Auerbach-Gale Analysis Agrees on the Worsening Fiscal Outlook

Alan Auerbach of the University of California-Berkeley and William Gale of the Tax Policy Center recently published a report, "Once More Unto the Breach: The Deteriorating Fiscal Outlook" that details their own budget outlook. Their findings are similar to the projections put out by the CBO, which shows debt increasing almost continuously after this year. The report also shows how different policy assumptions would affect the path of long-term debt.

Auerbach and Gale show debt to be on a continuous upward path from 76 percent of GDP in 2016 to 93.6 percent by 2026 (compared to the CBO estimate of 86 percent in 2026). Auerbach and Gale’s projections are similar to our alternative outlook, which shows debt reaching 92 percent in 2026. Like us, they assume that temporary tax cuts are made permanent, the health care taxes that were delayed in last year’s tax deal are repealed, and discretionary spending is increased above sequester levels.

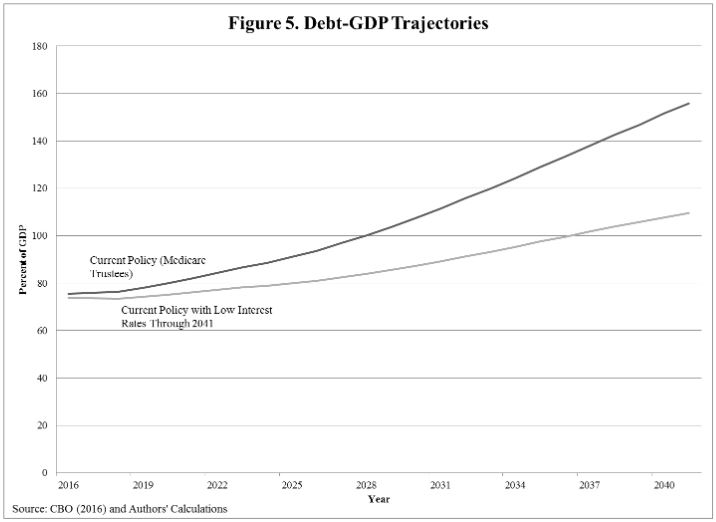

Even using more generous economic assumptions, Auerbach and Gale find debt rising as a percent of GDP. They specifically project that if interest rates remained at their current low levels for the next decade, an assumption they call “extreme,” debt would still rise to 81 percent of GDP by 2026.

Not surprisingly, the authors find that debt will continue to rise unabated over the longer term. They find that debt will exceed the size of the economy by 2028, hit the previous all-time high of 106 percent by 2030 and reach 156 percent in 25 years. Even assuming that interest rates remain at their current level for the next 25 years, which is highly unlikely, debt would still rise to 110 percent by 2041.

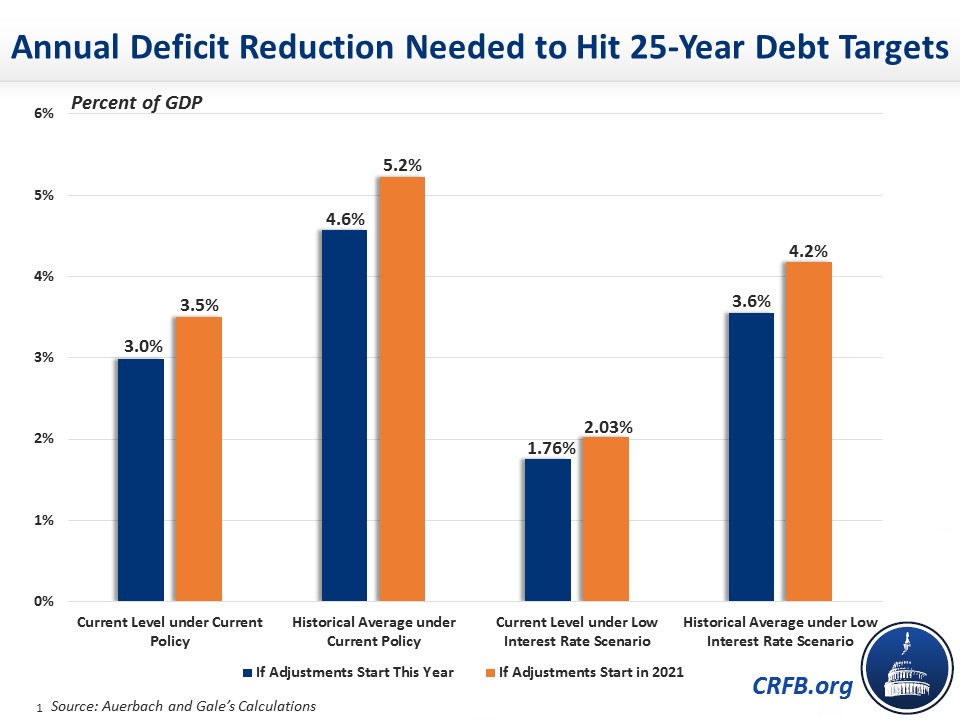

The authors estimate that it would take 4.6 percent of GDP of annual deficit reduction to get debt down to 36 percent of GDP in 25 years. They also show how delaying changes make them more difficult: waiting five years to get the debt down to 36 percent would increase the deficit reduction required to 5.2 percent. Clearly, lawmakers will need to come up with significant deficit reduction to bring down debt from its current high level.

The authors note that the debt-to-GDP ratio already is the highest in U.S. history at the end of the year in 2016, excluding a seven year period occurring during World War II. In contrast to that period, when debt fell rapidly in following years, debt will be rising over the next decade and beyond.

Auerbach and Gale agree with CBO that the debt will continue to rise to an unsustainable level, and they think it will happen even more quickly than CBO does. It is essential that lawmakers take steps soon to get our fiscal house in order rather than passing" legislation that makes the problem worse, as they have the past few years.

Read the full analysis here.