Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

Gene Steuerle: Social Security Must Be Fair for Everyone, Not Just Retirees

No one should assess Social Security policy in isolation.

Maya MacGuineas: Debate Questions But No Real Answers on National Debt, Social Security

Maya MacGuineas, president of the nonpartisan Committee for a Responsible Federal Budget and head of the Campaign to Fix the Debt, analyzed the vice...

Is Clinton's Tax Increase One of the Largest in History?

In addition to a statement about his tax cut during the first presidential debate in late September, Republican presidential nominee Donald Trump said...

Judd Gregg: Time for fiscal policy to drive growth

We are in the midst of a slow and anemic economic recovery. Productivity, which drives any effective period of economic growth, has stagnated.

Clinton & Trump: Where Will Our Debt Be in 10 Years?

Our recent report Promises and Price Tags: A Preliminary Update estimated that both major party presidential candidates' proposals would add to the...

Tim Penny: Clinton and Democrats Need to Address Social Security

Tim Penny is the president and CEO of the Southern Minnesota Initiative Foundation, a former congressman from Minnesota, and a co-chair of the...

Senator Dan Coats Introduces Bill To Establish Fiscal Commission

Senator Dan Coats (R-IN) introduced the ‘‘Mandatory Bureaucratic Realignment and Consolidation Commission Act of 2016’’ (or the ‘‘Mandatory BRACC Act’...

As We Enter the New Fiscal Year, A Look Back at FY 2016

While most of the country will not be celebrating the new year for another three months, today marks the turnover of the fiscal year (FY) with FY 2016...

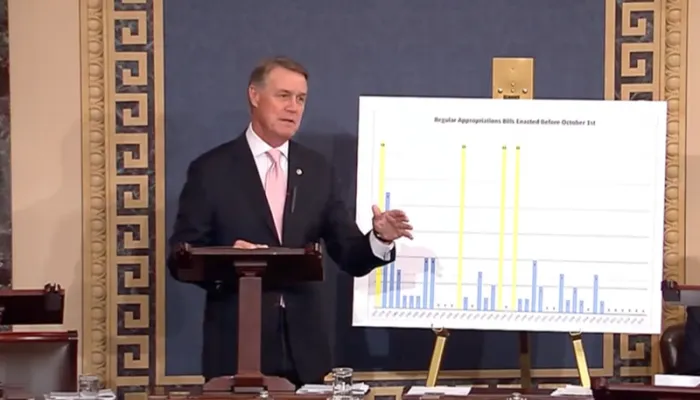

Senator David Perdue Advocates For New Budget Process Reforms

As Congress rushed to pass a temporary continuing resolution to keep the government operating when the fiscal year begins on Saturday, a group of...

A Conversation With the Candidates' Economic Advisors

We hosted a lunch conversation with economic advisors from the presidential campaigns of Hillary Clinton and Donald Trump. The event "How Would...

Senate to Vote on Continuing Resolution

With the deadline for avoiding a government shutdown approaching on Friday, Senate Majority Leader Mitch McConnell (R-KY) introduced last Thursday a...

Is Trump's Tax Cut the Largest Since Reagan?

During the first Presidential debate on September 26, Republican Presidential candidate Donald Trump said "my tax cut is the biggest since Ronald...