CBO: GSE Reform Saves $58 Billion (Or $7 Billion)

One of the bills to replace Fannie Mae and Freddie Mac and overhaul the housing finance system just got a verdict from CBO: it will save $58 billion under the current budget rules for scoring credit programs. The bill, the Housing Finance Reform and Taxpayer Protection Act of 2014 (S. 1217), passed the Senate Banking Committee in May by a 13-9 vote, with both bipartisan support and opposition.

Fannie and Freddie have drawn the ire of some policymakers after the federal government placed them into conservatorship and infused hundreds of billions of dollars to rescue them during the heart of the financial crisis. However, after a change in the terms of the agreement that required the two government-sponsored enterprises (GSEs) to pay their net worth back to the federal government each quarter, the situation has reversed: Fannie and Freddie have brought in an estimated $200 billion for the Treasury in the past two years alone. Still, lawmakers are concerned about the inherent instability of the current arrangement and the potential risk to taxpayers if the housing market turns down again.

S. 1217 would replace Fannie and Freddie by 2020 with a new Federal Mortgage Insurance Corporation (FMIC), which would provide mortgage guarantees funded by fees.

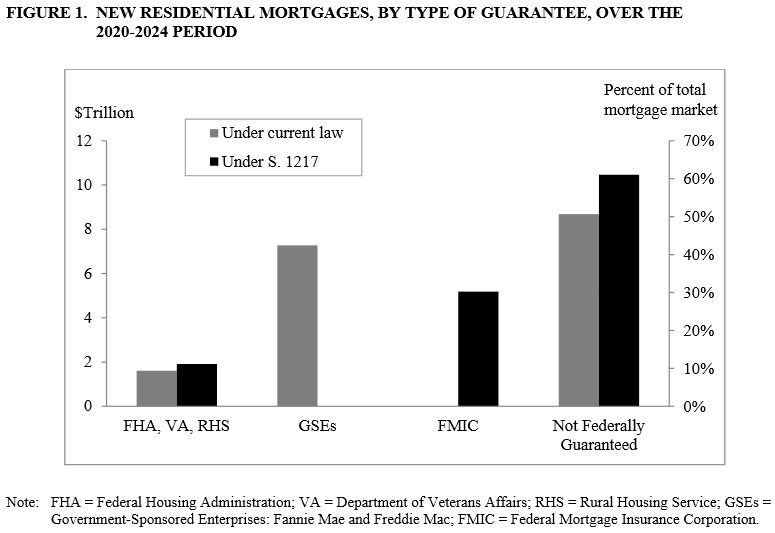

The FMIC would operate similarly to the GSEs in some respects, but it would take up less market share: CBO projects the GSEs would guarantee 40 percent of all mortgages issued in the 2020-2024 period, while the FMIC would guarantee 30 percent. The mortgages left out of the new system would either be covered by the Federal Housing Administration's (FHA) guarantee program or would simply not have a federal guarantee.

As we explained previously, the FMIC would have a number of layers of protection intended to better limit taxpayer exposure than the GSEs would. In addition to tightening standards for mortgages to make them less risky, the FMIC would require private sector guarantors to have sufficient capital to withstand 10 percent losses on the mortgages they guarantee. It would only step in with funding once the private position was wiped out, and taxpayer funding would only be necessary if losses were greater than both the private guarantor and the FMIC could withstand. In addition, CBO estimated that the new fees that FMIC would charge the issuers of MBSs would exceed the costs of the guarantees.

CBO concluded that as a result of those protections the FMIC guarantees in the legislation would expose the government to less risk than it would under continued operations of GSEs under current law and therefore replacing GSEs with FMIC would save money. Although the FMIC would spend $1 billion in the first five years funding Fannie and Freddie's administrative costs, ending the GSEs in 2020 would save $5 billion (equal to their subsidy cost) for net savings of $4 billion. The FMIC's guarantee itself is expected to bring in $9-10 billion annually for savings of $47 billion through 2024, since the present value of the fees is expected to exceed expected payouts.

The bill would also save $1.7 billion from assessing fees to fund administrative costs and $7.3 billion from collections to fund affordable housing programs (since those programs would take time to ramp up and would not spend money right away). Finally, the bill would reduce revenue by $1.5 billion since the Federal Housing Finance Agency (FHFA) that houses Fannie and Freddie would no longer assess fees to cover administrative costs.

| 2015-2024 Savings/Costs (-) of Banking Committee Bill (billions of dollars) | ||

| FCRA Method | Fair-Value Method | |

| End GSE Guarantees | $4 | $4 |

| Establish FMIC Guarantees | $47 | -$4 |

| Collect Fees for FMIC Administrative Costs | $2 | $2 |

| Collect Fees for Affordable Housing Programs | $7 | $7 |

| End FHFA Assessments | -$2 | -$2 |

| Total Savings | $58 | $7 |

Source: CBO

The score, though, brings up a controversy surrounding how credit programs are scored, an issue we explored in detail a few months ago. The default method, established in the Federal Credit Reform Act (FCRA), compares the present value of receipts to expected costs based on borrowers' default rates. Some have advocated instead for fair-value accounting, which adds in a component of market risk to account for possible shifts in overall economic conditions which could lead to higher costs and lower receipts. Fortunately, CBO provides the score using both methods. Using fair-value accounting for the FMIC guarantee program swings the budgetary effect from $47 billion of savings to $4 billion of costs and reduces the overall savings from $58 billion to $7 billion. So while the bill would save money on net under either method, the new guarantee program would only be a boon to the federal government under the FCRA method.

The main focus should not be whether the bill reduces deficits by $58 billion or $7 billion. Instead, housing reform should seek to strike the right balance of policies to achieve policymakers' goals for affordable housing while limiting taxpayer exposure to the sorts of devastating losses possible in a financial crisis. This legislation includes several reforms which make positive steps toward making government guarantees more transparent and accountable and limiting risk to taxpayers.