Can Tax Reform Substantially Accelerate Economic Growth?

Since the 2016 Presidential campaign began, a number of candidates have touted tax reform – either overhauling or replacing the current income tax – as a way to promote economic growth. In fact, well-designed tax reform can and probably would promote economic growth; though perhaps not by as much as some of the candidates claim.

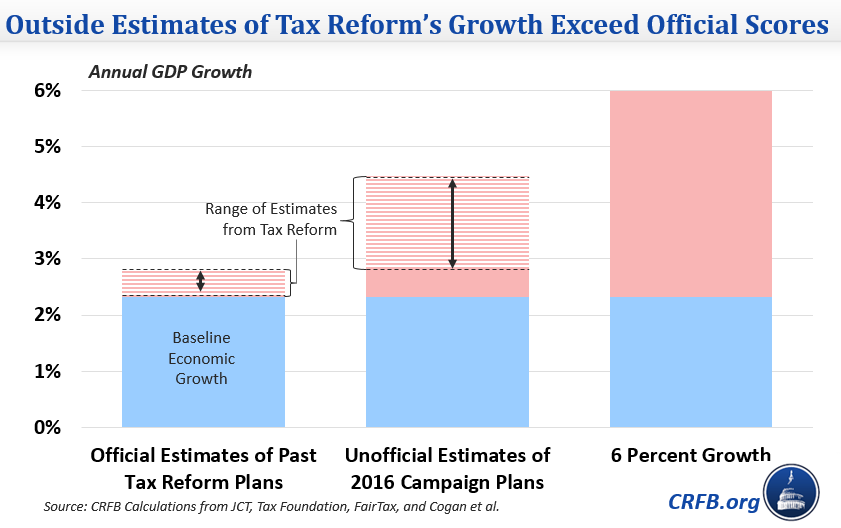

Both the Joint Committee on Taxation (JCT) and Department of Treasury have attempted to measure the economic impact of tax reform. Depending on the type of tax reform, official estimates suggest the size of the economy can be boosted by between 0.1 and 2.4 percent on average over 10 years. This is equivalent to a 0.02 to 0.5 percent change in the annual growth rate, which would increase projected average real economic growth to somewhere between 2.35 and 2.8 percent over the next decade.

Tax reform could help to promote growth in several ways. Most significantly, it can improve incentives to work and invest (increasing labor and capital supply, respectively) by reducing effective marginal rates and can reduce the crowd-out of productive investment by increasing revenue collection for deficit reduction. Tax reform can also eliminate distortions in the tax code to help money flow to activities and investments which produce more welfare or yield greater economic returns, reduce the cost of tax compliance and avoidance, encourage certain pro-growth activities such as research and development, or improve America's global competitiveness.

Yet these gains are not without limits. Depending on the type of reform pursued and the economic model used, JCT and Treasury have found that tax reform could boost the size of the economy between 0.1 and 2.4 percent on average over 10 years. Importantly, the high-end estimates may be overly optimistic because they assume lawmakers eventually stabilize the debt, which lessens the economic drag of deficits, even though that would take additional legislation.

Economic Estimates of Tax Reform Plans

| Tax Reform Plan | Average Ten-Year GDP Impact | Change in GDP by the 10th Year |

|---|---|---|

| Official Estimates (Congressional Budget Office, Joint Committee on Taxation, U.S. Treasury) | ||

| JCT, 2011: Illustrative Revenue-Neutral Individual Income Tax Reform | 0.5%-0.8% | 0.8%-1.1%* |

| JCT, 2006: Illustrative Revenue-Neutral Individual Income Tax Reform | 0.7%-1.6% | 1.1%-1.9% * |

| JCT economists: Illustrative Revenue-Neutral Corporate Tax Reform | 0.0%-0.2% | -0.1%-0.2%* |

| JCT: The Tax Reform Act of 2014 | 0.1%-1.6% | 0.1%-1.4%* |

| 2005 Panel: Growth and Investment Tax Plan | 2.4% | 2.4%† |

| 2005 Panel: Progressive Consumption Tax | 2.3% | 2.3%† |

| 2005 Panel: Simplified Income Tax | 0.5% | 0.5%† |

| Outside Estimates | ||

| Tax Foundation: Rubio's "Economic Growth and Family Fairness" | 7.5% | 15% |

| Tax Foundation: Paul's "Flat and Fair Tax" | 4.7% | 9.4% |

| Americans for Fair Taxation: "FairTax" national sales tax proposed by Huckabee | 10.2% | 10.9% |

| Cogan, Feldstein, Hubbard, Warsh: Bush's "Reform and Growth Act of 2017" | ~2.5% | 5% |

| Tax Foundation: Bush's "Reform and Growth Act of 2017" | 5% | 10% |

Average GDP impact shows average amount that GDP rises above baseline estimates, or if it's not available, CRFB calculations approximating the same figure (for instance, averaging GDP impact between the first five years and the second five years).

*Estimates for the 10th year are not available. Figure shows the average effect over ten years.

†The 2005 Panel estimates are given for "over the budget window," without any detail about when the growth would occur, so they are listed here as both the 10-year average and the growth in the 10th year.

Not surprisingly, supporters of various tax reform plans tend to have much rosier estimates than the official scoring agencies. For example, the advocates of the FairTax estimate it would increase the size of the economy by about 11 percent over the next decade.

Whether using official estimates or rosier ones, it is clear that tax reform can help to promote economic growth, but it is important to put that growth in perspective. One presidential candidate has suggested his tax reform plan would lead to 6 percent growth, a claim that seems out of line with most economic analysis. Rather, tax reform may lift growth (projected to average 2.3 percent per year) by a fraction of a percentage point.

As an example, the Tax Reform Act of 2014 was projected to increase the size of the economy by somewhere between 0.1 to 1.6 percent of Gross Domestic Product (GDP) during the next decade. Assuming that this average occurs by the mid-point of the decade, that plan would increase average growth rates between 0.02 and 0.32 percent. If sustained, average real growth could reach 2.6 percent – an improvement over current projections but a far cry from 6 percent. Even growth estimates provided by supporters of the Fair Tax – which are likely several times higher than what official estimates would suggest – only imply a growth rate of 4.5 percent, still far short of 6 percent.

Tax reform can improve economic growth by improving the incentive to work and invest, eliminating inefficiencies, and increasing international competitiveness. However, the growth estimates touted by some presidential candidates are an order of magnitude higher than those used by official estimators. It's important to have realistic expectations of what tax reform can and cannot achieve.

Update 9/10/2015: Added Tax Foundation estimates of Bush's tax plan.

Update 9/11/2015: Changed table to include 10th year growth estimates for easier comparison with outside estimates.