Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

Bipartisan Budget Act Means the Return of Trillion-Dollar Deficits

Lawmakers have passed a budget deal that will increase deficits by $320 billion over a decade or almost $420 billion with interest and sets the stage...

Budget Deal Would Bust Original BCA Caps

The budget deal currently being considered by Congress would increase discretionary spending caps over the next two years by $165 billion for defense...

Budget Deal Could Ultimately Add $2 Trillion in Debt

The budget deal lawmakers have agreed to would increase discretionary spending above and beyond repeal of the sequester and the caps set in law under...

CBO Finds Budget Deal Will Cost $320 Billion

The Congressional Budget Office has released a series of estimates for the budget deal announced yesterday. The deal would add $320 billion to...

Budget Deal Would Assure Permanent Trillion-Dollar Deficits

Note (2/9/2018): We have published an update to this blog reflecting passage of the Bipartisan Budget Act of 2018. It is posted here . Lawmakers...

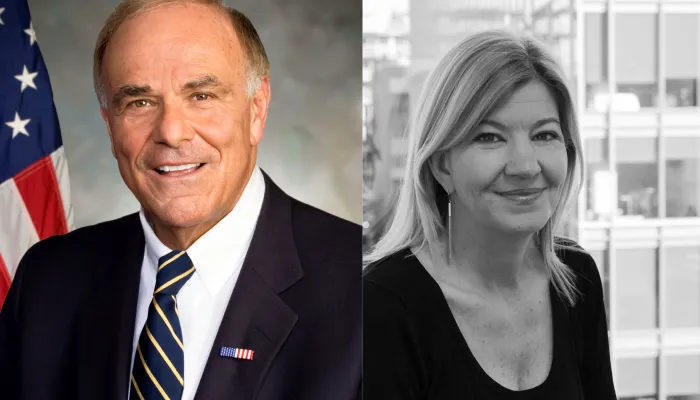

MacGuineas Testifies Before Senate Subcommittee

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, testified before the Senate Homeland Security and Governmental Affairs...

Post-State of the Union Fact Check Roundup

The President's first State of the Union address included several claims related to the recently passed tax legislation, including a few repeat claims...

Facebook Page Remembering Ed Lorenzen

In order to provide information on Ed Lorenzen's tributes and arrangements, we have set up a public Facebook page that will be constantly updated with...

Debt-O is Back for the State of the Union Address!

President Donald Trump will give his first State of the Union address tonight at 9 p.m. ET. CRFB will be live tweeting the speech, providing analysis...

Washington Post: In a house fire, America loses a devoted servant

Following the untimely death of Committee for a Responsible Federal Budget senior advisor Ed Lorenzen and his son, Michael, The Washington Post's...

Maya MacGuineas: Wake Up: The Current Fiscal Free-for-All is Untenable

Maya MacGuineas is president of the nonpartisan Committee for a Responsible Federal Budget and head of the Campaign to Fix the Debt. She recently...

IMF: Tax Bill's Boost to Growth is Short-Term

This week, the International Monetary Fund (IMF) released a new estimate of economic growth, revising their short-term estimate upwards because of the...