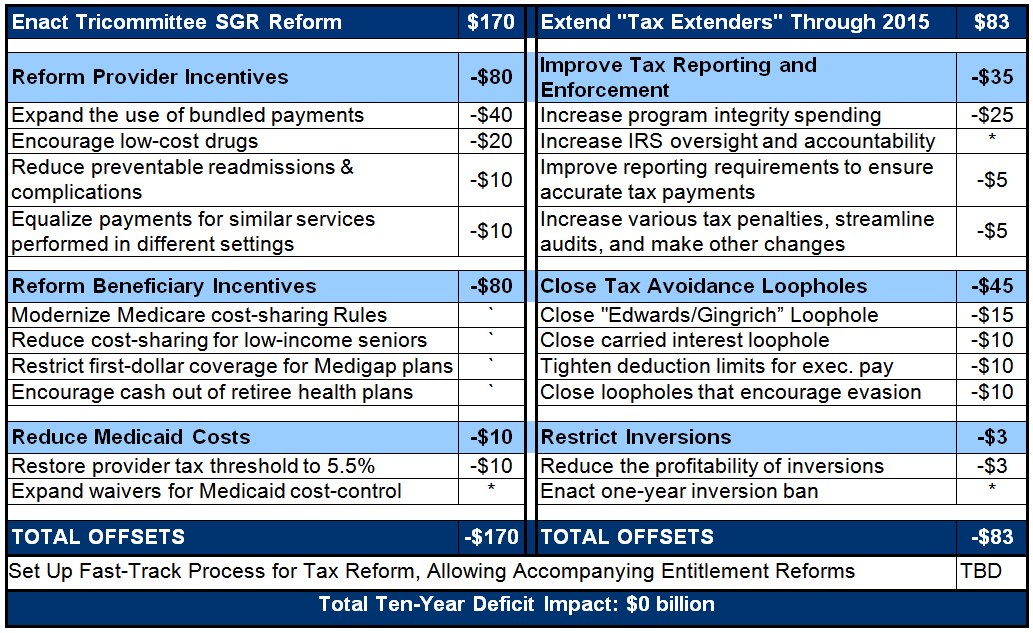

The PREP Plan assumes (but does not endorse) the passage of the Tricommittee SGR reform bill and a two-year tax extenders package. The plan includes over $250 billion of offsets, roughly two thirds from reforming incentives to slow health care cost growth and one third from improving tax compliance, along with a fast-track process for tax reform.

You can read the full plan here and view some of the details in the table below.

`Due to interactions, policies can't be scored on an individual basis

*Savings are less than $500 million

In addition to putting forward a plan, CRFB released a number of principles that should apply to any effort to continue extenders or reform the SGR.

For the tax extenders, we believe lawmakers should:

- Address most tax extenders permanently in the context of tax reform.

- Fully offset the cost of any continued temporary extenders without undermining tax reform.

- Include a fast-track process to achieve comprehensive reform.

For the SGR replacement, lawmakers should:

- Permanently replace the SGR with a value-based payment system.

- Fully offset any costs relative to current law.

- Enact offsets that bend the health care cost curve and are gimmick-free.

As the PREP Plan shows, it is possible to pursue bipartisan and fiscally responsible reforms that pay for SGR reform and tax extenders, improve compliance in the current tax code, truly help to bend the health care cost curve, and set the wheels in motion for further tax reform. For those who disagree with some of the specifics, the paper also provides an appendix table of alternative offsets.

As we argue:

The expired extenders and returning SGR should be viewed as an opportunity to make real improvements and reforms to the Medicare program and tax code; not an opportunity to add to the massive national debt.

The PREP Plan presents one way to achieve these goals. Ultimately, our leaders will need to enact significant adjustments to reverse the growing long- term debt. In the meanwhile, policymakers should at least avoid making the situation worse.

Read the full plan here.