Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

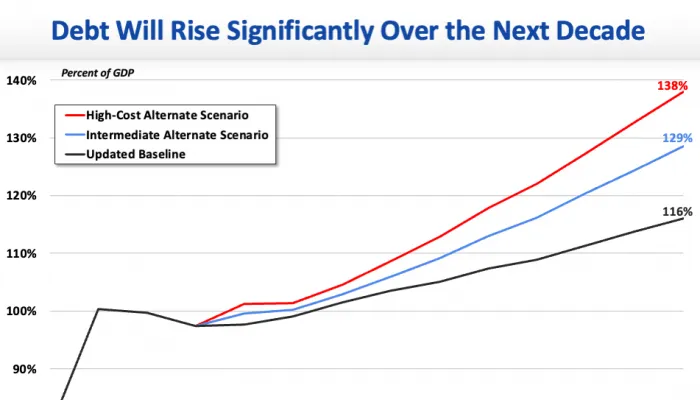

New Projection: Federal Debt Will Reach Record Levels Sooner Than Expected

The nation’s fiscal and economic outlook has deteriorated substantially since the last Congressional Budget Office (CBO) baseline in May, when CBO...

IRS Releases Updated Tax Gap Analysis

The Internal Revenue Service (IRS) recently released an updated analysis of the “ tax gap” – the difference between taxes owed to the federal...

Mitch Daniels: Modern Monetary Theory, debunked everywhere except among government big-spenders

Mitch Daniels is the president of Purdue University, a former governor of Indiana, a former director of the Office of Management and Budget, and a co...

Treasury: FY 2022 Deficit Was $1.4 Trillion

The US Department of the Treasury released its final Monthly Treasury Statement for Fiscal Year (FY) 2022, showing a $1.4 trillion deficit for the...

COVID Relief End Explains All of 2022 Deficit Decline

The budget deficit fell by half between Fiscal Year (FY) 2021 and FY 2022, from $2.8 trillion to $1.4 trillion. While the Biden Administration has...

CBO Offers Approaches to Reduce Commercial Health Prices

The Congressional Budget Office (CBO) recently released a report discussing different policy approaches to reducing the prices paid by commercial...

New York Times Highlights Need to Improve Medicare Advantage

A recent investigation published in The New York Times highlights the need for Medicare Advantage (MA) improvements by calling attention to widespread...

Student Debt Cancellation is Not Financially Justified

The White House has justified the unilateral implementation of its $400 billion student debt cancellation plan based on authority the Secretary of...

Is Biden's Student Debt Cancellation Plan Still Regressive?

The Biden Administration’s new $420 billion student debt cancellation and repayment pause plan will deliver the majority of the benefits to those in...

Legislation to Bring Transparency to MA Introduced

Representative Katie Porter (D-CA) introduced legislation this week that would require Medicare Advantage (MA) plans to provide data on supplemental...

Committee Co-Chair Timothy Penny on KROC Minnesota Radio

Committee for a Responsible Federal Budget Co-Chair Timothy Penny, former representative for Minnesota’s first Congressional district and president...

Student Loan IDR Changes Are Highly Problematic, Report Shows

While much attention has been paid to President Biden's costly and inflationary plan to cancel $10,000 to $20,000 of student debt, his proposed...