Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

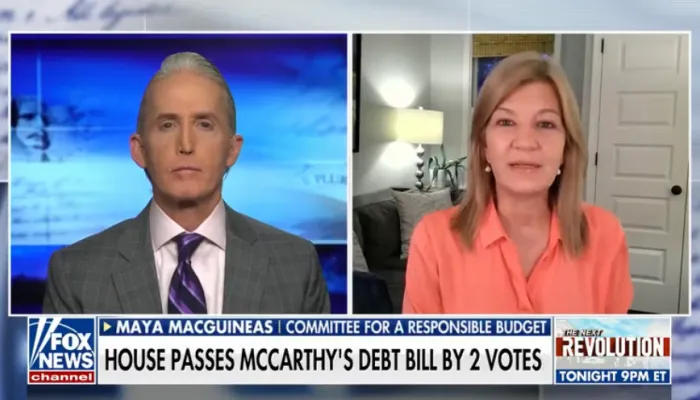

Maya MacGuineas on Fox News' "Sunday Night in America"

Committee for a Responsible Federal Budget President Maya MacGuineas recently joined Fox News' "Sunday Night in America" with Trey Gowdy to discuss...

John Kasich and Timothy Penny: Balanced Budgets Don't Need to Be a Thing of the Past

John Kasich and Timothy Penny are former Members of Congress and a board member and a co-chair, respectively, of the Committee for a Responsible...

Putting the Limit, Save, Grow Act in Context

The Limit, Save, Grow Act would reduce deficits by about $4.5 trillion over the next decade, with $3.2 trillion of those savings coming from caps to...

CBO Scores the Limit, Save, Grow Act

Update (4/26/2023): The Congressional Budget Office released an estimate of the House Rules Committee amendments to the bill, reducing the savings of...

ARCHIVE: What's in the Limit, Save, Grow Act?

Update (4/25/2023): The Congressional Budget Office has released an official score of the Limit, Save, Grow Act; read our analysis of that score here...

Build Your Own Discretionary Budget

Each year, Congress must pass a new set of appropriations bills to fund the discretionary side of the budget and avoid a government shutdown. There...

Breaking Down the Proposals in the President's FY 2024 Budget

The FY 2024 President’s budget includes policy changes that it estimates would reduce budget deficits by $3 trillion over a decade, the net effect of...

Paragon Health Institute Releases Proposals to Lower Health Care Costs

The Paragon Health Institute recently released a report highlighting 12 options to decrease federal health care spending. The report, titled “Turning...

Event Recap: Checking in on the Social Security and Medicare Trust Funds

On April 4, the Committee for a Responsible Federal Budget hosted "Checking in on the Social Security and Medicare Trust Funds." The event featured...

Social Security and Medicare Trustees Release 2023 Reports

The Social Security and Medicare Trustees just released their annual reports on the financial status of the Social Security and Medicare programs over...

Goldwein Testimony Highlights $970 Billion in Student Loan Cancellation

CRFB’s Marc Goldwein testified to the House Subcommittee on Higher Education and Workforce Development, on March 23, on the $970 billion recently...

Watch: Committee Senior Vice President Testifies to House Higher Education Subcommittee

Committee for a Responsible Federal Budget Senior Vice President and Senior Policy Director Marc Goldwein testified before the House Subcommittee on...