Adding Realistic Assumptions to CBO's Baseline

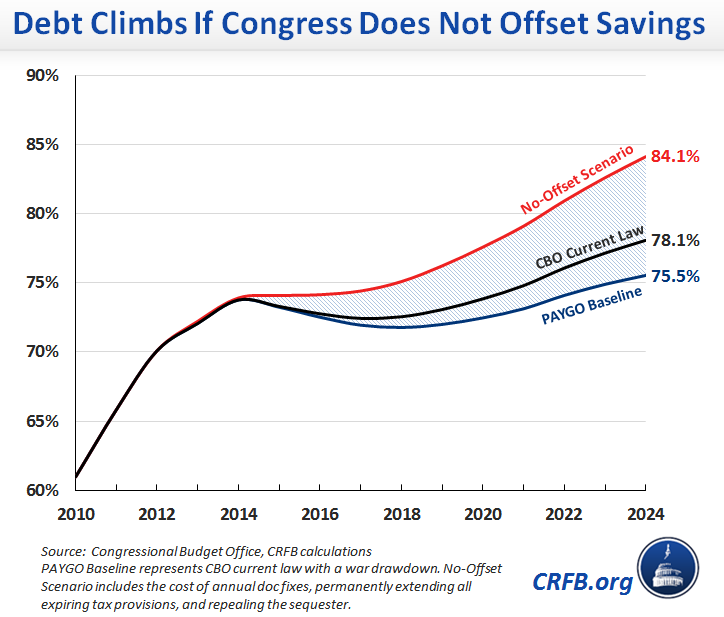

CBO's most recent budget projections show debt on an unsustainable path – rising from a post-war record 73 percent of GDP today to 78 percent by 2024. Importantly, however, CBO's projections do not always reflect where debt is likely to go after accounting for the actions that lawmakers might take.

For that reason, CRFB has constructed two alternatives to the CBO baseline, based on numbers that CBO provides. One alternative, which we call the "PAYGO Baseline," assumes that lawmakers stick to current law, but also reflects the troop drawdown currently underway. By convention, CBO assumes that any uncapped discretionary spending (such as the amounts spent in Iraq and Afghanistan) will grow indefinitely with inflation – an assumption inconsistent with the current drawdown. Adjusting for this assumption, deficits over the next decade will be $700 billion lower than the CBO baseline, including additional interest savings. Under this PAYGO Baseline, where lawmakers draw down war spending and fully pay for new spending and/or tax cuts, debt will decline to 75.5 percent of GDP by 2024.

However, the debt could be much worse than it is under this scenario, which assumes Congress is fiscally responsible and fully abides by pay-as-you-go rules. In our "No-Offset Scenario," we continue to assume the troop drawdown, but also assume that lawmakers enact annual doc fixes, extend the refundable tax credit expansions after 2017, reinstate and continue both the currently expired "normal tax extenders" and bonus depreciation, and repeal future sequestration cuts – all without offsetting the costs. Under this No-Offset Scenario, ten-year deficits would be $1.6 trillion higher than CBO's baseline, and debt would rise to 84 percent of GDP by the end of the decade.

The difference between the PAYGO scenario and the No-Offset scenario highlights the need to abide by PAYGO rules as a minimum standard of fiscal responsibility. Doing so would mean a rising level of debt, but one which would be addressed through reasonable reforms. Failing to abide by PAYGO could mean ever growing debt levels which prove difficult to control.

Importantly, we did not include any estimates for unpredictable events that would make the budget picture even worse, such as future military actions, unexpected increases in interest rates, or additional emergency funding in response to natural disasters.

The table below lists the specific costs associated with each of the policies. In particular, this year's "No-Offset Scenario" includes the $244 billion cost of bonus depreciation, a tax break that was enacted as a stimulus measure in 2008 to spur business investment. Even though it was enacted in response to the Great Recession, the measure was continued along with the annual tax extenders package at the beginning of 2013, and appears poised to be continued without offsets once again.

| Alternative Assumptions About Future Deficits |

||

| Policy Assumption |

2014-2019 Savings/Costs |

2014-2024 Savings/Costs |

| CBO Current Law Deficits |

- $3.421 trillion |

- $8.110 trillion |

| Draw down war spending | $219 billion | $572 billion |

| Interest savings | $16 billion | $109 billion |

| PAYGO Baseline Deficit | - $3.186 trillion | - $7.429 trillion |

| Repeal sequester | - $350 billion | - $874 billion |

| Extend normal tax extenders | - $217 billion | - $466 billion |

| Extend refundable credit expansions | - $30 billion | - $165 billion |

| Enact a permanent doc fix | - $51 billion | - $124 billion |

| Extend bonus depreciation | - $195 billion | - $244 billion |

| Net interest costs | - $56 billion | - $286 billion |

| No-Offset Scenario | - $4.085 trillion | - $9.588 trillion |

Source: Congressional Budget Office April 2014 baseline, CRFB calculations. Savings are positive. Costs and deficits are negative.