CBO's Long Term Spending and Revenues

The CBO’s long-term projections offer an interesting look at future revenues and spending that show the stark implications of fiscal irresponsibility. With a comparison of spending and revenue under the Extended Alternative Fiscal Scenario (AFS) and the Extended Baseline Scenario (EBS), the future consequences of avoiding tough decisions in the present become clear. The Extended Baseline assumes the continuation of current law while the Extended Alternative Fiscal Scenario assumes some changes to current law based on past policy decisions, often labeled as "current policy." Under the AFS, we would avoid the "fiscal cliff" but only through policies that would greatly add to the debt. While both approaches have their flaws, we believe that the Alternative Fiscal Scenario is the more realistic of two policies, and thus our fiscal outlook is a cause for concern.

Spending

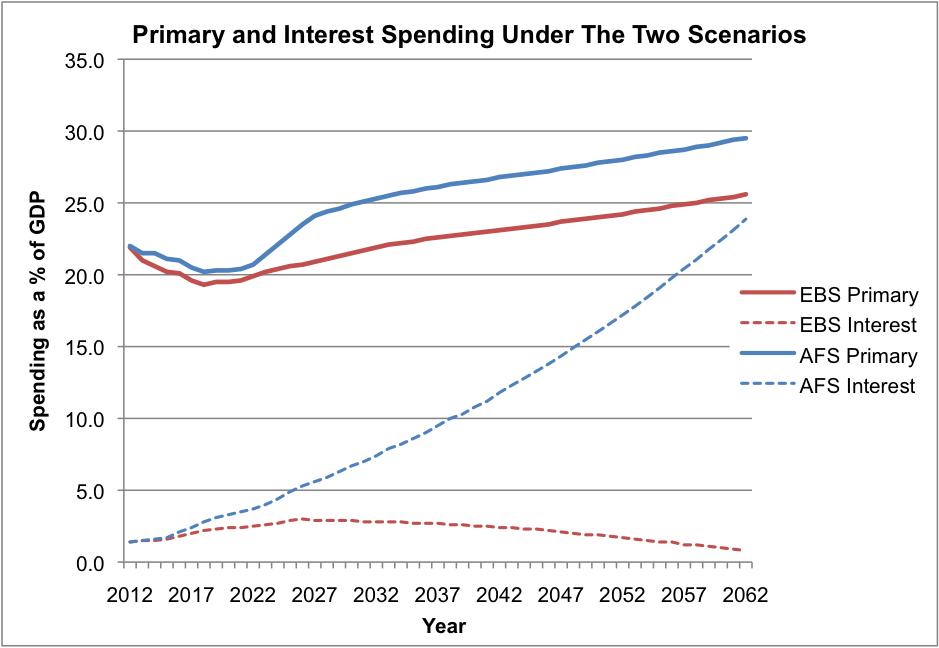

Spending under AFS reaches 35 percent of GDP by 2036, 50 percent by 2058, and an astronomical 77 percent by 2087. Under the Extended Baseline Scenario, spending still grows but at a slower rate reaching 25 percent by 2035, 26 percent by 2053, and approaching 27 percent by 2087. The large discrepancy in spending mostly due to interest payments on the debt, a function of both the lower revenues and increased discretionary and mandatory spending. As is shown in the chart below, primary spending grows more rapidly under AFS but not enough to explain the explosion of total spending under that scenario. It is interest payments that balloon under the AFS, rising to 45 percent of GDP alone by 2087 while remaining below 3 percent under the EBS and gradually decline as debt is slowly paid off. By the end of the 75-year projection, over half of the country’s spending under AFS is interest payments on the debt.

The other main driver of increased spending under AFS is health care, which assumes that cost controls from the health care reform law only work up until 2022 (or are repealed then), the "doc fix" is continued permanently, and the exchange subsidies grow faster than current law. Under the Extended Baseline Scenario, cost control measures are assumed to be in effect through 2029 and physicians would have to take a 27 percent payment cut. The assumptions of the current law projection for health care may be unrealistic, and therefore a sustainable debt plan will need to address health care to control spending. Finally the sequester also comes in play, as it is assumed to occur under the Baseline Scenario but not under the Alternative Fiscal Scenario.

Revenues

Both sets of projections see revenues increase as a percentage of GDP from its current level at 15.7 percent. However under the AFS, revenues grow only to 18.5 percent of GDP by 2022 and hold at that level in the years after, just below the historical average. Alternatively, under the Extended Baseline revenues continue to grow approaching 30 percent of GDP by 1980. To give some historical perspective, revenues have never risen beyond 21 percent of GDP, and the level of revenue under the Extended Baseline Scenario would represent an unprecedented increase in taxes. Revenues would keep increasing under the EBS as the 2001/2003 Bush tax cuts expire, "tax extenders" are canceled, and the unindexed AMT increasingly affects more taxpayers. The growth of revenue is the primary cause of deficit reduction under the Extended Baseline Scenario, as spending continues to grow.

Source: CBO, CRFB

Neither baseline is the ideal solution. Under the Extended Baseline Scenario, debt would be reduced, but at the cost of potentially pushing the economy into a recession in the short-term and with the use of some policies that would be absurd over the long run (for example, the physician payment cuts). Such an increase will have implications for future growth. On the other hand, debt will skyrocket to levels never seen in history under the AFS. It would be impossible for the U.S. to sustain this rate of growth in government debt.

Comprehensive fiscal reform will be needed to prevent either of these two situations from becoming a reality.

For more analysis on the CBO's long term outlook, take a look at our analysis of CBO's projections.