Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

Explaining the House Farm Bill

The 2014 farm bill expires on September 30, which means policymakers have less than five months to pass a new one. The House Agriculture Committee has...

What's in the President's Rescission Request?

Update: CBO released an estimate of the effect of the CHIP rescission on outlays and coverage. CBO estimates that the proposed rescission would not...

A Conversation with CBO Director Keith Hall

The Committee for a Responsible Federal Budget and our partners at the Campaign to Fix the Debt hosted a conference call conversation with Dr. Keith...

Multiemployer Pensions: The Next Source of Budget-Busting Legislation?

The newly-created Joint Select Committee on Solvency of Multiemployer Plans is tasked with crafting legislation to improve the finances of the nation...

Mandatory Spending Makes Up the Bulk of Spending Growth

Over four-fifths of the growth in nominal spending over the next decade is driven by Social Security, federal health programs, and interest on the...

Rescissions, How Do They Work?

Recent press reports have indicated that the Trump Administration is looking to use a process known as rescission to cut spending from the recent...

Judd Gregg: Fixing the unfixable — the federal budget

Judd Gregg, a former Republican senator from New Hampshire, served as chairman of the Senate Budget Committee from 2005 to 2007 and ranking member...

A "Cheat Sheet" to Our Recent Work on Debt

Over the past month, we've been explaining different elements of CBO's recent budget outlook. Below is a summary of our recent work. Decade of Debt...

Republican Study Committee Releases FY 2019 Budget

While the House and Senate Budget Committees have yet to release a budget for FY 2019, the Republican Study Committee (RSC) has released its own...

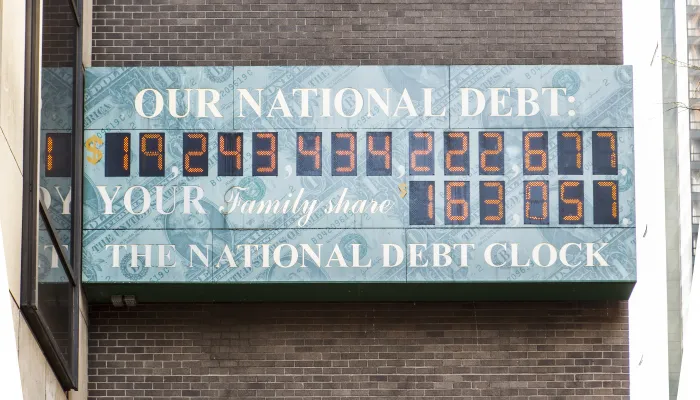

Budget Barometer: 6 Key Debt Numbers

A good way to judge the national debt is as a share of the overall economy (or GDP). Based on the latest figures from the Congressional Budget Office...

CBO Sees Major Trust Fund Exhaustions On The Horizon

The Congressional Budget Office estimates that three major trust funds will deplete their reserves within the next ten years, with a fourth exhausting...

Interest Spending is on Course to Triple

According to CBO's latest projections, the rising cost of interest on the debt is a significant driver of growing deficits and debt. In this piece, we...